AWWPA report: assets held in custody accounts abroad, own-use assets and crypto assets

For any questions please email aussenwirtschaft.WPA@oenb.at.

Contents

See the directory on the right.

Key reporting data

Report code | AWWPA |

Designation | Assets held in custody accounts abroad, own-use assets and crypto assets |

Description | Assets not held in domestic custody accounts (securities held abroad, own-use assets, crypto assets and other custody accounts). |

Reporting agents | Residents owning securities that are not held in domestic custody accounts. |

Reporting interval | quarterly |

Reporting date | 15th day of the following month |

Reporting reference date | Last day of the month |

Reporting threshold | EUR 5,000,000 |

Reporting currency/unit | Euro or nominal currency; amounts rounded to one decimal place (default) or two decimal places (optional) |

Reporting channel (reporting data) | recommended: other options:

Information on the registration (access requests) for all reporting channels can be found here. |

Reporting group (for technical reporters) | Z – External sector (file type: PA) |

Master data for reporting and validation (for technical data providers) | Reporting master data (for technical data providers) (.xml) Validating master data (for technical data providers) (.xml) |

Contact |

Reporting matrix

Assets held in custody accounts abroad, own-use assets and crypto assets (AWWPA template) |

Reporting item |

Reporting reference date |

Securities stocks (STAND) |

Securities identification number (WK) |

Nominal currency (NOMWG) |

Type of custody (VERWART) |

Country of custody (LDV) |

Type of value (WA) |

Value |

Scope

Own holdings of securities that are not held or managed in domestic custody accounts must be reported based on the AWWPA template,

namely securities held

In a custody account abroad,

For one’s own account (e.g. held physically or in the shareholders’ register)

As crypto assets (e.g. blockchain)

Administered via another type of custody

Irrespective of

the underlying motive (portfolio investment, shareholding or collateral), excluding outward direct investment in the form of stocks → AWBET, AWBES,

whether the securities have been issued by residents or nonresidents, excluding outward direct investment in the form of stocks → AWBET, AWBES,

the currency in which the securities are denominated,

whether the securities have been issued in paper or digital form or in the form of crypto security tokens.

The definition of securities includes:

Equity securities, such as

common and preferred stock

mutual fund shares (to be invested in financial assets or real estate)

rights issues

dividend-right certificates and certificates of participation

Debt securities, such as

coupon bonds

zero-coupon bonds

floating rate notes

perpetual bonds (fixed-rate bonds that are not redeemable)

federal treasury bills and notes

commercial papers

certificates of deposit

medium-term bonds

registered bonds

mortgage bonds (Pfandbriefe), asset-backed securities.

pool factor bonds

inflation-indexed bonds

Other bonds, such as

warrants

certificates (index tracker bonds, convertible bonds, reverse convertible bonds, credit-linked notes),

securitized leveraged products

The definition of securities does not include:

Financial derivatives (options and futures, even when ISIN-based, swaps → AWFDE),

Bonded loans → AWFUV,

Shares in limited liability companies and cooperatives → AWBET, AWBES,

Checks,

Promissory notes.

Do not include in the report:

Securities held or managed in a domestic custody account → AWWPI

Stocks issued abroad that are held in connection with outward direct investment → AWBET, AWBES

Securities repurchase and lending transactions

Fees and commissions

Coupon income, dividend income and distributed income

Tax refunds

Reporting threshold

Own holdings of securities other than those that are not held or managed in a domestic custody account must be reported if they add up to EUR 5,000,000 or more (or the euro equivalent).

Nil reports are required in the following cases:

- If the reported volumes drop below the reporting threshold in the month following the report, a one-off nil report is required. Another option would be to resend the previous report, with balances set to zero. The reporting requirement would be reactivated only once transactions or balances again exceed the reporting threshold. Instead of submitting nil reports, reporting agents may choose to report data even below the reporting threshold.

- Nil reports also serve to cancel earlier reports made for a given reporting period.

- Nil reports may also be requested by the OeNB.

Reporting entity/reporting agent

The data must be provided by residents (excluding those subject to reporting obligations under the second main part, section 6 → AWWPI ) who own securities that are not held or managed in a domestic custody account.

Reporting reference date/reporting period

The data must be provided by the 15th day of the month following the reporting quarter. The reporting reference date is the last day of the quarter.

Securities stocks (STAND)

Data field description and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

Securities identification number (WK)

Reporting agents are required to provide security-by-security with ISIN codes (international securities identification numbers).

The international securities identification number (ISIN) is a 12-digit combination of letters and numbers that serves to unambiguously identify a given securities instrument (ISIN code under ISO 6166). ISINs are being assigned by national numbering agencies (NNAs); in Austria by the Oesterreichische Kontrollbank (OeKB). An ISIN will be deemed valid when it is contained in the database of the Association of NNAs (ANNA).

An ISIN consists of:

a 2-digit country code (AT for Austria, DE for Germany, etc.),

a 9-digit national ID, and

a 1-digit verification code.

Do not use

official securities identification numbers other than the ISIN (as provided by Wertpapier-Mitteilungen (WM) Frankfurt, Clearstream, CUSIP and Valoren),

securities identification numbers beginning with “XF” (these are not unambiguous),

securities identification numbers beginning with “QOXDBY” (these are preliminary numbers, used for accounting purposes)

In case of transactions with non-ISIN securities, report master data (including data on dividends) → Master data required for reporting.

Nominal currency (NOMWG)

Use three-digit ISO codes to report the currency of denomination of securities in nominal amounts.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Check your account statements to look up the nominal currency of the securities.

Type of custody (VERWART)

Securities held or managed in a foreign custody account (DEPOT)

Securities held for own account (e.g. held physically or in the shareholders’ register) (EIGEN)

Securities held or managed on a blockchain or in some other crypto form (KRYPTO).

Securities held or managed in a form other than listed (but not in a domestic custody account) (ANDERE)

Country of custody (LDV)

Use the two-digit ISO codes to indicate the country of the custodian if the securities are held or managed in a foreign custody account.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Indicate “AT” for Austria if the securities are held for own account, as crypto assets or in some other form (other than in a domestic custody account).

Type of value (WA)

Nominal amount in nominal currency for interest rate-bearing or other securities (NN) or

Number of securities for shares or other securities (STK)

Market value in euro (MW).

If current market values are not available, then use some other form of valuation (e.g. the latest market value available, the book value or the purchase price). If no valuation is available, copy the value indicated under type of value (NN or STK). Zero may be used only if the asset is worthless.

The market value is the price of an asset that is established through supply and demand (trade). The market value does not include (accrued) (nominal) interest that has not been credited (= clean price).

Interest accrued is, however, part of the market value in the case of zero-coupon bonds (and with regard to other differences between the issuance and redemption price).

In the case of pool factor bonds, market prices are to be adjusted for the pool factor; in the case of inflation bonds, market prices are to be adjusted for the inflation factor.

Value

Amounts must be reported in euro and, if applicable, the nominal currency of the security by using the last exchange rate available for the reporting month.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

For all datasets for which positions other than zero were reported in the previous reporting period, a position (even zero) must be reported in the current reporting period; or a nil report must be provided.

Nil reports are required in the following cases:

- If the reported volumes drop below the reporting threshold in the month following the report, a one-off nil report is required. Another option would be to resend the previous report, with balances set to zero. The reporting requirement would be reactivated only once transactions or balances again exceed the reporting threshold. Instead of submitting nil reports, reporting agents may choose to report data even below the reporting threshold.

- Nil reports also serve to cancel earlier reports made for a given reporting period.

- Nil reports may also be requested by the OeNB.

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Use the comments function for system-related queries that may arise during reporting (mandatory).

Quality requirements

AWWPA reports must be complete and must be submitted to the OeNB in due time.

The data reported will be checked by the OeNB. We will contact you in case any queries should arise, Queries need to be answered without delay.

See also: General provisions.

Technical description

Reporting template (enhanced for IT interface)

Header data | Concepts reported | Dimensions | ||

Code | Designation | Code | Designation | |

Report code (EC): AWWPA Reporting item (MO) Reporting date (MP) | STAND | Securities positions | WK | Securities identification number |

NOMWG | Nominal currency | |||

VERWART | Type of custody | |||

LDV | Country of custody | |||

WA | Type of value | |||

Dimensions (data fields)

Code | Designation |

WK | Securities identification number |

NOMWG | Nominal currency |

VERWART | Type of custody |

LDV | Country of custody |

WA | Type of value |

Attributes

WK Securities identification number | |

Code | Designation |

ISIN or internal securities identification number | Securities identification number |

NOMWG Nominal currency | |

Code | Designation |

ISO currency code | Nominal currency |

VERWART Type of custody | |

Code | Designation |

DEPOT | Custody account |

EIGEN | Own account |

KRYPTO | Crypto account |

ANDERE | Other |

LDV Country of custody | |

Code | Designation |

ISO country code | Country |

WA Type of value | |

Code | Designation |

NN | Principal |

STK | Number |

MW | Market value |

Reporting examples (xlsx/xml)

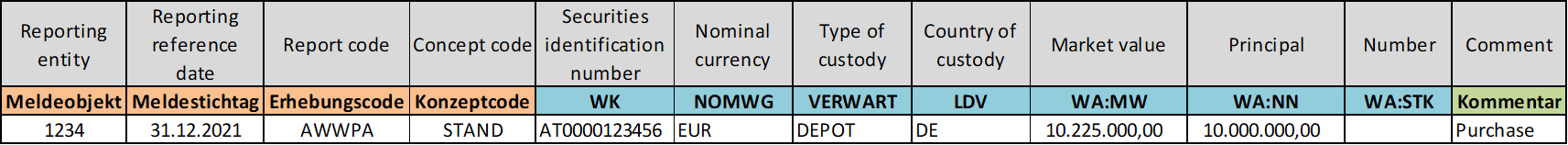

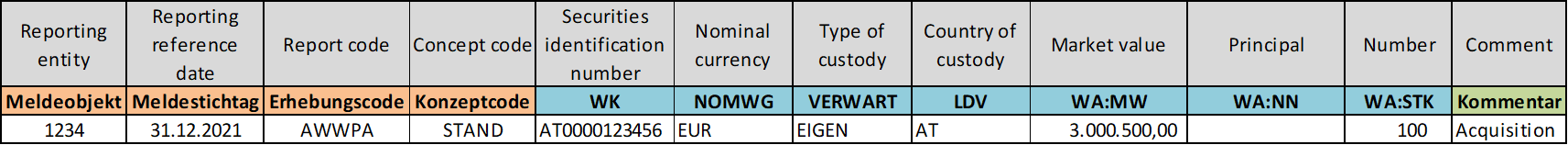

Example 1:

Purchase of an Austrian government bond, to be managed in a custody account held with a German bank:

Partial bond sale:

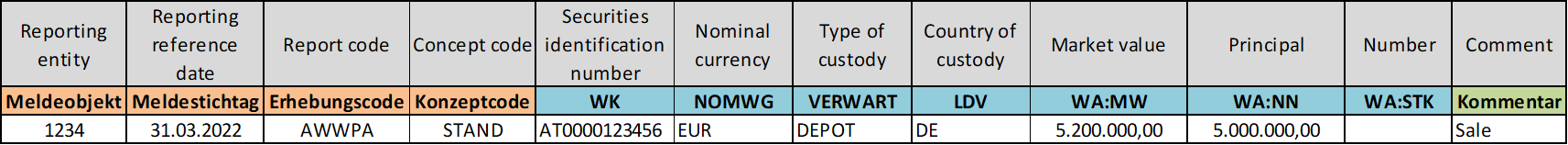

Transfer to Austria or complete sale, or sale bringing the new balance below the reporting threshold (EUR 5 million):

Other options include a nil report (MeldeWeb), or a voluntary report below the reporting threshold.

Example 2:

Acquisition of shares in a domestic unlisted stock corporation with a securities identification number (ISIN). The equity interest acquired is recorded in the shareholders’ register, but no physical stocks are issued.

Equity interests in a domestic stock corporation without an ISIN do not have to be reported.

Exceptions: Insurance companies that report equity interests as securities under Solvency II using an internal securities identification number.