For any questions please email aussenwirtschaft@oenb.at.

Contents

See the directory on the right.

General

Master data include ident attributes, relationship attributes and securities attributes (for descriptions see below). Such attributes serve to uniquely identify entities and securities and are essential for adequately processing and aggregating the reported data. Master data are the backbone of data mapping analysis.

Therefore, master data must always be current. In case your master data should have changed, please make sure to update them before transmitting new data.

Master data for AWBET, AWBES and AWFUV reports

To input your master data for the https://oenb.atlassian.net/wiki/x/SoG7, https://oenb.atlassian.net/wiki/x/TYG7 and https://oenb.atlassian.net/wiki/x/UIG7 reports, please use the MeldeWeb application (menu point Enter/edit master data). This is the only tool available for supplying master data.

Master data needs to be supplied for reporting entities, counterparties (e.g. foreign shareholders/parent company, foreign subsidiary, foreign group company, etc.) and the relationship between reporting entities and counterparties. Master data relating to reporting entities and counterparties are referred to as ident attributes. Master data indicating the relationship between reporting entities and counterparties are referred to as relationship attributes.

See Data fields and attributes (see below) for a complete list of attributes. Which data fields are mandatory in a given reporting cycle will depend on the range of ident and relationship types (such as sister company relationships) involved. In case you find your range of mandatory master data fields to have grown, please supply the required information during the next round of edits.

Master data are required only for those counterparties for which data need to be supplied with the https://oenb.atlassian.net/wiki/x/SoG7, https://oenb.atlassian.net/wiki/x/TYG7 and/or https://oenb.atlassian.net/wiki/x/UIG7 reports.

For foreign units, please supply the data available from the foreign company or trade registers. Links to freely accessible company and trade registers are provided in the MeldeWeb application.

The MeldeWeb interface indicates which fields need to be filled with current data and which fields need to be filled with historically correct data. Historically correct data means that the data must have been current on the reporting reference date. Fields to be completed with historically correct data are shown as statistical data fields in the MeldeWeb application. Current data fields must be filled with the most up-to-date registry data available. Fields to be completed with current data are shown as identifying data fields in the MeldeWeb application.

Master data are to be supplied as spelled in the company or trade register of the respective entity’s place of residency.

Step-by-step instructions for supplying master are provided here: https://oenb.atlassian.net/wiki/x/BwC5Dg (available only in German)

Data fields and attributes

Ident attributes

|

Ident attributes |

|||

|

Attribute |

Features |

Explanation |

Current (identifying) or historically correct (statistical) information |

|

Identification number |

OeNB ID number |

Indicate the ID provided by the OeNB for the domestic or foreign entity. |

current |

|

Type of ident object |

Nonresident enterprise |

Select if the foreign entity is a separate legal entity and no financial institution. |

current |

|

Nonresident financial institution |

Select if the foreign entity is a financial institution. |

||

|

Branch |

Select if the foreign entity is not a separate legal entity. This includes branches, business establishments, long-term (>1 year) partnerships, and drillships and offshore platforms. |

||

|

Natural persons |

Select if the foreign entity is a natural person. |

||

|

Resident stock corporation/SE |

Select if a domestic stock corporation/SE is under the direct or indirect control of the reporting entity. |

||

|

Reporting entity |

Select for entering data on the reporting entity. |

||

|

Company name |

Company name |

Indicate the company name as spelled in the company or trade register. Short forms or abbreviations in the company name are allowed only for common abbreviations of the legal form. |

current |

|

First name |

First name |

Indicate the first name for natural persons. |

current |

|

Last name |

Last name |

Indicate the last name for natural persons. |

current |

|

Date of birth |

Date |

Indicate the birth date (DD.MM.YYYY style) for natural persons. |

current |

|

Address |

Address |

Provide the current address as indicated in the company or trade register. Indicate the main residence for natural persons. |

current |

|

Postal code |

Postal code |

Provide the current postal code as indicated in the company or trade register. Indicate the current postal code of the main residence for natural persons. If postal codes are not available for the place of residency, pick “0.” |

current |

|

City/town |

City/town |

Indicate the current location as provided in the company or trade register. Indicate the current postal code of the main residence for natural persons. |

current |

|

Main location/ head office |

OeNB ID number of main location/head office |

For branches, indicate the OeNB ID for the main location/head office. |

current |

|

Residence |

Residence |

Indicate the country of registration for legal entities and the country of main residence for natural persons (select from the list of ISO country and currency code). The place of residency may be edited and changed only for natural persons. Should other types of ident objects be moved to a different place of residency, you will need to create a new unit. |

current |

|

Legal form (national accounts) |

Listed stock corporation |

Select if the entity in question is a listed stock corporation/SE. |

historically correct

|

|

Unlisted stock corporation |

Select if the entity in question is an unlisted stock corporation/SE. |

||

|

Other legal form |

Select if the unit in question is not a stock corporation/SE. Select for entities that are not separate legal entities. |

||

|

Legal form |

Legal form |

Having selected the place of residency, you need to select the appropriate legal form. For entities that are not separate legal entities, enter the legal form of the main location/head office. |

current |

|

Legal entity identifier |

Legal entity identifier |

Indicate the legal identity identifier if assigned to the entity. |

current |

|

National identification feature |

National identification feature (foreign key) |

Having selected the place of residency, please select a category (e.g. company register) from the picklist and supply a national identifier (foreign key), such as your entity’s company register number. Links to freely accessible company and trade registers are provided in the MeldeWeb application: Links zu Firmenbüchern (available only in German) Step-by-step instructions are provided here: Anleitung Fremdschlüssel (available only in German) |

current |

|

Industry |

NACE code |

Industry: Indicate the first three digits of the NACE (ÖNACE) code for the main economic activity of the foreign entity. For units producing a range of goods and services, pick the activity with the highest share of value added. In the case of holding companies, please distinguish between “active” holding companies that effectively control and manage the group (NACE code 701) and “formal” holding companies that do not employ any operating staff (NACE code 642). For private individuals, select NACE code 970. The field industry affiliation is also sourced from other sources (e.g. foreign company registers and the trade register). Therefore, not every change will be evident from the MeldeWeb. |

historically correct |

|

Foreign controlled See examples of foreign controlled entities below the table |

Yes |

Entities are foreign controlled if strategic foreign investors directly or indirectly hold more than half of all voting rights. This question is not about the actual amount of influence exerted at the time of reporting. |

historically correct |

|

No |

Entities are domestically controlled if strategic domestic investors directly or indirectly hold more than half of all voting rights. This question is not about the actual amount of influence exerted at the time of reporting. In the case of stock corporations, free float ownership is to be neglected. In other words: Companies with a majority of free float ownership are invariably considered to be domestically controlled. |

||

|

UCI country See the notes below the table for examples of the country of the ultimate controlling institution (UCI). |

UCI country |

The country of the ultimate controlling institution (UCI country) is defined as the country in which the corporate headquarters have been established. From a statistical perspective, this is the highest-ranking controlling legal entity to which the entity filing data to the OeNB reports. In case several investors resident in different countries (not Austria) hold identical shares, enter “XX.” If none of the investors is a legal entity and more than 50% of the shares are being directly held by a foreign natural person, indicate that individual’s country of residence as the UCI country. (Select from the list of ISO country and currency codes.) The UCI country of a domestically controlled reporting entity is AT (“Austrian-controlled”) |

historically correct |

|

Balance sheet date |

Date |

Specify the end-of-month date as of which the foreign entity’s financial information is stated. For entities that are not separate legal entities drawing up local financial statements, use the accounting reference date of the main location/head office. |

historically correct |

|

Accounting currency |

Currency |

Indicate the currency used by the reporting entity for its financial statements (select from the list of ISO country and currency codes). For entities that are not separate legal entities with local financial statements, use the accounting currency of the main location/head office. |

historically correct |

|

First recorded in the company register |

Date |

Indicate the last day of the month in which the foreign entity was first registered in the national company register. For units without a separate legal entity (e.g. operational facilities) that were not registered in the local company register or trade register, indicate the date of establishment. |

historically correct |

|

Border crossing ident |

OeNB ID number of direct investor |

For indirect affiliates, indicate the OeNB ID number of the direct foreign affiliates which directly or indirectly controls the indirect investor. |

historically correct |

Relationship attributes

|

Relationship attributes |

|||

|

Attribute |

Features |

Explanation |

Current (identifying) or historically correct (statistical) information |

|

Type of relationship See the selection tree below the table for identifying the given type of relationship. |

Direct investor |

Report a direct investor relationship for reportable direct investment transactions (AWBET report) or if the reporting threshold for AWBES reports is reached or exceeded. |

historically correct |

|

Indirect investor |

Report an indirect investor relationship if an indirectly controlled affiliate reaches or exceeds the reporting threshold for AWBES reports. Report indirectly controlled affiliates in case the following criteria apply:

|

historically correct |

|

|

Sister company |

Report a sister company relationship if a foreign group member is to be reported in the AWFUV report and if investment in this entity does not constitute a direct investor or indirect investor relationship. |

historically correct |

|

|

Third-party cross-border investor |

Report a third-party cross-border investor relationship with a counterpart outside the group and beyond affiliation relationships in the AWFUV report if so requested by the OeNB. |

historically correct |

|

|

Other investment |

Report an “other investment” relationship for reportable other investment transactions (AWBET report – transactions related to other outward or inward investment below 10%, excluding stocks). |

historically correct |

|

|

Controlling interest |

Report a controlling interest relationship if an Austrian stock corporation or a European stock corporation (SE) registered in Austria is being directly or indirectly controlled by the reporting entity, and if the reporting entity had at least an inward direct investor relationship at the reporting reference date. |

historically correct |

|

|

ID number – reporting entity |

OeNB ID |

Indicate the ID number assigned to the reporting entity by the OeNB. |

historically correct |

|

ID number – counterparty |

OeNB ID |

Indicate the ID number assigned to the counterparty by the OeNB. |

historically correct |

|

Direction |

Outward |

Indicate an outward investment relationship for domestic entities (reporting entity) holding a stake in a foreign entity. |

historically correct |

|

Inward |

Indicate an inward investment relationship for foreign entities holding a stake in a domestic entity (reporting entity). |

historically correct |

|

|

Share in % |

Percentage |

Indicate the share of stocks or nominal capital in % that is being held directly in the foreign affiliate or by foreign investor (rounded to two decimal places). The share in % is excluding reacquired stock. |

historically correct |

|

Share in EUR |

Amount |

Indicate the share of stock or nominal capital that is being held directly in the foreign affiliate/by the foreign investor. Indicate this amount in euro, rounded to one decimal place (default) or two decimal places (optional).

For units that are not separate legal entities and thus do not disclose any stock or nominal capital, select “1.” |

historically correct |

|

Weighted share in % |

Percentage |

To quantify indirect investor relationships, indicate the weighted share in percent (rounded to two decimal places). To arrive at the weighted share, multiply out all shares in the investment chain. |

historically correct |

|

Investment motive |

Labor costs |

Select the primary reason for investing. In the case of inward direct investment relationships, remember to select the foreign investor’s investment motive. |

historically correct

|

|

Access to supplies |

|||

|

Market access |

|||

|

Taxation issues |

|||

|

Other |

|||

|

Start-up |

Yes |

Select “yes” if the foreign affiliate was newly established by the reporting entity, or if the reporting entity was newly established by the foreign investor. |

historically correct |

|

No |

Select “no” if the foreign affiliate was not newly established by the reporting entity, or if the reporting entity was not newly established by the foreign investor. Such cases might involve changes of legal form, changes to the company name, or an inaugural investment in an existing entity. |

||

|

Month of initial investment |

Date |

Indicate the month in which the investment relationship started. In the case of start-ups, this is the month in which the company was first registered in the company register. For any other business cases, indicate the month in which the reporting entity first invested directly in a foreign entity, or in which foreign investors first invested directly in the reporting entity. This information must be provided even if the direct investment relationship has not yet led to transactions that have to be reported. Definitions - direct investment |

historically correct |

|

Effective from / relationship from |

Date |

Indicate the month in which the relationship started. |

historically correct |

|

Effective until / relationship until |

Date |

Indicate the month until which the relationship lasted. Do not fill in this field if the relationship is ongoing. The month indicated is the last month for which data may be reported on the direct investment relationship in the AWBET and AWFUV reports. |

historically correct |

Examples

Example: Decision tree to establish relationship types

|

What kind of relationship is there between the reporting entity and the foreign counterparty? |

|||||||

|

Relationship with affiliates or investors |

Relationship with other counterparty |

||||||

|

Outward direction

|

Inward direction

|

Counterparty is a group member * |

Counterparty is not a group member |

||||

|

Direct affiliates |

Indirect affiliates |

Direct investor |

Result:

|

Result:

|

|||

|

10% of shares or more |

Below 10% of shares |

Controlling interest ** |

No controlling interest |

10% of shares or more |

Below 10% of shares *** |

|

|

|

Result:

|

Result:

|

Result:

|

Result:

|

Result:

|

Result:

|

||

* All connected units and all units with which the reporting entity or a connected entity have a direct or indirect investor relationship (share of 10% or more; need not be a controlling interest)

** Controlling interest means a share of more than 50% at each stage of the control chain. Control may be exerted only over foreign direct (or indirect) affiliates. Do not select this type of relationship if indirect affiliates are being held via direct (or indirect) Austrian affiliates.

*** Report an inward direct investor relationship in all cases where a direct investor holds more than 10% of shares together with other direct investors.

**** Business partners are to be reported only if so requested by the OeNB.

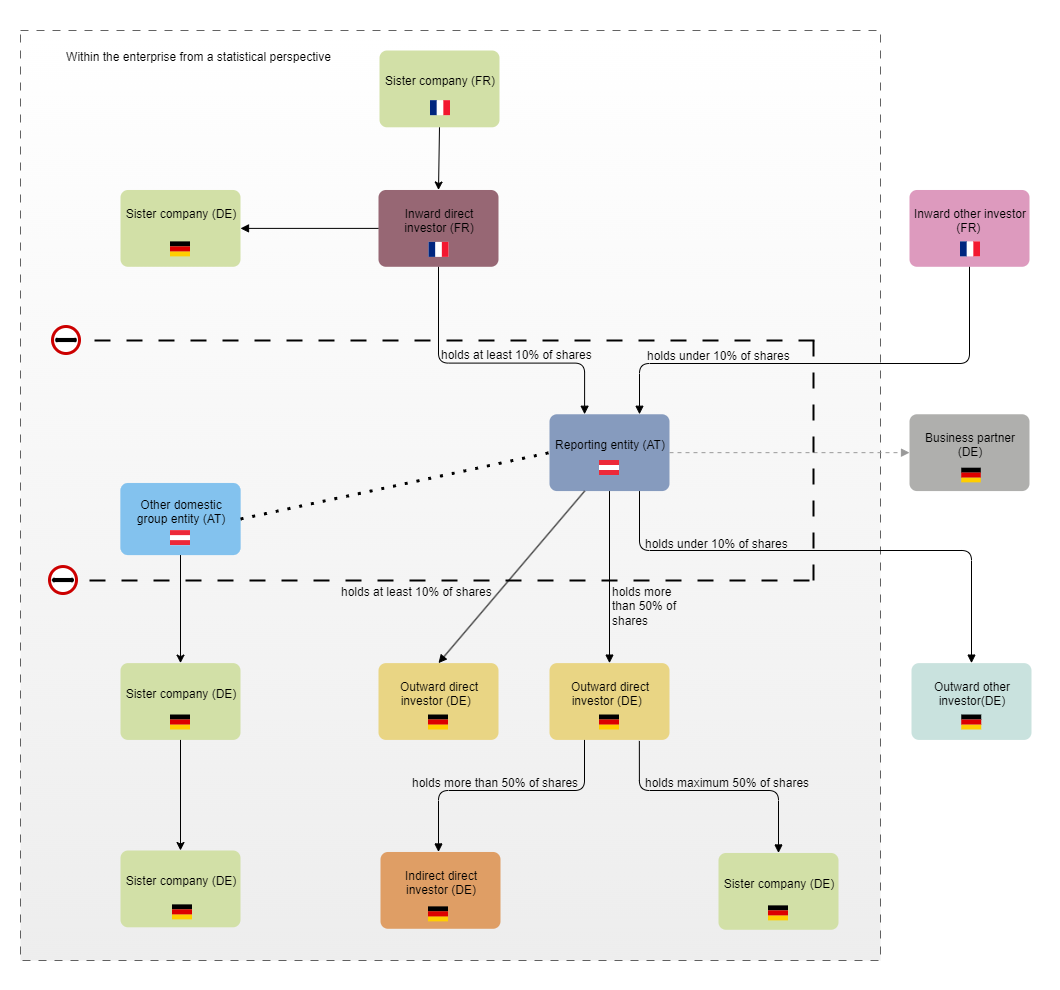

The reporting entity has entered into the following investment relationships:

-

Outward direct investor: The reporting entity has two direct affiliates abroad in with it holds a share of 10% or more.

-

Outward other investor: The reporting entity has one direct affiliate abroad in with it holds a share of less than 10% or.

-

Indirect direct investor: The reporting entity has one indirectly controlled affiliate; the investment relationship is such that control can be exerted at each level of investment between the reporting entity and the indirect affiliate, with the indirect affiliate being a foreign company.

-

Sister company: There are several sister company relationships. Report sister company relationships when the counterparty is a group company and no other direct investment relationships apply. In the case at hand, there are sister companies with another entities,

-

that holds shares in the direct investor,

-

that is held by the same shareholder

-

that is held through another Austrian entity in the group

-

that is held but not controlled by a direct subsidiary of the reporting entity. (shareholding not greater than 50% at the second level).

-

-

Inward direct investor: There is an investor with a direct share of at least 10%.

-

Inward other investor: There is an investor with a direct share of less than 10%, who is not connected with the other investor.

-

Business partner: Other investments in a third-party entity are to be reported upon the OeNB’s request.

How to report which types of relationships?

|

Type of relationship |

AWBET report |

AWBES report |

AWFUV report |

|

Outward direct investor |

x |

x |

x |

|

Outward other investor |

x |

|

x |

|

Indirect direct investor |

|

x |

x |

|

Sister company |

|

|

x |

|

Inward direct investor |

x |

x |

x |

|

Other inward investor |

x |

|

x |

|

Business partner |

|

|

x |

Example: Change in type of relationship

If the relationship type is changed, the relationship stored in the master data must be terminated with the month of the relationship change. A new relationship with the same company must then be created with the new relationship type in the same month.

Example 1: an indirect direct investor becomes an outward direct investor due to a group reorganization.

Example 2: a sister company becomes an outward direct investor due to a group reorganization.

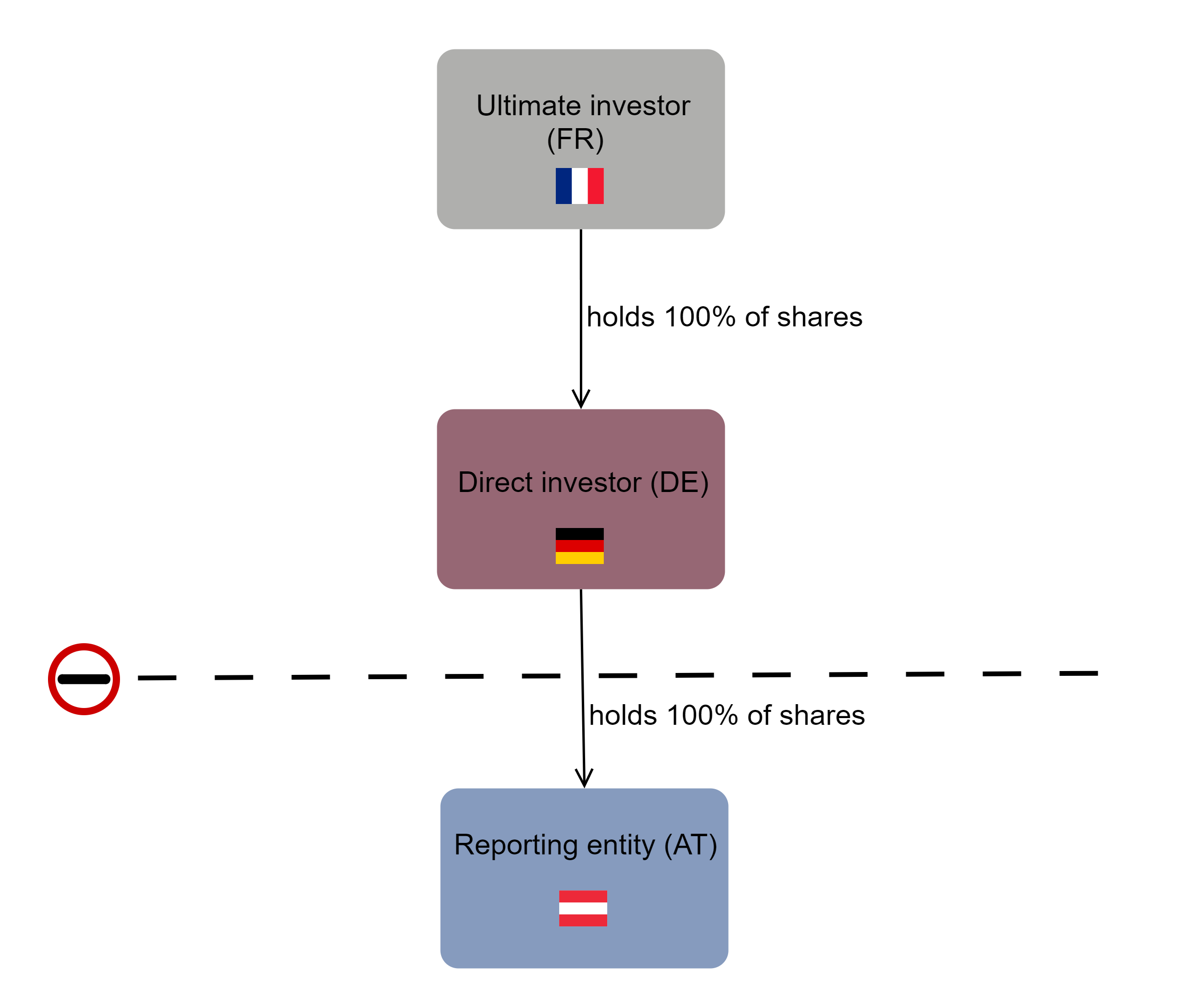

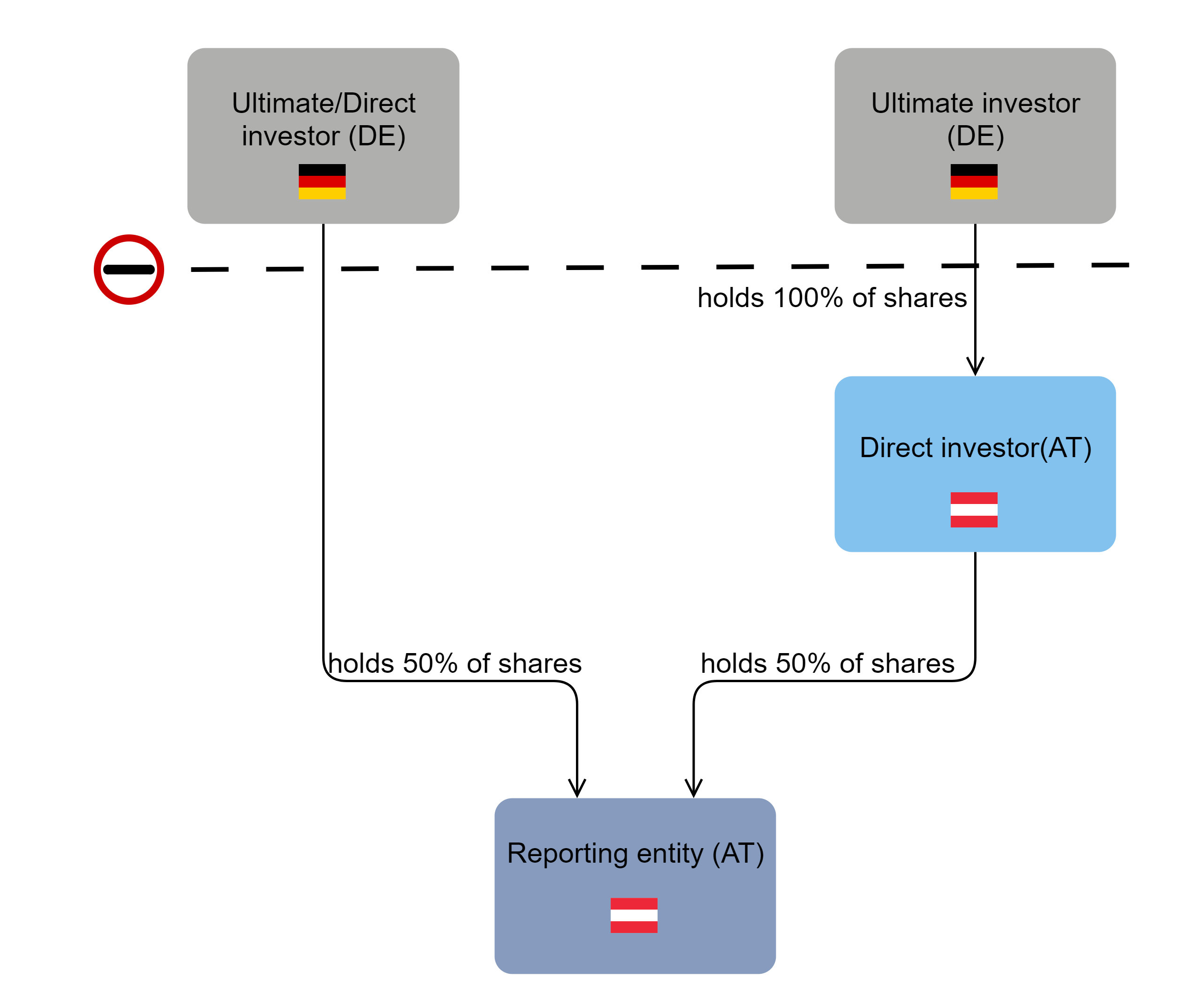

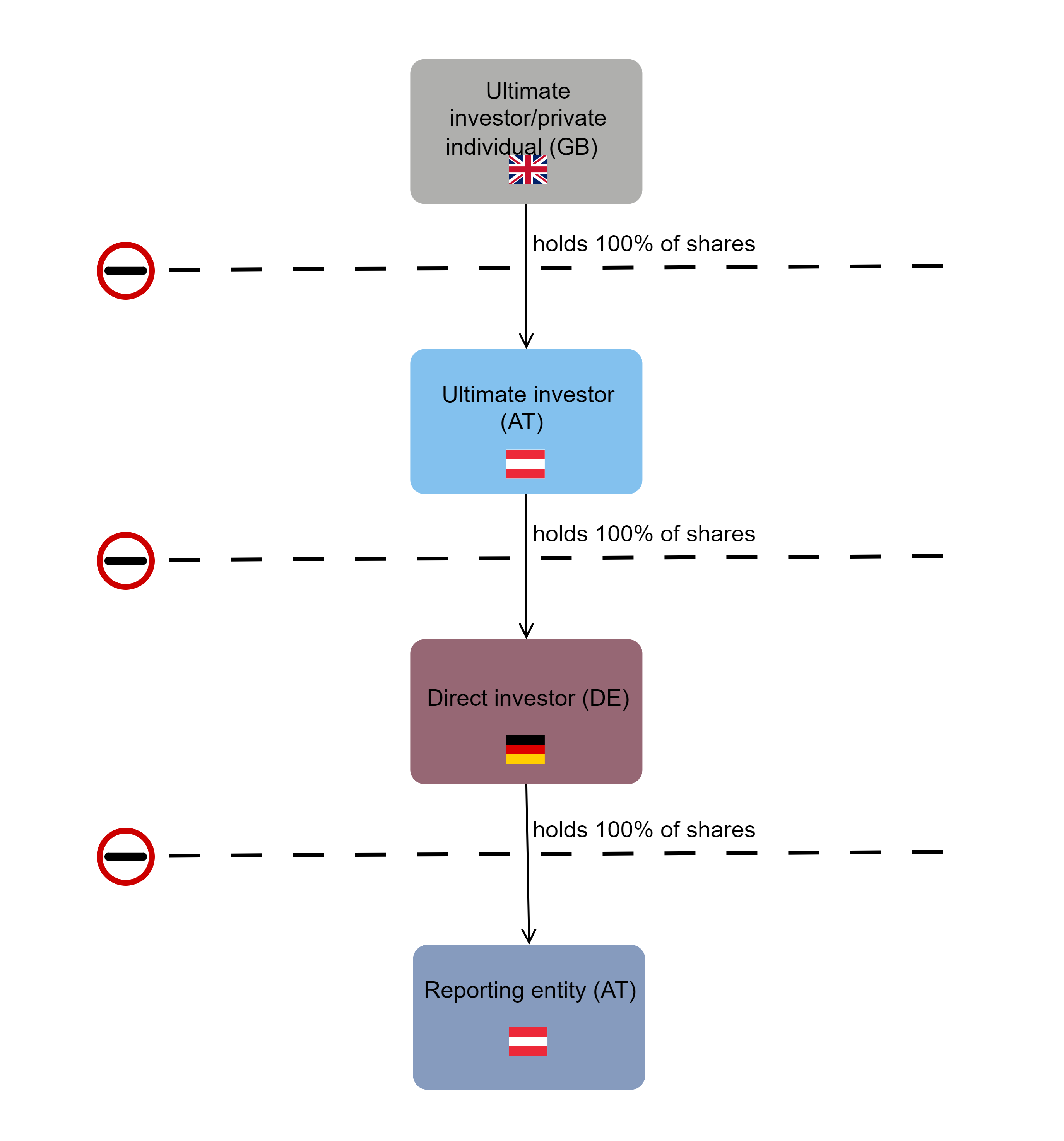

Example 1: Foreign control and UCI country

Example 1 shows that the Austrian reporting entity is fully owned by a German direct investor, which is in turn fully owned by a French direct investor.

This is a case of foreign control as the highest-tier foreign investor owns more than 50% of the reporting entity at every intermediary level.

The UCI country to be indicated is France (FR), because the requirement is to indicate the country of the ultimate owner.

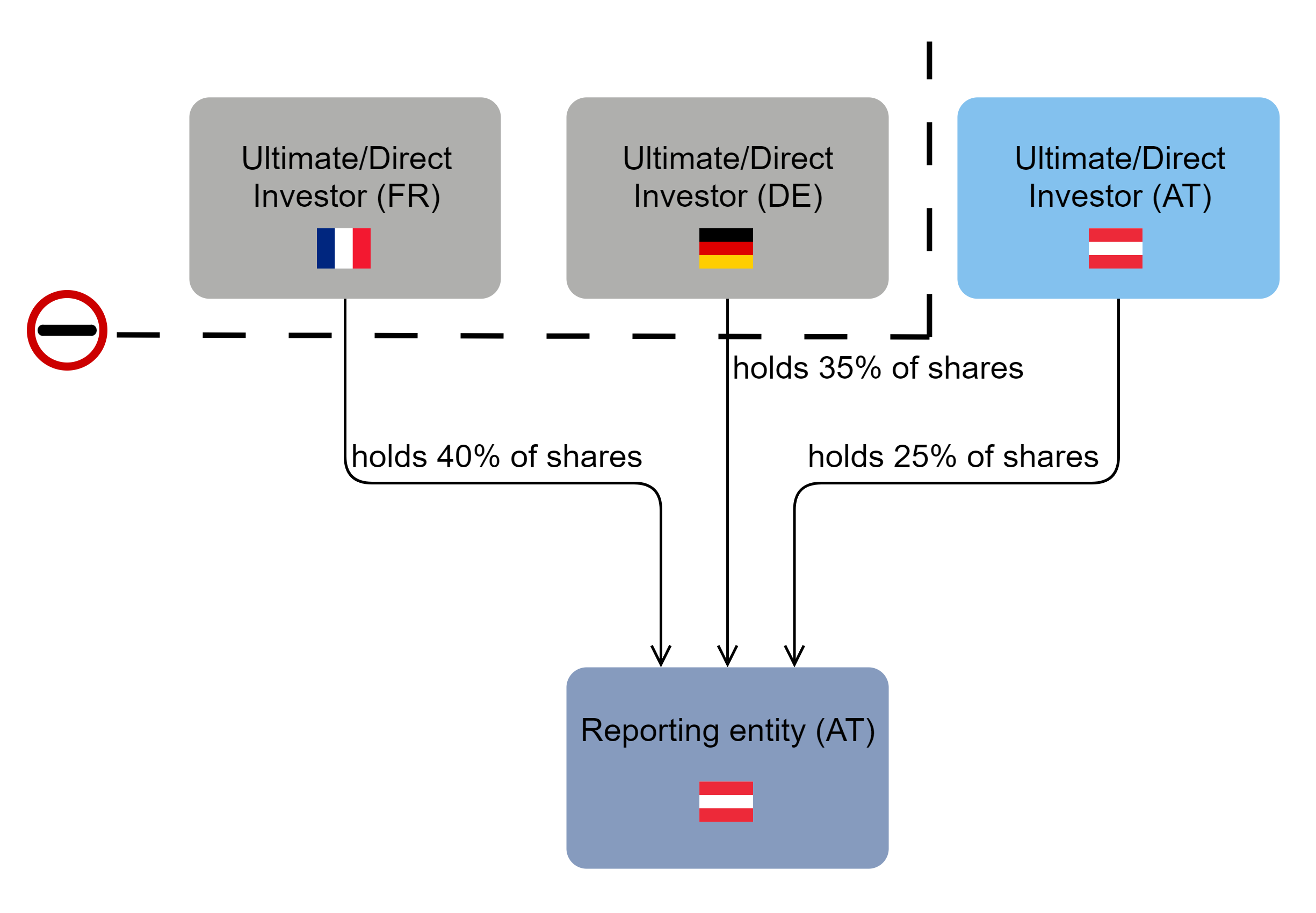

Example 2: Foreign control and UCI country

Example 2 shows that three companies are co-owners of an Austrian reporting entity: a French company (40%), a German company (35%) and another Austrian company (25%).

This is a case of foreign control as more than 50% of the company are being owned by foreign investors, and as there is no ultimate Austrian owner above these foreign companies.

The UCI country to be indicated is France (FR). Because the reporting entity is subject to foreign control but because no investor holds more than 50% of the shares in the reporting entity, the country to be indicated as the UCI country is the country of the single biggest investor.

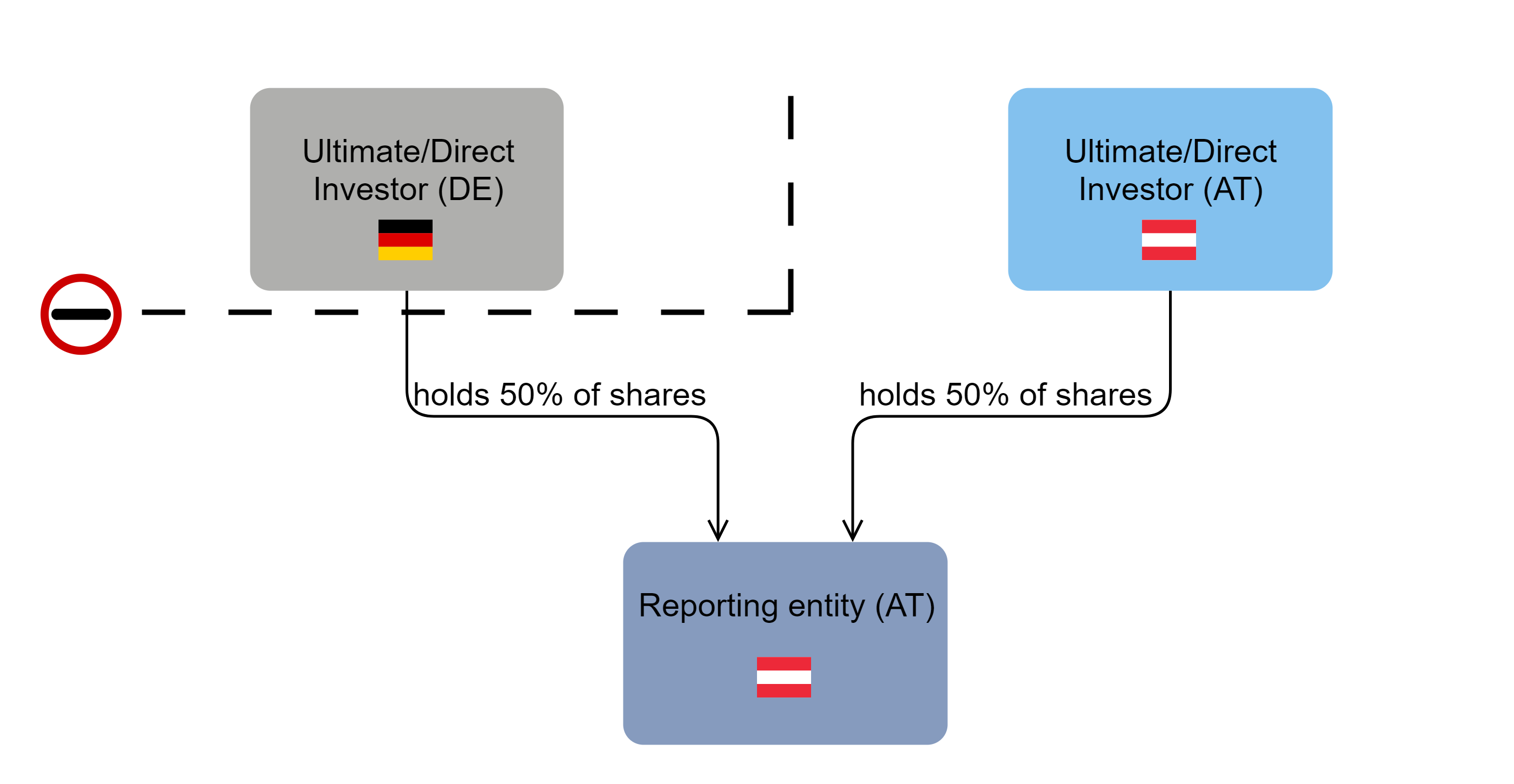

Example 3: Foreign control and UCI country

Example 3 shows an Austrian reporting entity being owned in equal parts by an Austrian company and a German company.

This is not a case of foreign control as foreign investors do not hold more than 50% of the shares in the reporting entity, neither directly nor indirectly.

In the absence of foreign control, Austria (AT) is to be indicated as the UCI country.

Example 4: Foreign control and UCI country

Example 4 shows an Austrian reporting entity being owned in equal parts by an Austrian corporation and a German corporation, with the Austrian direct investor being controlled by another German corporation.

This is a case of foreign control, since 50% of the shares are being held directly and 50% indirectly by two German companies. In sum, more than 50% of the shares in the reporting entity are being held by foreign corporations.

The UCI country to be indicated is Germany (DE), since German entities hold more than 50% of the shares in the reporting entity, directly and indirectly (as ultimate owners).

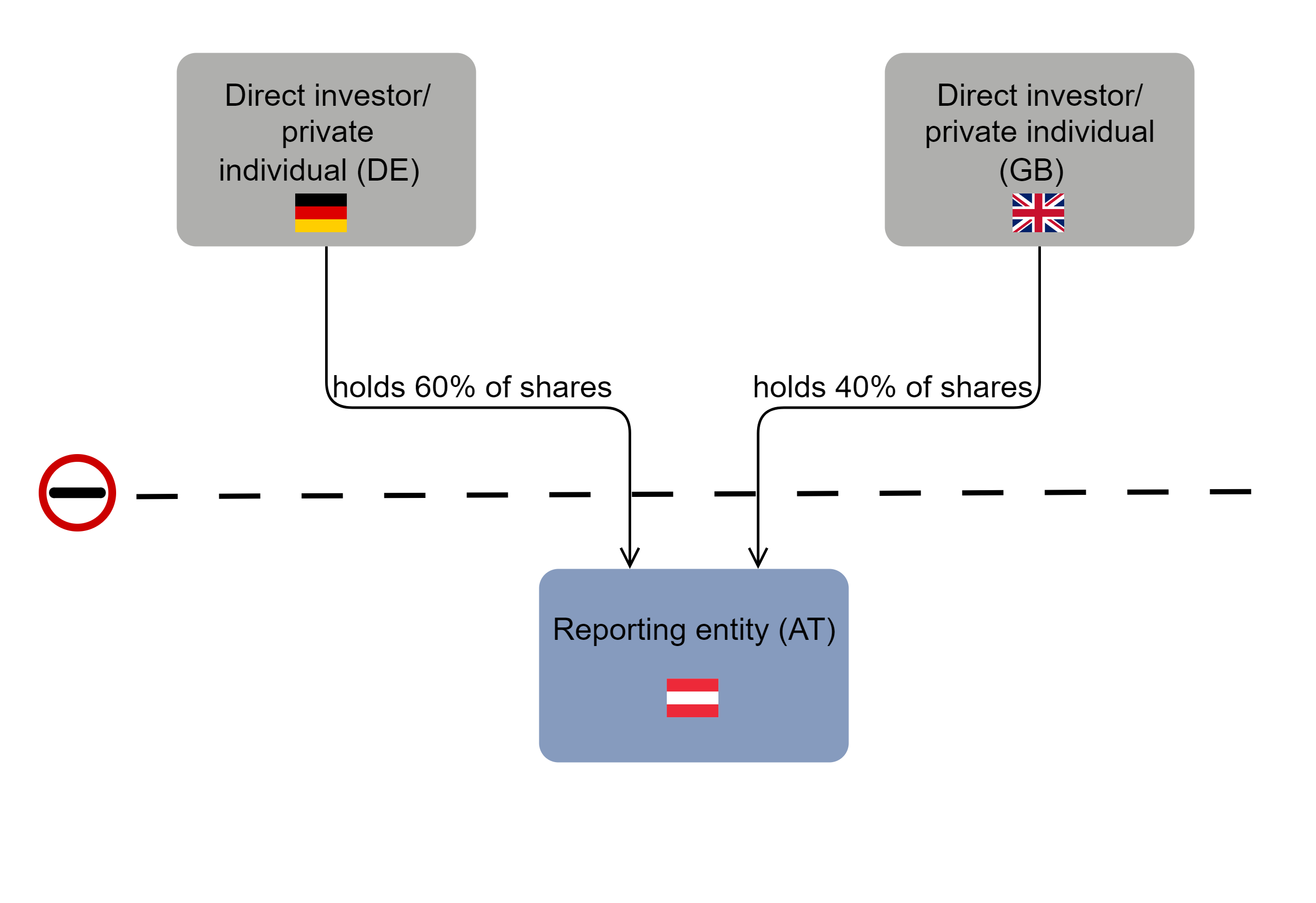

Example 5: Foreign control and UCI country

Example 5 shows an Austrian reporting entity being held by a German individual (with a share of 60%) and a British individual (with a share of 40%).

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by private individuals resident abroad.

The UCI country to be indicated is Germany (DE), since more than 50% of the shares in the reporting entity are being held by a German individual.

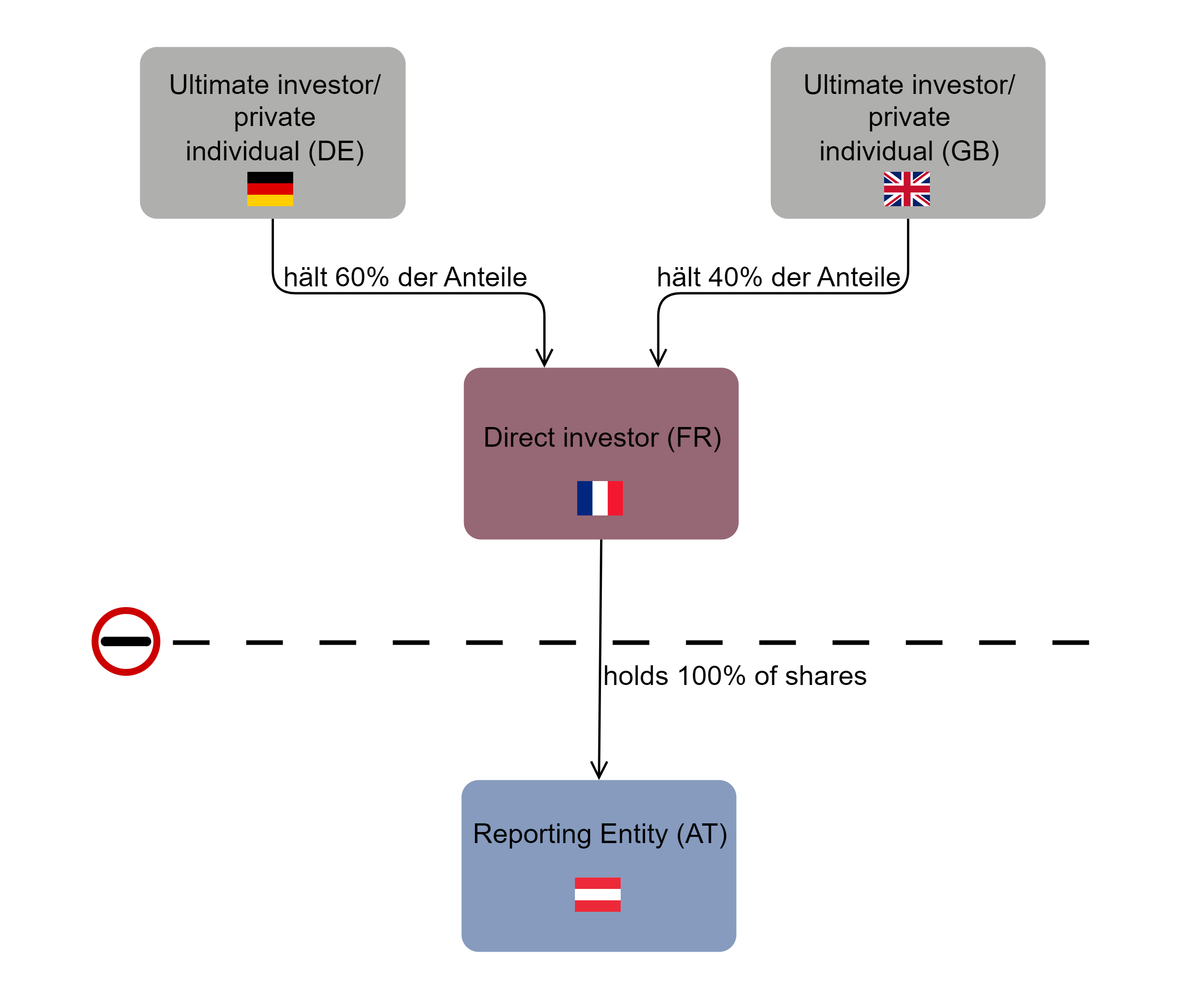

Example 6: Foreign control and UCI country

Example 6 shows an Austrian reporting entity being fully owned by a French corporation, the shares of which are being held by two private individuals: a German (60%) and a Brit (40%).

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by nonresident investors.

The UCI country to be indicated is France (FR), since the country of the ultimate private owner will be used only when the private owner is a direct investor. The UCI country is, by definition, the country of residency of the ultimate majority owner of the reporting entity.

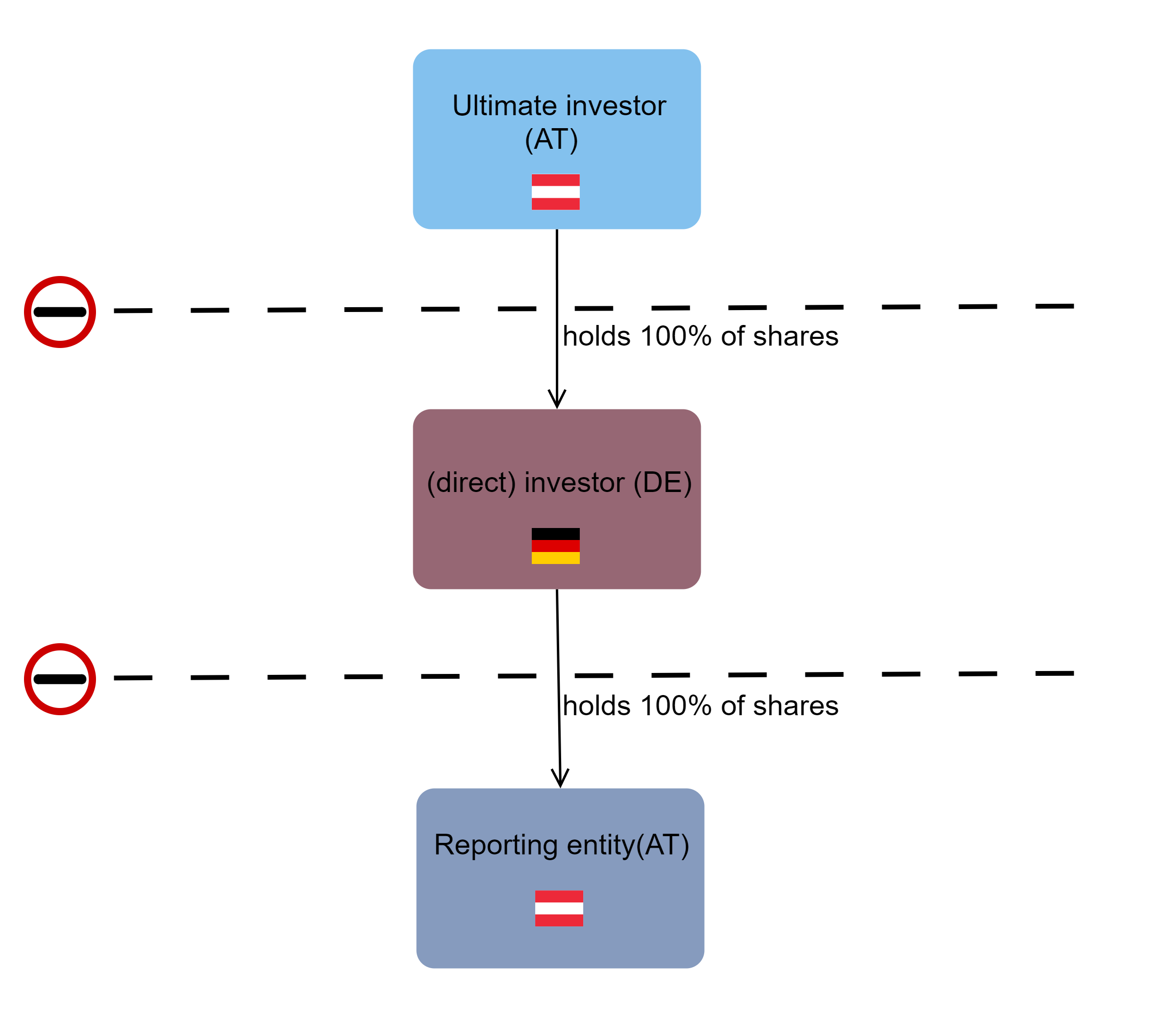

Example 7: Foreign control and UCI country

Example 7 shows an Austrian reporting entity being fully owned by a German corporation, which is in turn fully owned by an Austrian corporation.

This is not a case of foreign control as the ultimate investor is an Austrian entity.

In the absence of foreign control, Austria (AT) is to be indicated as the UCI country.

Example 8: Foreign control and UCI country

Example 8 shows that the Austrian reporting entity is fully owned by a German investor, which is in turn fully owned by an Austrian company. The top-level company in Austria is fully owned by a foreign private individual.

In this case, foreign control exists because the ultimate legal entity is a resident in Austria and more than 50% of this entity is held directly by private individuals resident abroad (see example 5).

In this case, Great Britain (GB) must be indicated as the UCI country, since the ultimate legal entity is a company in Austria and more than 50% of this company is held by a British private individual.

Note: If the ultimate legal entity were a company abroad, the UCI country would be the country of the ultimate legal entity and not the country of the private individuals above it.

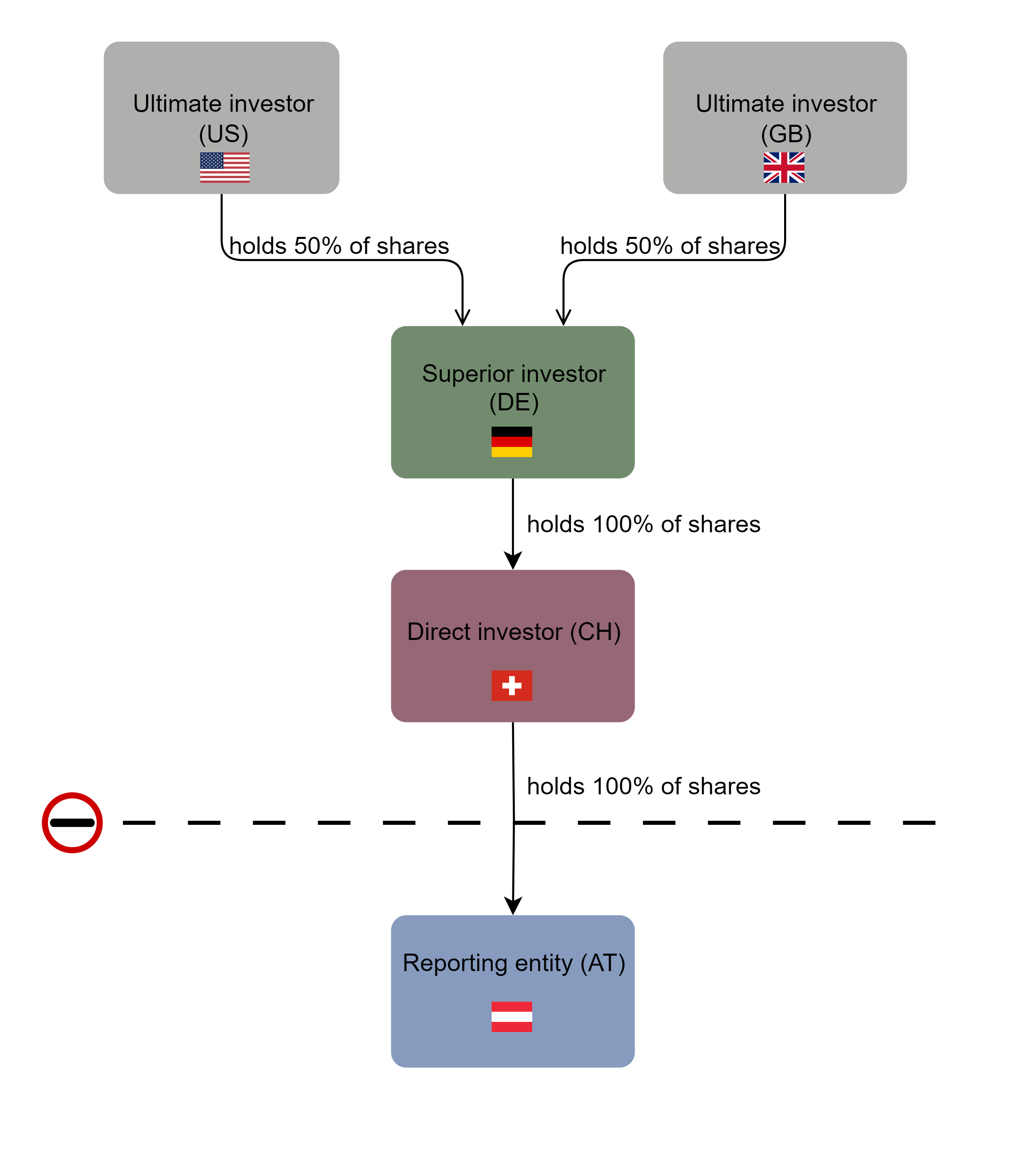

Example 9: Foreign control and UCI country

Example 9 shows an Austrian entity being fully owned by a Swiss corporation, which in turn is held and controlled by a German company. The entity in Germany is held by two foreign entities from different countries, each with a 50% share.

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by nonresident investors.

The UCI country to be indicated is Germany (DE), since the ultimate controlling entity of the reporting entity is domiciled in Germany. The USA or Great Britain should not be selected in this case, as none of these countries holds more than 50% of the shares in the controlling German company.

Example 10: Foreign control and UCI country

Example 10 shows an Austrian entity being fully owned by a German entity, The shares of which are being held by two foreign entities from different countries, each with a 50% share.

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by nonresident investors.

The UCI country to be indicated is Germany (DE), since the ultimate controlling entity of the reporting entity is domiciled in Germany. The USA or Great Britain should not be selected in this case, as none of these countries holds more than 50% of the shares in the controlling German company.

.png?cb=d9023d23c1d95542a323916bd2167547)

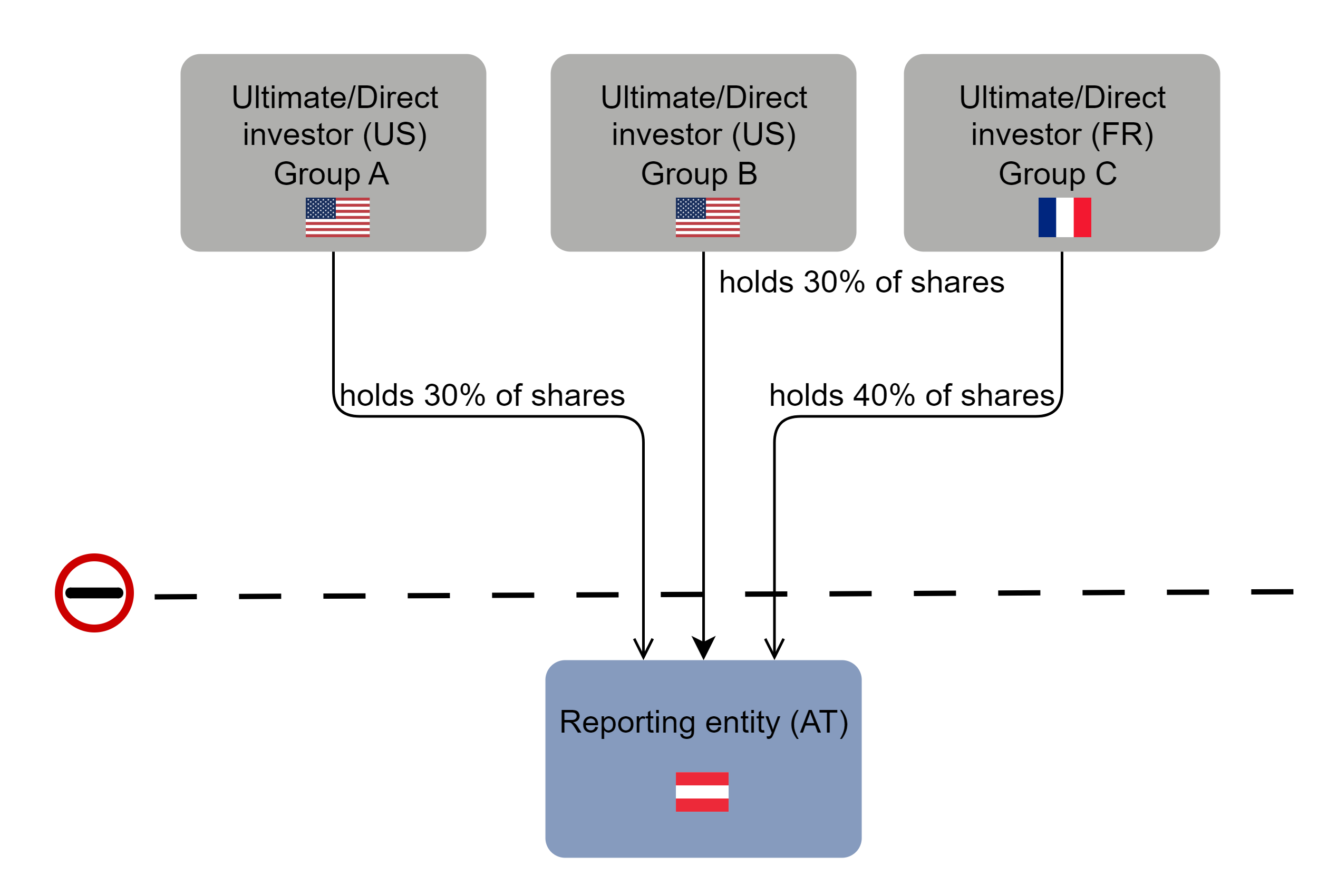

Example 11: Foreign control and UCI country

Example 11 shows that three companies are co-owners of an Austrian reporting entity: an US company (30%) of group A, an US company of group B (30%) and a French company of group C (40%).

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by nonresident investors.

The UCI country to be indicated is USA (US), since more than 50% of the shares are held by entities from the USA, even if these belong to different groups.

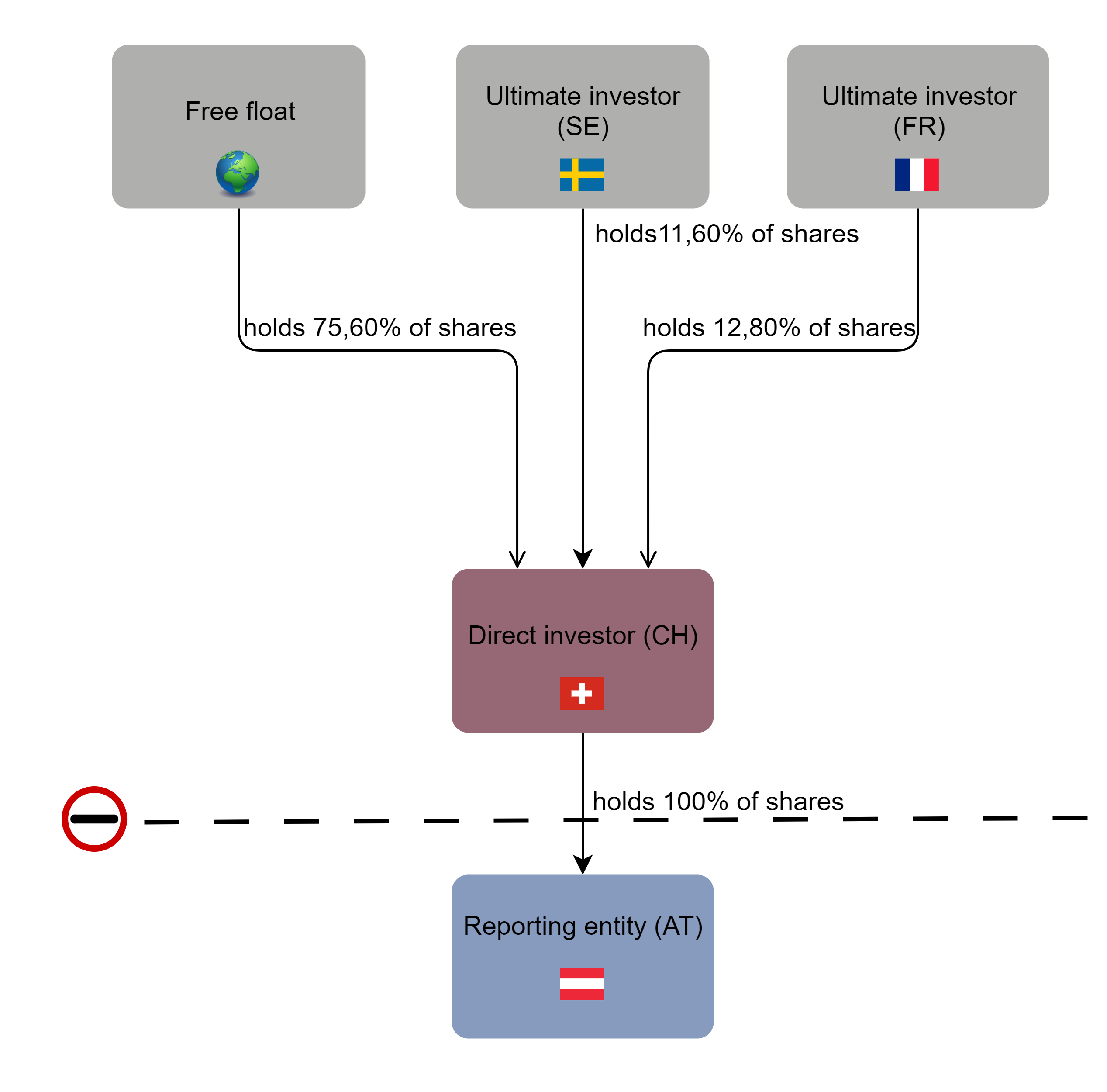

Example 12: Foreign control and UCI country

Example 12 shows an Austrian entity being fully owned by a Swiss entity, which in turn is held by many other shareholders. The largest shareholders are from Sweden with a share of 11.60% and France with a share of 12.80%. The remaining 75.60% of the shares are held in free float.

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by nonresident investors.

This is a case of foreign control, since more than 50% of the shares in the reporting entity are being owned by nonresident investors. It is not possible to assign a country of domicile to the owners of the free float. In this case, it is therefore not possible to determine whether more than 50% of the shares in the Swiss entity are held in the same country.

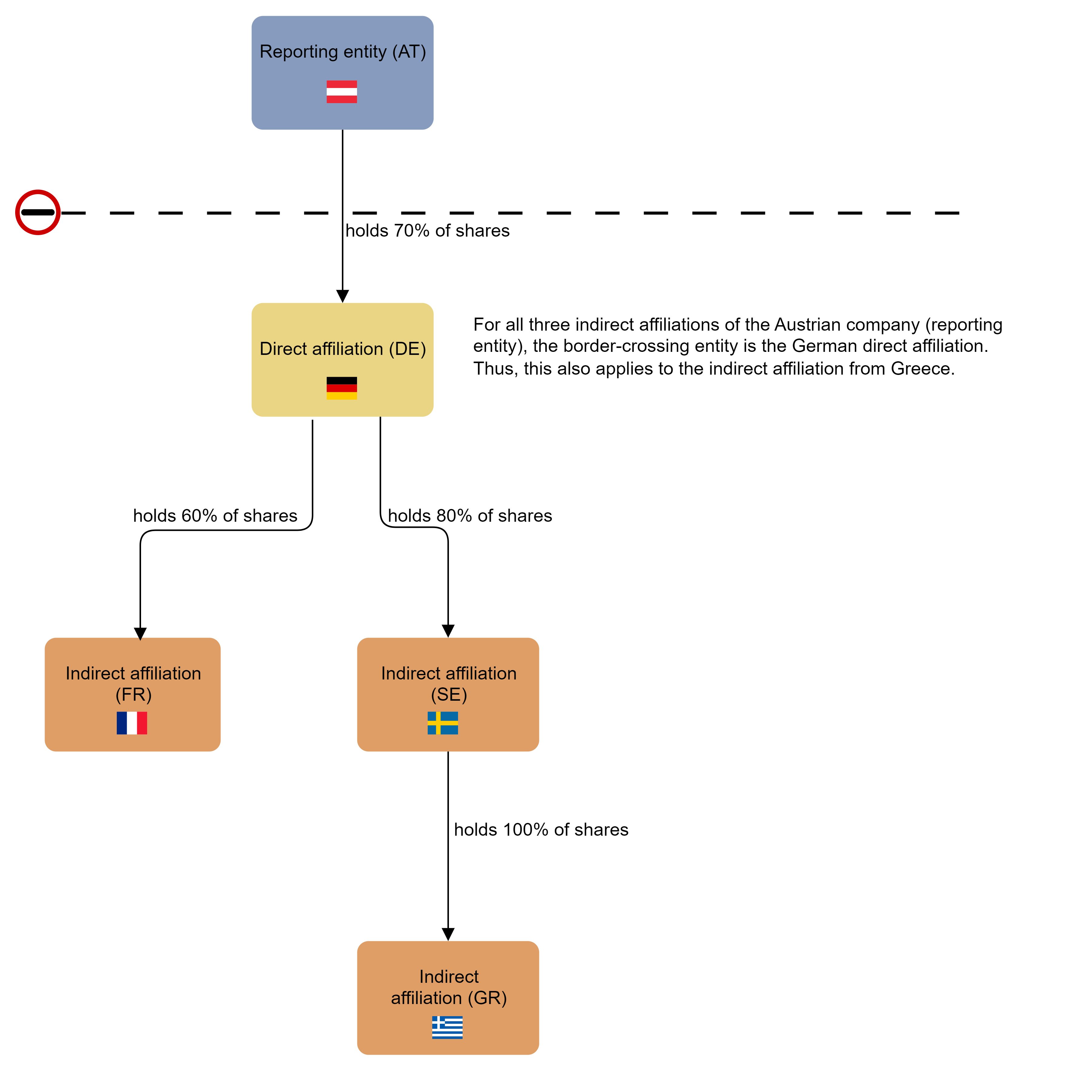

Example: Border-crossing identifier

The reporting entity holds 70% of shares of a direct German affiliate. This affiliate in turn holds 60% of shares of a French entiy and 80% of shares of a Swedish entity. The Swedish entity in turn is the 100% owner of a Greek entity. From the point of view of the Austrian reporting entity, the French, Swedish and Greek corporations are indirectly controlled affiliates.

Since all three indirectly controlled affiliates are being held via a German direct affiliate, the cross-order ident qualifier is the German affiliate for all three corporations.

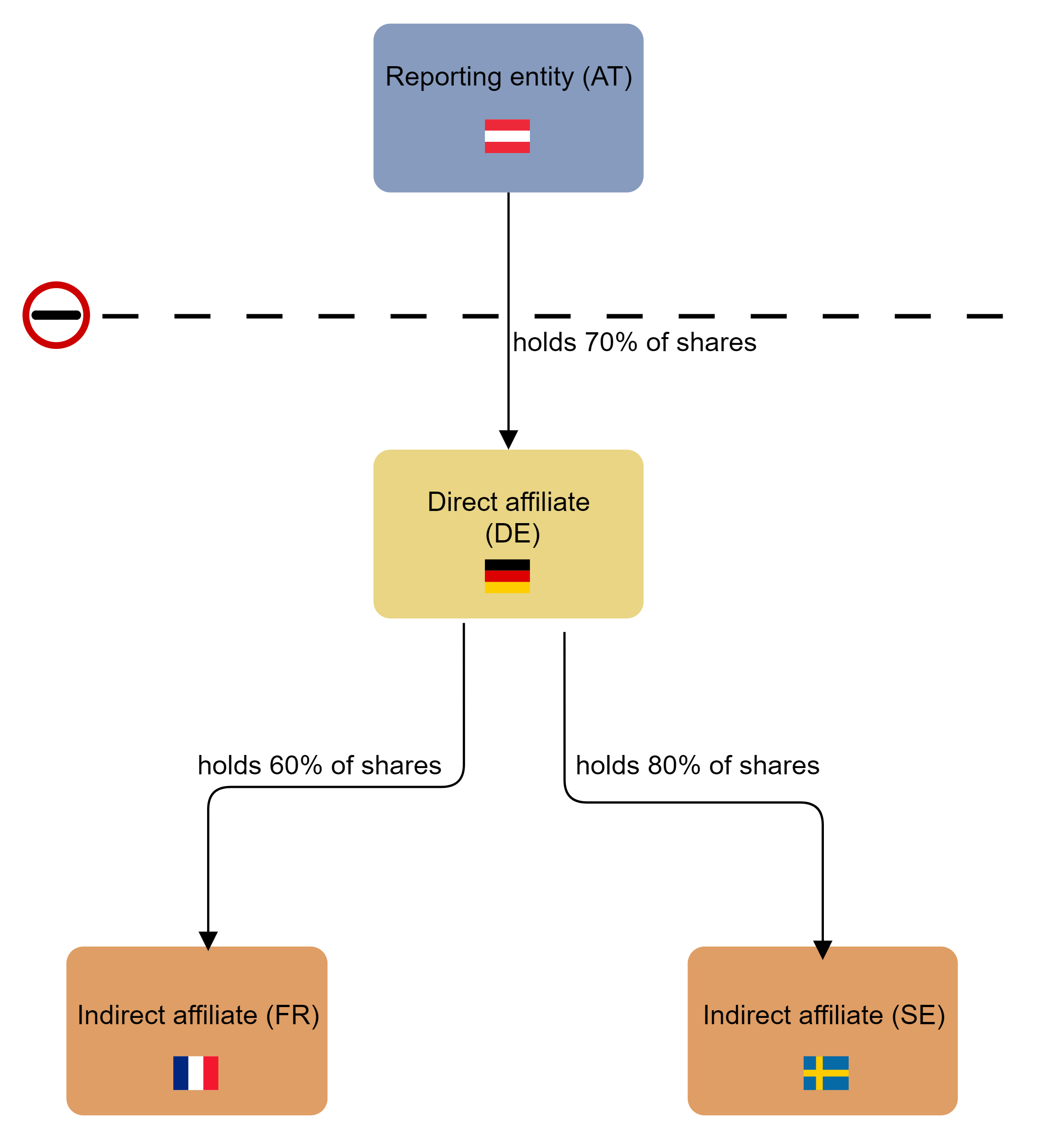

Example: Weighted share in %

The reporting entity holds 70% of shares of a direct German affiliate. This affiliate in turn holds 60% of shares of a French entity and 80% of shares of a Swedish entity. From the point of view of the Austrian reporting entity, the French and the Swedish corporations are indirectly controlled affiliates.

Calculate the weighted share of indirect affiliates as follows:

(reporting entity’s share of direct investment) * (direct investment share of indirect investment) = weighted share

-

Indirect investment in the French affiliates 0.7 x 0.6 = 0.42

-

Indirect investment in the Swedish affiliates 0.7 x 0.8 = 0.56

The weighted share of the reporting entity’s indirect investment in its French entity is 42%. The weighted share of the reporting entity’s indirect investment in its Swedish entity is 56%.

Mandatory fields

See below for a list of mandatory fields based on a selection of ident and relationship types. The PDF document below lists all mandatory fields for each object type and relationship type. Please note that different mandatory fields must be entered depending on the object type (e.g.: company, branch or natural person) and relationship type (e.g.: Outward direct investor or Sister company).

Fields that are mandatory fields only in the context of particular business cases or which may be completed on a voluntary basis are identified with an “x”.

Master data for AWWPI and AWWPA reports

Upload the master data for AWWPI and AWWPA reports in the MeldeWeb application (under “submit report”).

Data fields and attributes

Securities attributes

For a description of the data fields II.1 to II.19 and their attributes, see DV Schnittstellen- und fachliche Beschreibung der IWP-Meldung V 1.5.pdf.

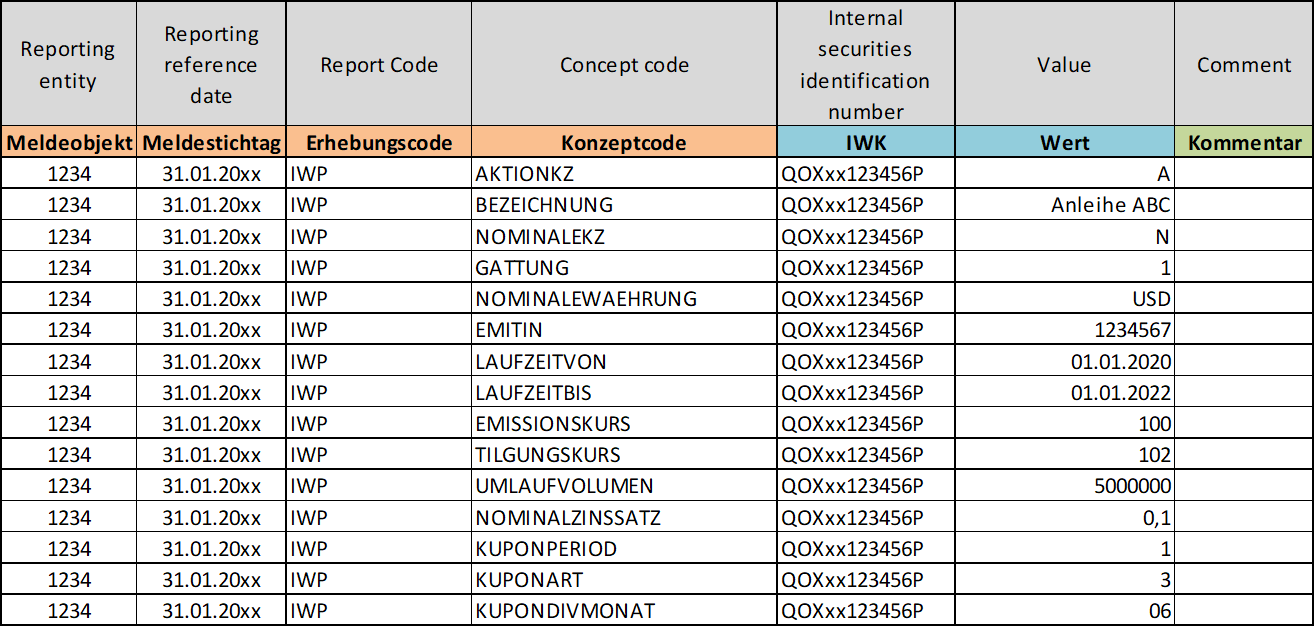

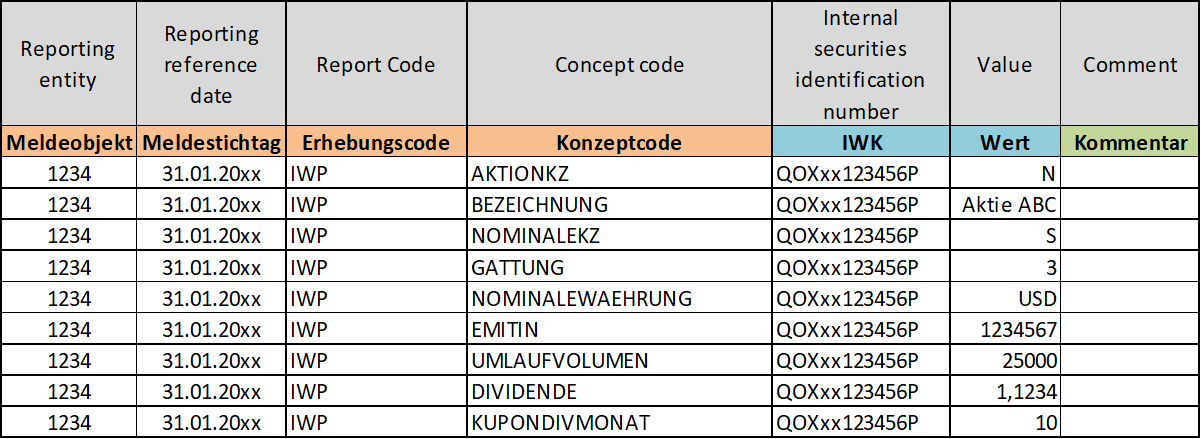

IWP template

|

Securities attributes |

Concept code |

|

II.1 Internal securities identification number |

→ Dimension: WK |

|

II.2 Action qualifier |

AKTIONKZ |

|

II.3 Category |

GATTUNG |

|

II.4 Designation of security |

BEZEICHNUNG |

|

II.5 Nominal value/units held qualifier |

NOMINALEKZ |

|

II.6 Issuer ID number |

EMITIN |

|

II.7 Nominal currency |

NOMINALEWAEHRUNG |

|

II.8 Start of redemption period |

LAUFZEITVON |

|

II.9 End of redemption period |

LAUFZEITBIS |

|

II.10 Issuing price |

EMISSIONSKURS |

|

II.11 Redemption price |

TILGUNGSKURS |

|

II.12 Outstanding volume |

UMLAUFVOLUMEN |

|

II.13 Nominal interest rate |

NOMINALZINSSATZ |

|

II.14 Coupon periodicity |

KUPONPERIOD |

|

II.15 Coupon type |

KUPONART |

|

II.16 Amount of dividends |

DIVIDENDE |

|

II.17 Coupon/dividend month |

KUPONDIVMONAT |

|

II.18 Group financing qualifier |

FINANZKZ |

|

II.19 Creditor ID number |

GLAEUBIN |

Example 1:

Example_of_IWP_report_bond_investment_change.xlsx

Example 2:

Example_of_IWP_report_bond_investment.xlsx

Quality requirements

-

Master data must be reported via the MeldeWeb application, and must have been validated, ahead of data transmission.

-

Since data cannot be transmitted unless the master data have been processed, we consider the “ahead of data transmission” requirement to have been met if the data can be reported within the reporting deadline and are indeed reported within the deadline.

-

The master data reported will be checked by the OeNB. We will contact you in case any queries should arise, Queries need to be answered without delay.

See also: General provisions.