AWWPI report: assets held in domestic custody accounts

For any questions please email aussenwirtschaft.WPI@oenb.at.

Contents

See the directory on the right.

Key reporting data

Report code | AWWPI |

Designation | Domestic custody accounts |

Description | Securities held for own account by MFIs, and transactions and balances managed or held for third parties (custody business) |

Reporting agents | The data must be provided by MFIs and residents holding securities in custody or managing securities for third parties (custody business) |

Reporting interval | monthly |

Reporting date: | 10th banking day of the following month (for MFIs) 15th day of the following month |

Reporting reference date | Last day of the month |

Reporting threshold | none |

Reporting currency/unit | Euro or nominal currency; amounts rounded to one decimal place (default) or two decimal places (optional) |

Reporting channel (reporting data) | |

Reporting group (for technical reporters) | Z – External sector (file type: PI) |

Master data for reporting and validation (for technical data providers) | Reporting master data (for technical data providers) (.xml) Validating master data (for technical data providers) (.xml) |

Contact |

Reporting matrix

Assets in domestic custody accounts (AWWPI template) | |||

|---|---|---|---|

Reporting item | |||

Reporting reference date | |||

Securities stocks (STAND) | Securities transactions (TRANS) | ||

Securities identification number (WK) | Securities identification number (WK) | ||

Nominal currency (NOMWG) | Nominal currency (NOMWG) | ||

Account holders – ESA sector (DPINESVG) | Account holder ID (DPIN) | Account holders – ESA sector (DPINESVG) | Account holder ID (DPIN) |

Residence (LD) | Residence (LD) | ||

Account holders | Account holders | ||

Type of transaction (TRANSART) | |||

Type of value (WA) | Type of value (WA) | ||

Value | Value | ||

Scope of reporting

We ask you to report the following:

Securities held for own account by the domestic head office and domestic branch offices (including branch offices in former customs enclaves) as well as

Securities transactions and stocks of securities held or managed for third parties (“customers”).

In line with the AWWPI template, irrespective of

the underlying motive (portfolio investment, shareholding or collateral),

whether the securities have been issued by residents or nonresidents,

the currency in which the securities are denominated,

whether the securities were issued in paper or digital form or in the form of crypto security tokens.

The definition of securities includes:

Equity securities, such as

common and preferred stock

mutual fund shares (to be invested in financial assets or real estate)

rights issues

dividend-right certificates and certificates of participation

Debt securities, such as

coupon bonds

zero-coupon bonds

floating rate notes

perpetual bonds (fixed-rate bonds that are not redeemable)

federal treasury bills and notes

commercial papers

certificates of deposit

medium-term bonds

registered bonds

mortgage bonds (Pfandbriefe), asset-backed securities.

pool factor bonds

inflation-indexed bonds

Other bonds, such as

warrants

certificates (index tracker bonds, convertible bonds, reverse convertible bonds, credit-linked notes),

securitized leveraged products.

The definition of securities does not include:

Financial derivatives (options and futures, even when ISIN-based, swaps → AWFDE)

Bonded loans → AWFUV

Checks

Promissory notes

Own-account holdings of securities

Include in the report:

Any securities listed on the asset side of the balance sheet,

including common stock and repurchases of own issues (without adjustment of outstanding volumes) as well as loan collateral used for OeNB tender operations,Any securities listed on the liabilities side of the balance sheet following short-selling,

Irrespective of where the securities are being held.

Do not include in the report:

Securities held or managed for other reporting units,

Own-account holdings of securities of foreign branches and subsidiaries,

Securities held in trust

Securities repurchase and lending transactions

Securities deposited as collateral by clients,

Issuance volumes offered for subscription but pending sale (issuance accounts),

Fees and commissions,

Coupon income, dividend income and distributed income,

Tax refunds.

Securities transactions and stocks of securities held or managed for third parties

Include in the report:

Securities held or managed for other parties

Irrespective of whether

The account holder is a resident, nonresident or international organization,

The securities are held in trust,

The securities are subject to restrictions (related to collateral).

Do not include in the report:

Securities held or managed for other reporting units,

Securities that serve as cover assets for domestic mutual funds (capital or real estate funds) and money market funds that are MFIs,

Securities repurchase and lending transactions

(if the transactions are shown as increasing or decreasing the assets held in custody for accounting reasons and a second “artificial” custody account is opened, both accounts are to be reported; same as with collateral accounts),Client issuance volumes offered for subscription but pending sale (issuance accounts),

Fees and commissions,

Coupon income, dividend income and distributed income

Tax refunds,

Securities deposited with the OeNB by other central banks under the European Collateral Management System (ECMS).

The OeNB reserves the right to contact reporting agents to query client information or details about individual business events on an ad hoc basis.

Guidance note on Article 6 para 8 Foreign exchange act 2004: The OeNB’s right to obtain these data (Article 6 para. 8 Foreign exchange act 2004) is not prejudiced by reporting agents’ obligation to maintain banking secrecy under Article 38 Banking Act (Bankwesengesetz – BWG).

Reporting threshold

There is no reporting threshold for these data.

Reporting entity/reporting agent

Reporting requirements have been defined for:

MFIs (excluding money market funds)

Residents holding or managing securities on behalf of investors (custody business – Article 1 para. 1 no. 5 Austrian Banking Act)

Special rules for reports by MFIs

Reporting entities required to report data under the OeNB’s smart cube reporting framework, specifically own-use assets, are exempt from AWWPI reporting.

Fusion / merger

The following options are available for reporting the transfer of customer accounts:

Option 1 (recommended):

In the fusion period, units about to be merged report negative transactions in their final pre-merger report, thus bringing their balances to zero, while the receiving units report offsetting positive transactions, reflecting the new/increased balances.

Option 2

Neither the unit to be merged nor the receiving unit report transactions in the fusion period. The receiving unit only reports the new/increased balances.

Unwinding of custody business (Article 1 para. 1 item 5 Austrian Banking Act)

Institutions that are no longer licensed as a custodian (e.g. because they returned their license or because the license was withdrawn) are required to keep reporting all transactions and balances relating to client accounts pending resolution.

Reporting reference date/reporting period

The data must be reported by the 15th day of the month following the reporting month. The reporting cutoff date is the last day of the month.

Special rules for reports by MFIs:

MFIs must submit monthly reports by the 10th banking day at the latest. The reporting reference date is the last day of the month.

Securities stocks (STAND)

Data field description and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

Securities identification number (WK)

Reporting agents are required to provide security-by-security with ISIN codes (international securities identification numbers).

The international securities identification number (ISIN) is a 12-digit combination of letters and numbers that serves to unambiguously identify a given securities instrument (ISIN code under ISO 6166). ISINs are being assigned by national numbering agencies (NNAs); in Austria by the Oesterreichische Kontrollbank (OeKB). An ISIN will be deemed valid when it is contained in the database of the Association of NNAs (ANNA).

An ISIN consists of:

a 2-digit country code (AT for Austria, DE for Germany, etc.),

a 9-digit national ID, and

a 1-digit verification code.

Do not use

official securities identification numbers other than the ISIN (as provided by Wertpapier-Mitteilungen (WM) Frankfurt, Clearstream, CUSIP and Valoren),

securities identification numbers beginning with “XF” (these are not unambiguous),

securities identification numbers beginning with “QOXDBY” (these are preliminary numbers, used for accounting purposes)

In case of transactions with non-ISIN securities, report master data (including data on dividends) → Master data required for reporting.

Nominal currency (NOMWG)

Use three-digit ISO codes to report the currency of denomination of securities in nominal amounts.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Account holders (general) – ESA sector / residence / account holders – dominance code

Account holders – ESA sector (DPINESVG)

Use the classification of the European System of Accounts 2010 (ESA 2010) to provide a breakdown of account holders. Own-use assets are to be reported under the ESA sector of the respective entity.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Accounts held in trust must be reported with the ESA sector to which the fiduciary client belongs.

For detailed information on the ESA classification of individual units, see the standardized master data (SSD) in the integrated reporting data model → Standardisierte Stammdatenmeldung (SSD). Any custody account holders whose identity has not yet been established, are to be reported under the category “Other domestic households.”

Do not report any assets held in custody for account holders classified under the following ESA sectors:

1210, 1220A-Z – Oesterreichische Nationalbank and MFIs: These entities are required to report the full scope of their holdings, irrespective of where the assets are being held → no reports of custody accounts for domestic interbank accounts.

1230A, 1240A-Z – money market funds, mutual funds: These data are reported to the OeNB from other sources → no reports of custody accounts for domestic (money market) funds.

1270F – Nonresident non-holding companies: Allowed only for foreign account holders.

1280Z – Insurance companies n.e.c.: Custody accounts held by domestic farinsurance companies must use 1280A-D for data encryption → report under the respective ESA sector.

1300Z – government n.e.c.: Custody accounts held by public sector entities must use 1311-1314 for data encryption → report under the respective ESA sector.

Residence (LD)

Use the two-digit ISO codes to report the countries of residence of account holders.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

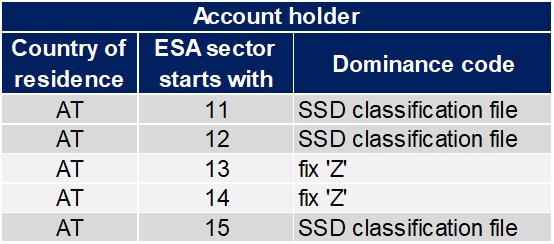

Account holders – dominance code (DPDOM)

Within the ESA sector, classification is governed by dominance:

Dominated by domestic public entities (1)

Dominated by domestic private entities (2)

Dominated by foreign entities, not SPE (3)

Dominated by foreign entities, realeconomy SPE (R)

Not dominated/ambiguous (Z)

Use the dominance code Z for ESA sectors beginning with 13 or 14 (public sector and private sector entities).

Dominance code information need not be provided for foreign account holders.

Account holders (specific) – ID

Account holders – ID (DPIN)

If the account is being held by

the Republic of Austria

the Austrian debt management office (OeBFA)

a domestic financial special purpose entity (SPE)

report the OeNB ID of the account holder. To check whether an account holder is an financial SPE, look up the standardized master data (SSD) in the integrated reporting data model (dominance code= S).

Account holders reported with their OeNB ID must not be reported a second time under ESA sector/residence/account holder/dominance code.

Type of value (WA)

Nominal in nominal currency for interest-bearing and non-interest-bearing assets (NN) or

Number of securities for shares or other securities (STK)

Euro balances of market value (= sales value) (MW)

For all nominal balances/non-par balances, also indicate market value. If current market values are not available, then use some other form of valuation (e.g. the latest market value available, the book value or the purchase price). If no valuation is available, copy the value indicated under type of value (NN or STK). Zero may be used only if the asset is worthless.

The market value is the price of an asset that is established through supply and demand (trade). The market value does not include (accrued) (nominal) interest that has not been credited (= clean price).

Interest accrued is, however, part of the market value in the case of zero-coupon bonds (and with regard to other differences between the issuance and redemption price).

In the case of pool factor bonds, market prices are to be adjusted for the pool factor; in the case of inflation bonds, market prices are to be adjusted for the inflation factor.Number of account holders (ANZ)

For the domestic (domicile country = AT) ESA sectors 1270B, 1400A and 1400B, report the number of underlying custody account holders.

Value

Amounts must be reported in euro and, if applicable, the nominal currency of the security by using the last exchange rate available for the reporting month.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

For all datasets for which positions other than zero were reported in the previous reporting period, a position (even zero) must be reported in the current reporting period.

Value comment

Commenting data entries has been enabled and may reduce the need for queries.

Comments explaining a business event are required for negative balances on custody accounts.

Securities transactions (TRANS)

Data field description and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

Securities identification number

Reporting agents are required to provide security-by-security information with ISIN codes (international securities identification numbers).

The international securities identification number (ISIN) is a 12-digit combination of letters and numbers that serves to unambiguously identify a given securities instrument (ISIN code under ISO 6166). ISINs are being assigned by national numbering agencies (NNAs); in Austria by the Oesterreichische Kontrollbank (OeKB). An ISIN will be deemed valid when it is contained in the database of the Association of NNAs (ANNA).

An ISIN consists of:

a 2-digit country code (AT for Austria, DE for Germany, etc.),

a 9-digit national ID, and

a 1-digit verification code.

Do not use

official securities identification numbers other than the ISIN (as provided by Wertpapier-Mitteilungen (WM) Frankfurt, Clearstream, CUSIP and Valoren),

securities identification numbers beginning with “XF” (these are not unambiguous),

securities identification numbers beginning with “QOXDBY” (these are preliminary numbers, used for accounting purposes)

In case of transactions with non-ISIN securities, report master data (including data on dividends) → Master data required for reporting.

Nominal currency

Use three-digit ISO codes to report the currency of denomination of securities in nominal amounts.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Account holders (general) – ESA sector / residence / account holders – dominance code

Account holders – ESA sector (DPINESVG)

Use the classification of the European System of Accounts 2010 (ESA 2010) to provide a breakdown of account holders. Own-use assets are to be reported under the ESA sector of the respective entity.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

For detailed information on the ESA classification of individual units, see the standardized master data (SSD) in the integrated reporting data model → Standardisierte Stammdatenmeldung (SSD). Any custody account holders whose identity has not yet been established, are to be reported under the category “Other domestic households.”

Do not report any assets held in custody for account holders classified under the following ESA sectors:

1210, 1220A-Z – Oesterreichische Nationalbank and MFIs: These entities are required to report the full scope of their holdings, irrespective of where the assets are being held → no reports of custody accounts for domestic interbank accounts.

1230A, 1240A-Z – money market funds, mutual funds: These data are reported to the OeNB from other sources → no reports of custody accounts for domestic (money market) funds.

1270F – Nonresident non-holding companies: Allowed only for foreign account holders.

1280Z – Insurance companies n.e.c.: Custody accounts held by domestic insurance companies must use 1280A-D for data encryption → report under the respective ESA sector.

1300Z – government n.e.c.: Custody accounts held by public sector entities must use 1311-1314 for data encryption → report under the respective ESA sector.

Residence (LD)

Use two-digit ISO to report the country of residence of the account holders.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

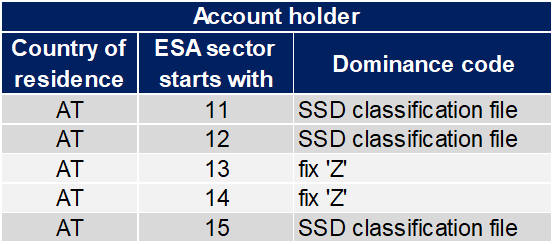

Account holders – dominance code (DPDOM)

Within the ESA sector, classification is governed by dominance:

Dominated by domestic public entities (1)

Dominated by domestic private entities (2)

Dominated by foreign entities, not SPE (3)

Dominated by foreign entities, realeconomy SPE (R)

Not dominated/ambiguous (Z)

Use the dominance code Z for ESA sectors beginning with 13 or 14 (public sector or private sector entities).

Dominance code information need not be provided for foreign account holders.

Account holders (specific) – ID

Account holders – ID (DPIN)

If the account is being held by

the Republic of Austria

the Austrian debt management office (OeBFA)

a domestic financial special purpose entity (SPE)

report the OeNB ID. To check whether an entity is an financial SPE, look up the standardized master data (SDD) in the integrated reporting data model (dominance code= S).

Account holders reported with their OeNB ID must not be reported a second time under ESA sector/residence/account holder/dominance code.

Type(s) of transaction

Transactions for value (MGW)

The sum total of inflows and outflows during the respective reporting period with an identifiable euro equivalent (amount of money), irrespective of whether they lead to a change of principal amounts/units held, e.g. supply/receipt against payment.

Under types of value, report market value (MW) and principal amount (NN) or unit (STK). Transactions for value need not be reported if the two types of value (MW and NN or STK) sum to zero.

Transactions for value (MGW)

Balance on December 31, STK 600, MW EUR 750

Inflows January 15, STK 100, MW EUR 125

Inflows January17.1, STK 100, MW EUR 127

Outflows January 20, STK 200, MW EUR 230

Outflows January 25, STK 50, MW EUR 60

Balance on January 31, STK 550, MW EUR 660

Transactions for value to be reported (MGW): STK -50, MW -EUR 38.

Balance on December 31, STK 600, MW EUR 750

Inflows January 15, STK 100, MW EUR 125

Inflows January17.1, STK 100, MW EUR 127

Outflows January 20, STK 200, MW EUR 230

Balance on January 31, STK 600, MW EUR 720

Transactions for value to be reported (MGW): STK 0, MW -EUR 22.

Balance on December 31, STK 0

Inflows January 15, STK 100, MW EUR 125

Inflows January17.1, STK 100, MW EUR 127

Outflows January 20, STK 200, MW EUR 230

Balance on January 31, STK 0

Transactions for value to be reported (MGW): STK 0, MW -EUR 22.

Balance on December 31, STK 600, MW EUR 750

Inflows January 15, STK 100, MW EUR 125

Inflows January17.1, STK 100, MW EUR 127

Outflows January 20, STK 200, MW EUR 252

Balance on January 31, STK 600, MW EUR 720

No transactions for value to be reported (MGW). Alternatively, you might report: STK 0, MW EUR 0.

Transactions without value (OGW)

The sum total of inflows and outflows during the respective reporting period which lead to a change of principal amounts/units held, for which no euro equivalent and no sales/purchase price are known, such as account carryovers, share splits or swaps.

Report only principal amounts (NN) or units (STK).Transactions without any impact on balances (OSTV)

The sum total of inflows and outflows during the respective reporting period which do not lead to a change of principal amounts/units held, such as payment inflows from partial redemptions of pool factor bonds, bonus payments.

Report only market values (MW).

Type of value

Principal transactions in nominal currency for interest rate-bearing or other securities (NN) or

Number of securities for shares or other securities (STK)

Market value transactions in euro (MW)

Euro equivalent (amount of money) or sale/purchase price in euro including accrued interest, excluding fees and commissions.

Value

Amounts must be reported in euro and, if applicable, the nominal currency of the security by using the exchange rate of the respective day.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

For all datasets for which positions other than zero were reported in the previous reporting period, a position (even zero) must be reported in the current reporting period.

Value comment

Commenting data entries has been enabled and may reduce the need for queries.

Quality requirements

AWWPI reports must be complete and must be submitted to the OeNB in due time.

A complete AWWPI report is a “self-contained” report all transactions and balances for a given period. In other words, the balance of a given period can be derived from the final balance of the previous period and the transactions made since then.

The data reported will be checked by the OeNB. We will contact you in case any queries should arise. Queries need to be answered without delay.

See also: General provisions

Technical description

Reporting template (enhanced for IT interface)

Header data | Concepts reported | Dimensions | ||

Code | Designation | Code | Designation | |

Report code (EC) Reporting item (MO) Reporting date (MP) | STAND | Securities positions | WK | Securities identification number |

NOMWG | Nominal currency | |||

DPINESVG | Account holders – ESA sector | |||

LD | Residence | |||

DPDOM | Account holders – dominance code | |||

DPIN | Account holders – OeNB ID | |||

WA | Type of value | |||

TRANS | Securities transactions | WK | Securities identification number | |

NOMWG | Nominal currency | |||

DPINESVG | Account holders – ESA sector | |||

LD | Residence | |||

DPDOM | Account holders – dominance code | |||

DPIN | Account holders – OeNB ID | |||

TRANSART | Type(s) of transaction | |||

WA | Type of value | |||

Dimensions (data fields)

Code | Designation |

WK | Securities identification number |

NOMWG | Nominal currency |

DPINESVG | Account holders – ESA sector |

LD | Residence |

DPDOM | Account holders – dominance code |

DPIN | Account holders – OeNB ID |

TRANSART | Type(s) of transaction |

WA | Type of value |

Attributes

WK | |

Code | Designation |

ISIN or internal securities identification number | Securities identification number |

NOMWG | |

Code | Designation |

ISO currency code | Currency |

DPINESVG | |

Code | Designation |

1100 | Nonfinancial corporations |

1210 | Central banks |

1220A | MFIs – CRD – required to hold minimum reserves |

1220B | MFIs – Non-CRD, other MFIs |

1220C | CRD – not subject to minimum reserves |

1220Z | MFIs n.e.c. |

1230A | Money market funds |

1240B | Fixed-income funds |

1240C | Other funds |

1240D | Real estate investment funds |

1240E | Equity funds |

1240F | Hedge funds |

1240G | Mixed funds |

1240Z | Mutual funds n.e.c. |

1250A – applicable until November 30, 2021 | Other financial corporations (excl. insurance corporations and pension funds) |

1250B | Severance funds |

1250C | Clearing houses |

1250D | FVCs (ECB definition) |

1250E | Financial leasing companies |

1250F – applicable from December 31, 2021 | Security and derivate dealers (SDDS) classified as MFIs (ECB definition) |

1250G – applicable from December 31, 2021 | Other security and derivate dealers (SDDS) (ECB definition) |

1250H – applicable from December 31, 2021 | Factoring units |

1250I – applicable from December 31, 2021 | Other financial corporations engaged in lending (FCLs) (ECB definition) |

1250F – applicable from December 31, 2021 | Housing banks (non-MFIs) |

1250F – applicable from December 31, 2021 | Other special capital corporations |

1250Z | Other financial institution n.e.c. |

1260A | Lending and insurance auxiliaries |

1260B | Financial head offices |

1270A | Captive financial companies and money lenders excl. private foundations (holdings) |

1270B | Private foundation (Foundation Act) |

1270C | Savings bank foundations (asset management) |

1270E | Pawnhouses extending credit |

1270F | 1270F Nonresident non-holding companies: |

1270Z | Captive financial institutions (n.e.c.) |

1280A | Re-insurance policies |

1280B | Life insurance policies |

1280C | Non-life insurance |

1280D | Mixed insurance plans |

1280Z | Insurance companies |

1290 | Pension funds (old-age provision) |

1311 | General governments |

1312 | Regional governments (including regional chambers and funds) |

1313 | Local governments (including municipal funds and associations |

1314 | Social security funds |

1300Z | Government, n.e.c. |

1400A | Self-employed households (with and without employees) |

1400B | Other households |

1400Z | Households, n.e.c. |

1500 | Nonprofit institutions serving households |

DPIN | |

Code | Designation |

OeNB ID number | ID number |

LD | |

Code | Designation |

ISO country code | Country |

DPDOM | |

Code | Designation |

1 | Dominated by domestic public entities |

2 | Dominated by domestic private entities |

Z | Other |

S | Foreign dominated, SPE |

3 | Foreign dominated, non-SPE |

TRANSART | |

Code | Designation |

MGW | Transactions for value |

OGW | Transactions not for value |

OSTV | Transactions without any impact on balances |

WA | |

Code | Designation |

ANZ | Number |

NN | Principal |

STK | Number |

MW | Market value |