AWFUV report: cross-border credit and debit balances

For any questions please email aussenwirtschaft.FUV@oenb.at.

Contents

See the directory on the right.

Key reporting data

Report code | AWFUV |

Designation | Cross-border credit and debit balances |

Description | Credit and debit balances arising from cross-border transactions, including interest rates accrued and changes not related to transactions, broken down by country/region, foreign group entities or counterparty. |

Reporting agents | Natural residents, legal residents and other resident entities with or without a separate legal identity |

Reporting interval | monthly |

Reporting date | 15th day of the following month |

Reporting reference date | Last day of the month |

Reporting threshold | Sum of credit and/or sum of debit balances reaching EUR 10,000,000. Data on other investment must be reported separately from trade credit data. If the sum of credit balances or the sum of debit balances reaches the reporting threshold, the counterpart (credit or debit) balance must be reported as well. |

Reporting currency/unit | Original currency; amounts rounded to one decimal place (default) or two decimal places (optional) |

Reporting channel (reporting data) | recommended:

other options: Information on the registration (access requests) for all reporting channels can be found here. |

Reporting channel (master data) | Use the “MeldeWeb” platform to enter your data |

Reporting group (for technical data providers) | Z – External sector (file type: FV) |

Master data for reporting and validation (for technical data providers) | Reporting master data (for technical data providers) (.xml) Validating master data (for technical data providers) (.xml) |

Contact |

Reporting matrix

Cross-border credit and debit balances (AWFUV template) | |

Reporting entity | |

Reporting reference date | |

Credit and debit balances (STANDOW) | |

Original currency (WG) | |

Original maturity (URLFZ) | |

Type of investment (INVART) | |

Residence (LD) | ID number (IN) |

Type of balance (BESTART) | |

Type of value (WA) | |

Value | |

Scope

The AWFUV template serves to report credit and debit balances arising from cross-border transactions, including interest accrued and changes not resulting from transactions, broken down by region and/or by foreign affiliated entities or counterparties.

The amounts are to be reported

in the original currency,

based on outstanding principal amounts and

must be submitted even if the balances have not changed since the previous period covered.

The AWFUV report covers cross-border credit and debit balances. This includes for example:

Loans (broken down into loans to banks and nonbanks and by counterparty),

Current accounts and deposits

Clearing and cash pooling accounts

Financial leasing

Promissory note loans

Syndicated loans

Export promotion loans

Securities repurchase agreements and securities lending transactions

Trade credit

Other receivables and payables

The AWFUV report does not include:

Debt securities (with ISIN), as they are to be reported under securities (AWWPI, AWWPA) and not under debt,

Operating leasing (to be reported under the corresponding survey of cross-border services).

Guarantees (if or as long as no accounting receivable or liability position arises for the guarantor itself).

Reporting threshold

Credit and debit balances arising from other cross-border investment activities (excluding trade credits) must be reported separately if they add up to EUR 10,000,000 or more (or the euro equivalent).

Credit and debit balances arising from other cross-border trade credits must be reported must be reported separately if they add up to EUR 10,000,000 or more (or the euro equivalent).

In order to determine an entity’s reporting obligations, first establish the credit balance and the debit balance as such. The reporting requirement kicks in and remains in place at least for the next six reporting periods once the combined balance exceeds the reporting threshold in a given reporting period. For the requirement to be lifted again, the combined credit and debit balance need to remain below the reporting threshold six reporting periods in a row. For reporting purposes, please indicate the respective shortfall from the reporting thresholds. Starting with the seventh period, reporting is still possible on a voluntary basis – for a cancellation of the reporting obligation in OeNB’s systems please send an email to aussenwirtschaft.fuv@oenb.at. Nil reports for individual financial instruments will lift the reporting requirement without delay.

For the purpose of reporting threshold calculations, trade credits (HAKRE) may be dealt with separately from any other types of investment. If the reporting limit is only exceeded for this type of investment (HAKRE), credit and debit balances arising from other cross-border investment activities (excluding trade credits) do not have to be reported obligatory (reporting on a voluntary basis is possible).

Interpreting the reporting threshold

Credit and debit balances arising from other cross-border investment activities must be reported in AWFUV, if

the sum of credit balances arising from other cross-border investment activities (excluding trade credits) add up to EUR 10,000,000 or more or if

the sum of debit balances arising from other cross-border investment activities (excluding trade credits) add up to EUR 10,000,000 or more or if

the sum of credit balances arising from trade credits add up to EUR 10,000,000 or more or if

the sum of debit balances arising from trade credits add up to EUR 10,000,000.

Example 1:

An Austrian entity has the following credit and debit balances (and bank accounts) as of 31.12.2022:

Positive bank account balance (Germany): EUR 1,000,000

Receivables IC-loans (Spain): EUR 4,000,000

Receivables cashpooling (Italy): EUR 6.000.000

Liabilities bank loans (USA): EUR 1,000,000

Receivables trade credits (Germany): EUR 2,000,000

Receivables trade credits (Great Britain): EUR 1,000,000

Liabilities trade credits (China): EUR 6,000,000

Liabilities trade credits (Belgium): EUR 500,000

Build the sums (1. to 4.) stated above:

Sum of credit balances arising from other cross-border investment activities (excluding trade credits) = EUR 11,000,000 (= EUR 1,000,000 + EUR 4,000,000 + EUR 6,000,000)

Sum of debit balances arising from other cross-border investment activities (excluding trade credits) = EUR 1,000,000

Sum of credit balances arising from trade credits = EUR 3,000,000 (= EUR 2,000,000 + EUR 1,000,000)

Sum of debit balances arising from trade credits = 6,500,000 (= EUR 6,000,000 + EUR 500,000)

All credit and debit balances arising from other cross-border investment activities (excluding trade credits; see points 1. and 2.) must be reported, because the sum of credit balances arising from other cross-border investment activities (excluding trade credits) reaches the reporting threshold of EUR 10,000,000.

Trade credits (see points 3. and 4.) must not be reported, because the sum of credit balances arising from trade credits as well as the sum of debit balances arising from trade credits are below the reporting threshold of EUR 10,000,000.

Example 2:

An Austrian entity has the following credit and debit balances (and bank accounts) as of 31.12.2022:

Positive bank account balance (Germany): EUR 1,000,000

Receivables IC-loans (Spain): EUR 1,000,000

Receivables cashpooling (Italy): EUR 1.000.000

Liabilities bank loans (USA): EUR 9,000,000

Receivables trade credits (Germany): EUR 2,000,000

Receivables trade credits (Great Britain): EUR 11,000,000

Liabilities trade credits (China): EUR 6,000,000

Liabilities trade credits (Belgium): EUR 500,000

Build the sums (1. to 4.) stated above:

Sum of credit balances arising from other cross-border investment activities (excluding trade credits) = EUR 3,000,000 (= EUR 1,000,000 + EUR 1,000,000 + EUR 1,000,000)

Sum of debit balances arising from other cross-border investment activities (excluding trade credits) = EUR 9,000,000

Sum of credit balances arising from trade credits = EUR 13,000,000 (= EUR 2,000,000 + EUR 11,000,000)

Sum of debit balances arising from trade credits = 6,500,000 (= EUR 6,000,000 + EUR 500,000)

All credit and debit balances arising from trade credits (see points 3. and 4.) must be reported, because the sum of credit balances arising from trade credits reaches the reporting threshold of EUR 10,000,000.

Credit and debit balances arising from other cross-border investment activities (excluding trade credits; see points 1. and 2.) must not be reported, because the sum of credit balances arising from other cross-border investment activities (excluding trade credits) as well as the sum of debit balances arising from other cross-border investment activities (excluding trade credits) are below the reporting threshold of EUR 10,000,000.

Example 3:

An Austrian entity has the following credit and debit balances (and bank accounts) as of 31.12.2022:

Positive bank account balance (Germany): EUR 15,000,000

Receivables IC-loans (Spain): EUR 10,000,000

Receivables cashpooling (Italy): EUR 100.000.000

Liabilities bank loans (USA): EUR 2,000,000

Receivables trade credits (Germany): EUR 2,000,000

Receivables trade credits (Great Britain): EUR 1,000,000

Liabilities trade credits (China): EUR 53,000,000

Liabilities trade credits (Belgium): EUR 5,000,000

Build the sums (1. to 4.) stated above:

Sum of credit balances arising from other cross-border investment activities (excluding trade credits) = EUR 125,000,000 (= EUR 15,000,000 + EUR 10,000,000 + EUR 100,000,000)

Sum of debit balances arising from other cross-border investment activities (excluding trade credits) = EUR 2,000,000

Sum of credit balances arising from trade credits = EUR 3,000,000 (= EUR 2,000,000 + EUR 1,000,000)

Sum of debit balances arising from trade credits = 58,000,000 (= EUR 53,000,000 + EUR 500,000)

Credit and debit balances arising from other cross-border investment activities (excluding trade credits; see points 1. and 2.) as well as trade credits (see points 3. and 4.) must be reported, because the sum of credit balances arising from other cross-border investment activities (excluding trade credits) and the sum of debit balances arising from trade credits reach the reporting threshold of EUR 10,000,000.

Example: No reporting requirement

A domestic company conducted the following cross-border transactions:

Took out a loan from a Swiss bank in the amount of EUR 5,000,000 with an original maturity of three years.

Took out a loan from a Luxembourg bank in the amount of EUR 2,000,000 with an original maturity of 18 months.

These two loans qualify as long-term loans (original maturity ≥ 12 months), but they do not exceed the reporting threshold (EUR 10,000,000) when added up. Therefore, no AWFUV report is required.

Example: Reporting threshold is exceeded by one transaction

A US company sets the payment terms for an Austrian supplier such that the latter has 60 days to pay the invoice, which totals USD 15,000,000. The two companies are unconnected entities. The Austrian supplier (the domestic entity) must include this transaction in its AWFUV report in the original currency “USD”, with an original maturity “K0-12” (short-term, up to 12 months), indicating “trade credit” as the type of investment, “US” as the country of residence, “debit” as the type of balance, “principal amount” under type of value, with a value of “15,000,000”.

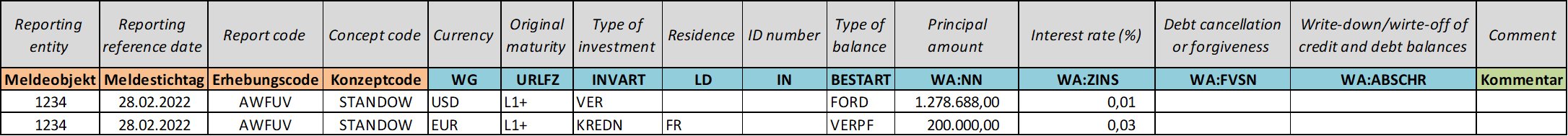

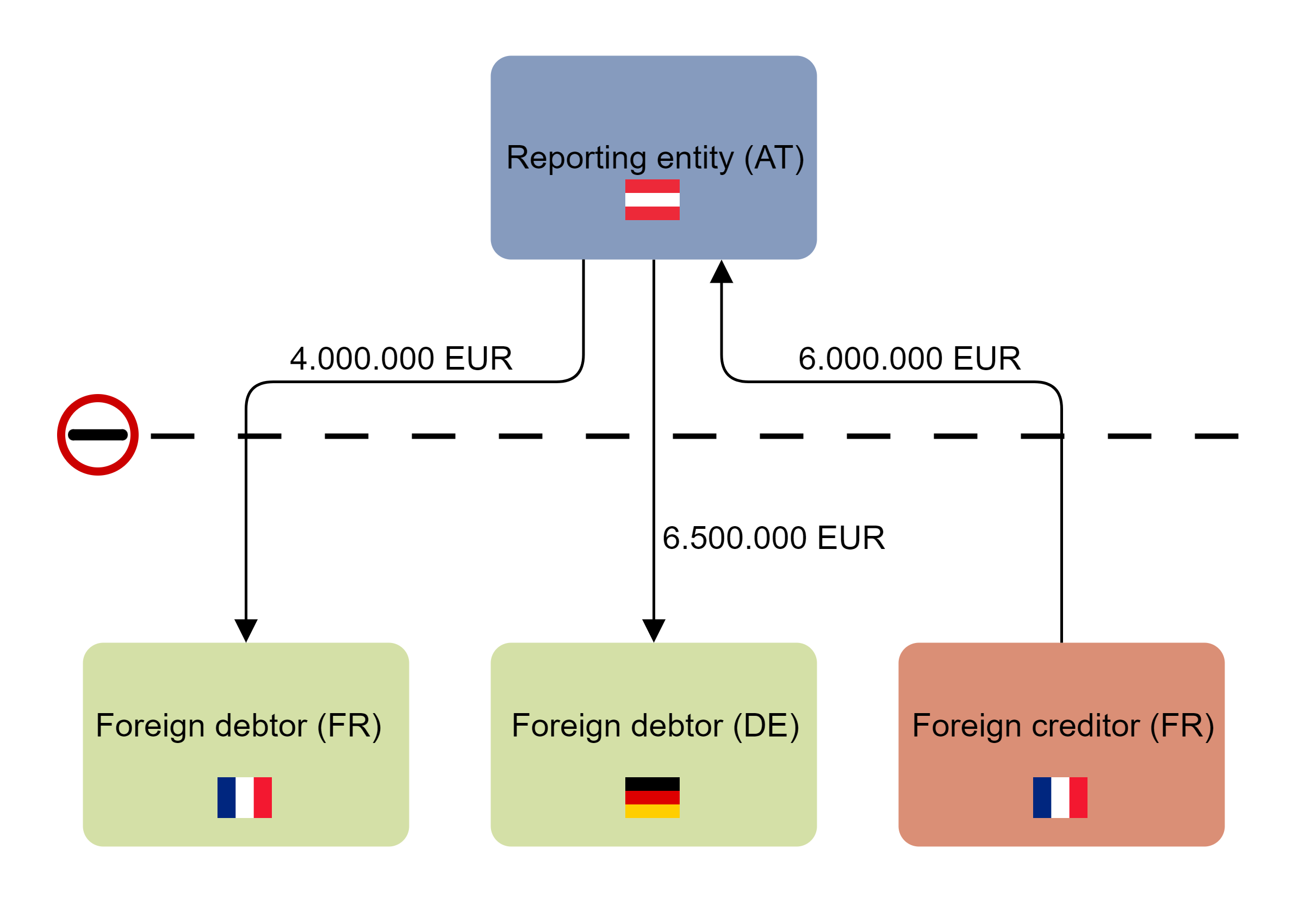

Example: Reporting threshold is exceeded by several transactions

A domestic company conducted the following cross-border transactions:

Granted a short-term loan to a foreign company based in France. The loan totaled EUR 4,000,000 (The two companies are unconnected entities.).

Has other receivables totaling EUR 6,500,000 from a foreign group company headquartered in Germany.

Took out a loan totaling EUR 6,000,000 from a foreign company based in France.

Credit balance: EUR 4,000,000 + EUR 6,500,000 = EUR 10,500,000.

Debit balance: EUR 6,000,000

Since these transactions exceed the reporting threshold on the credit side, both credit and debit balances need to be reported.

The types of balances are to be reported per country and per OeNB ID, in the original currencies.

Special rules for reporting other investment by MFIs

No reporting threshold applies for direct investment loans and deposits and other MFI balances reported for the purpose of external sector statistics (OeNB BOP reporting regulation 1/2022, annexes B.1 and B.2).

Reporting entity/reporting agent

Reports must be submitted by all residents who make or receive cross-border other investments.

Any receivables from residents arising from other investment activities that nonresidents seek to recover through collectors must be reported by the collectors commissioned. The reporting requirement covers all receivables of nonresidents to be recovered, with the total to be shown in the report under “debit”.

Example: Reporting obligation of a holding company

The German DE1 GmbH holds shares in the Austrian AT1 GmbH. The Austrian AT1 GmbH holds shares in the Austrian AT2 GmbH.

The German DE1 GmbH grants AT1 GmbH a loan in the amount of EUR 50,000,000.

The funds received by AT1 GmbH are passed on directly to AT2 GmbH in Germany.

AT1 GmbH is obliged to report here, even if it only acts as an "intermediate financing company".

Note for reporting entities submitting smart cube data

Note: Reporting entities required to report data under the OeNB’s smart cube reporting framework, specifically data on deposits and general accounts (OeNB smart cube code ESSC) loans (OeNB smart cube code KRSC), fulfill their AWFUV reporting obligation via reporting data to OeNB’s smart cubes.

Special rules for asset management companies under Article 3 (2) item 1 Investment Fund Act:

The requirement to report “cross-border other investment” pursuant to the second main part, section 3, of the OeNB BOP reporting regulation, AWFUV template does not apply to investment fund management companies (Article 3 para. 2 no. 1 Investment Fund Act 2011 – Investmentfondsgesetz 2011 – Federal Law Gazette no. 77/2011 as amended) and real estate investment management companies (Article 2 Real Estate Investment Fund Act – Immobilien-Investmentfondsgesetz – Federal Law Gazette I no. 80/2003 as amended; investment fund management companies report under Regulation (EU) No 1073/2013 of the European Central Bank of 18 October 2013 concerning statistics on the assets and liabilities of investment funds (ECB/2013/38), OJ L 319, 29.11.2013).

However, other investment made for own account and in the investor’s own name must be reported.

Note on the Reporting Obligation for Insolvent Entities

Companies or other reporting entities that are subject to insolvency proceedings remain obliged to report in the AWFUV survey, provided that the relevant reporting thresholds are met and unless otherwise specified by the OeNB.

For restructuring proceedings, the following applies:

Cross-border credit and debit balances must continue to be reported to the OeNB during the ongoing proceedings. Upon completion of the proceedings, a final nil report must be submitted (only zeros are to be entered in the WA:NN column). For creditors who have agreed to the restructuring plan, the last reported balance minus the amount (according to the quota) that has been settled must be entered in the WA:FVSN column. For creditors who have not agreed to the restructuring plan, the last reported balance minus the amount (according to the quota) that has been settled must be entered in the WA:ABSCHR column.

For bankruptcy proceedings, the following applies:

Cross-border credit and debit balances must continue to be reported to the OeNB during the ongoing proceedings. Upon completion of the proceedings, a final nil report must be submitted (only zeros are to be entered in the WA:NN column). Additionally, the amount of the last reported balance minus the amount (according to the quota) that has been settled must be entered in the WA:ABSCHR column.

Reporting reference date/reporting period:

The data must be reported by the 15th day of the month following the reporting month. If the 15th day of the month were to be a Saturday, Sunday or a public holiday, then the reporting deadline would shift to the next business day. The reporting reference date is the last day of the month.

Special rules for reporting other investment by MFIs:

The data must be reported by the 10th banking day of the month following the reporting month. The reporting reference date is the last day of the month.

Credit and debit balances (STANDOW)

Data fields and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

Currency

Amounts must be given in the original currency.

For foreign currency amounts, indicate the three-digit ISO code for the original currency of the respective type of investment.

→ Wechselkurse - Oesterreichische Nationalbank (OeNB)

All amounts are to be specified in original currency, as positive rounded figures (rounded to 1 decimal place (default) or up to two decimal places (optional)).

Do not convert non-euro-denominated amounts but report the amounts in original currency.

Example: Conversion into original currency

An Austrian company took out a loan denominated in Japanese yen, equivalent to EUR 16,000,000, from a Hungarian bank. The loan has an original maturity of 24 months. Redemption and interest payments are to be made in euro,

but must be reported in the original currency. Therefore, the EUR 16,000,000 need to be converted to JPY for reporting purposes.

For the example at hand, we assume a conversion rate of EUR 1 = JPY 103,27.

EUR 16,000,000 x JPY 103.27 = JPY 1,652,320,000.

In the report to the OeNB, amounts must be given in Japanese yen.

Original maturity

Please note that the original maturity, and not the remaining term, has to be reported in AWFUV.

On demand (TF)

Claims or liabilities without an agreed maturity or notice period. The balances may be used at all times (on demand).

Short-term (up to 1 year) (K0-12)

“Short-term” refers to all claims or liabilities with an original maturity of up to and including one year.

Long-term (over 1 year) (L1+)

“Long-term” refers to all claims and liabilities with an original maturity of more than one year.

Past due receivables and payables

At present, past due receivables and payables are to be reported only for export credits; any other claims and liabilities are to be reported under original maturity.

Past due receivables (UEF) and debt cancellation/forgiveness (FVSNUEF) are to be reported only by OeKB in the context of export credits granted by OeKB.

Type of investment

Settlement accounts (VER)

Only settlement/intercompany account receivables and payables of foreign branches vis-à-vis the Austrian head office, or settlement/intercompany receivables and payables of Austrian branches vis-à-vis the foreign head office, must be reported. If in the AWBES survey it is reported that the branch prepares its own financial statements, then in AWFUV only those receivables/payables that exist in addition to the equity reported in AWBES, if any, must be reported.

Cash pooling (CPOOL)

Report the sum total of all balances from cash pooling accounts with nonresidents per country or group. Use original currencies and indicate the respective OeNB ID numbers. Cash pooling accounts serve to bundle liquidity centrally. Intragroup liquidity balancing serves to withdraw liquidity from areas that have excess liquidity and channel liquidity to areas that are short of liquidity.

Other forms of intra-group cash/liquidity management must also be reported under this reporting item.

Lending (counterpart = banks) (KREDB)

Unsecuritized loans (granted and extended),

Current account credits

Revolving credits

Factoring & forfaiting receivables from nonresidents

Disclosed assignment of domestic receivables by domestic creditors to a nonresident third party (to be reported by the domestic borrowers)

Fiduciary loans (to nonresidents if the reporting entity is the trustor)

Securitized loans

EIB loans

Promissory note loans (in German: Schuldscheindarlehen) to foreign banks

Repurchase agreements if related, for instance, to bills of exchange or receivables rather than securities.

Regional breakdown of promissory note loans

The country of residence of the counterparty is not the country of residence of the arranging bank, but the country of residence of the actual creditor.

In the event of the transfer of promissory note loans to a new creditor and a resulting change in the regional breakdown of the creditors, care must be taken to ensure that this change in the regional breakdown is also taken into account in the AWFUV report.

Beispiel: Schuldscheindarlehen

In January 2022, an Austrian company (AT-Test GmbH) issues a promissory note loan in the amount of EUR 100,000,000 with the help of a German bank (DE-Bank 1) as arranger. The arranger (DE-Bank 1), another bank in Germany (DE-Bank 2), an Austrian bank (AT-Bank) and a bank in Spain (ES-Bank) will act as creditors in equal shares. The Austrian company must therefore report an obligation of EUR 50,000,000 (= two times 25,000,000) with the country code ‘DE’ and an obligation of EUR 25,000,000 with the country code ‘ES’ in AWFUV from January 2022 onwards. The remaining EUR 25,000,000, for which AT-Bank acts as creditor, is not to be taken into account in AWFUV, as AT-Test GmbH does not consider this to be a cross-border obligation.

In July 2023, DE Bank 2 transfers the outstanding EUR 25,000,000 to a new creditor, a bank in Italy (IT-Bank). From July 2023 onwards, obligations of EUR 25,000,000 with the country code ‘DE’, obligations of EUR 25,000,000 with the country code ‘ES’ and obligations of EUR 25,000,000 with the country code ‘IT’ must therefore be recognised in the AWFUV report from the perspective of AT-Test GmbH.

Lending (counterpart = nonbanks) (KREDN)

Unsecuritized loans (granted and extended)

Revolving credits

Factoring & forfaiting receivables from nonresidents

Domestic debt assigned to third-party nonresidents (to be reported by the domestic borrowers)

Fiduciary loans (to nonresidents if the reporting entity is the trustor)

Securitized loans

Promissory note loans (in German: Schuldscheindarlehen) to foreign companies or public authorities

Repurchase agreements if related, for instance, to bills of exchange or receivables rather than securities

Export credits, as long as public guarantees have not been invoked – once public guarantees have been invoked, loan receivables from nonresidents are reported by the government’s agency, Oesterreichische Kontrollbank Aktiengesellschaft (OeKB), under the Export Support Act. The reporting requirement for deductibles continues to lie with domestic exporters.

Example: Factoring

An Austrian company named AT-Test GmbH has receivables from Austrian customers.

Those receivables are sold from AT-Test GmbH to the German company DE-Test GmbH. AT-Test GmbH receives financial resources from DE-Test GmbH from this sale of receivables and this business case is recognized in AT-Test GmbH's accounts as a liability to DE-Test GmbH. AT-Test GmbH contractually declares, if domestic receivables are (partially) settled, to also settle/reduce the liability to DE-Test GmbH accordingly.

AT-Test GmbH has to report the liabilities against DE-Test GmbH, resulting from the Factoring-business case stated above, in the AWFUV-report. The liabilities have to be reported with type of investment (INVART) lending from nonbanks (KREDN).

Example:

As of 31.12.2022, the Austrian AT-Test GmbH has receivables in the amount of EUR 35,000,000 from Austrian customers.

As of 03.01.2023 AT-Test GmbH sells these receivables to the German DE-Test GmbH. This will be shown in the balance sheet/accounting of AT-Test GmbH as a liability to DE-Test GmbH.

In the AWFUV report with the reporting date 03.01.2023, AT-Test GmbH reports liabilities of EUR 35,000,000 to DE-Test GmbH.

On 14.02.2023, AT-Test GmbH's domestic receivables from its Austrian customers are reduced by EUR 5,000,000. With the funds received, AT-Test GmbH also reduces its liabilities to DE-Test GmbH to EUR 30,000,000.

In the AWFUV report with the reporting date 28.02.2023, AT-Test GmbH reports liabilities in the amount of EUR 30,000,000 to DE-Test GmbH.

Current accounts, deposits (EINL)

Current accounts

Initial margins

Deposits

Securities repurchase transactions or securities lending (REPO)

Credit balances resulting from lending to nonresidents via buy and sell-back securities transactions or against borrowed securities

Debit balances resulting from deposits from nonresidents related to buy and sell-back securities transactions or securities lending

Financial leasing (FINLE)

Credit or debit balances resulting from financial leasing transactions, hire purchases and sale and lease-back transactions

Operating lease

An operating lease is any lease transaction which does not qualify as a financial lease. The respective assets are assigned to the lessor and accounted for in the lessor’s balance sheet.

The underlying transactions are to be reported in the report on cross-border services. Depending on the relevant ÖNACE codes, the data are to be reported to the OeNB (ÖNACE 64, 65, 66) or to Statistics Austria (all others). For details, see: Report on cross-border services.

Syndicated loans (KONS)

How to establish credit shares under syndicated loans:

In case of syndicated loans with nonresident lead managers, report all liabilities arising from credit shares granted to residents by foreign lenders.

In case of syndicated loans with resident lead managers, report all liabilities arising from credit shares granted to residents by foreign lenders.

Do not report liabilities from syndicated loans that were provided by domestic lenders.

Example:

A domestic company wishes to take out a loan (EUR 300,000,000) from its bank. Since the bank does not want to raise this amount on its own, the loan is provided by several banks: the company’s domestic bank (lead manager), another domestic bank, a German bank and a Finnish bank. Each of the four banks provides one-quarter of the loan.

Since the lead manager is a domestic bank, the only liabilities to be reported are the shares of the loan that were provided by foreign banks. The reporting requirement does not extend to the shares of the loan that were provided by the domestic lead manager and the other domestic lender.

EUR 300,000,000 / 4 = EUR 75,000,000

As the reporting entity, use the AWFUV template to report liabilities from loan shares provided by the German and the Finnish bank under “KONS” (type of investment) with the pro rata shares under “DE” and “FI.”

Export credits (KREDN) (to be reported only by Oesterreichische Kontrollbank)

Trade credits (HAKRE)

Accounts receivable of residents from nonresidents or group companies related to the sale of goods or services, subject to agreed terms of payment (trade credit offered),

Accounts payable by residents to nonresidents or group companies related to the purchase of goods or services, subject to agreed terms of payment (trade credit received),

Advances paid by residents to nonresident suppliers related to the later supply of goods or services (advances paid),

Advances paid by nonresident customers related to the later supply of goods or services (advances received),

Bills of exchange, which are presented in the balance sheet as trade receivables or trade payables.

Other (SONS)

Fiduciary transactions such as fiduciary loans are to be reported by the trustee if the trustee is a resident and by the trustor if the trustee is a nonresident,

Bills of exchange (if these are not presented in the balance sheet as trade receivables or trade payables),

Undisclosed assignment of domestic receivables to a nonresident third party (to be reported by the (resident) assigning counterparty rather than the domestic debtor as other accounts payable),

Transactions with asset backed securities (ABS) as a special form of undisclosed assignment,

Dividends agreed upon but yet to be paid out,

Assets or liabilities that cannot be mapped unambiguously to any other “type of investment”.

If there are several data records with the same dimensionality, these have to be aggregated. To be more specific: If there exist several claims or liabilities against the same counterparty or country, if they are of the same type of investment and same original currency, these corresponding claims or liabilities are to be aggregated for reporting purposes.

Residence

The country of residence is the country in which the foreign counterparty to the transaction, which is neither a connected entity nor a group company, is headquartered. If the counterparty is a private individual, it is not the citizenship that counts but the place of abode.

Use the two-digit ISO codes to report the respective country.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

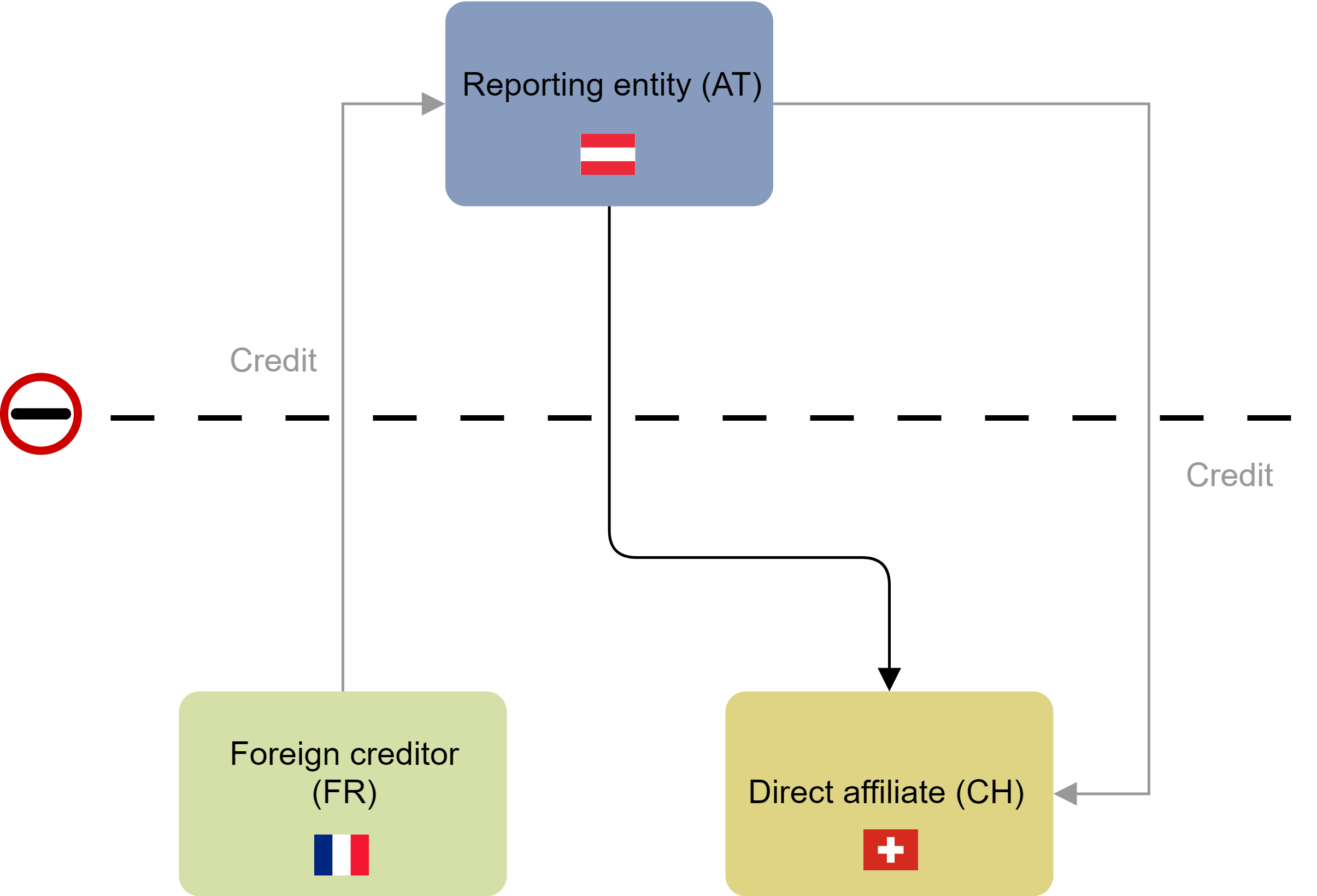

Residence OR identification number

Use either a breakdown by country of residence OR a breakdown by OeNB ID number, depending on group affiliation.

Country code for loans from the European Investment Bank (EIB)

When reporting loans against the European Investment Bank (EIB), "4C" must be entered as the country code.

ID number

Use the OeNB ID number rather than the country of residence for the breakdown of accounts receivable from and payable to foreign group companies or individual counterparties.

Master data

The relevant master data need to be entered before the reporting of data, and they need to be kept up to date. For further details on editing master data see Master data and reporting.

Example: Country breakdown vs. ID number breakdown

An Austrian company takes out a loan from a foreign bank and forwards the funds to a foreign subsidiary within its group of companies. As the reporting entity, report debit balances under “VERPF,” indicating the relevant country code, and credit balances under “FORD,” indicating the OeNB ID number assigned to the counterparty.

Type of balance

Credit balance (FORD)

Outstanding positive principal amounts

Debit balance (VERPF)

Outstanding negative principal amounts

Positive sign

Indicate absolute amounts (positive sign) for both credit and debit balances. With regard to balances that may alternate between credit and debit, adjust the type of balances accordingly rather than entering negative amounts.

Gross representation

Netting credit and debit balances with the same dimension characteristics is not allowed (in line with the gross perspective used for the balance of payments).

Type of value

For the purpose of reporting AWFUV, one of the following value types must be selected:

Principal amount (NN)

Use this field to indicate outstanding principal amounts of the credit and debit balances to be reported, per country or counterparty in the original currency.

Do not include a plus or minus sign for balances. The “type of balances” will indicate whether the amounts given relate to credit or debit balances.

Interest rate (ZINS)

Use this field to indicate the interest rate agreed for the respective type of balance. Report an average interest rate when a number of loans carry different interest rates but otherwise have the same dimension characteristics (same country, same currency, perhaps same counterpart). Add a negative sign to report negative interest rates. Adjust variable interest rates for the respective reporting period.

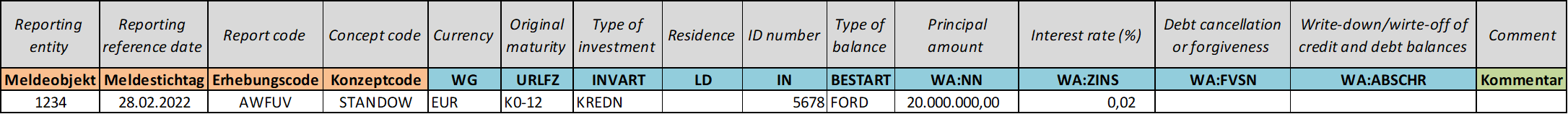

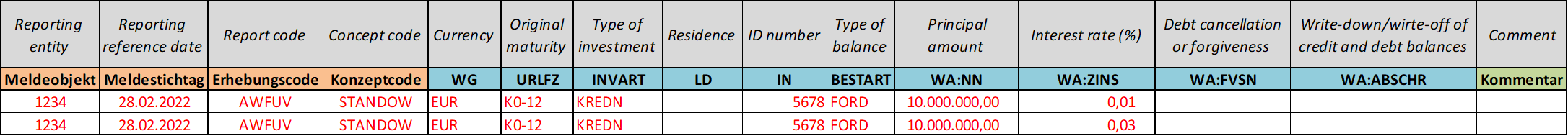

Example: Weighted average interest rate

The reporting company AT-Test GmbH with identification number 1234 has two short-term credit claims (original currency = Euro) against the foreign subsidiary DE-Testsubsidiary GmbH with identification number 5678.

Both receivables amount to EUR 10,000,000, with one loan bearing interest at 1% p.a. and the other at 3% p.a.

The two receivable balances must be reported as a total in the column WA:NN. A weighted average interest rate (= 10,000,000/20,000,000*0.01 + 10,000,000/20,000,000*0.03 = 0.02) must be entered in the column WA:ZINS.

Correct reporting:

The two credit balances may not be reported in two lines.

Wrong Registration:

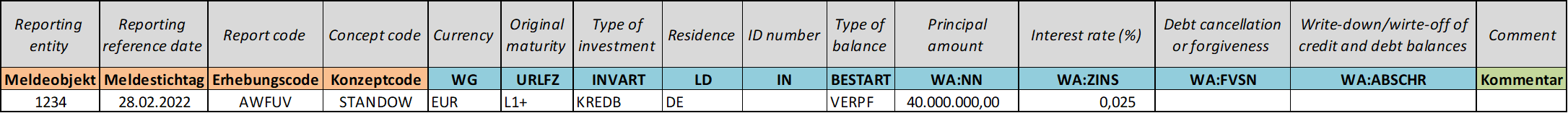

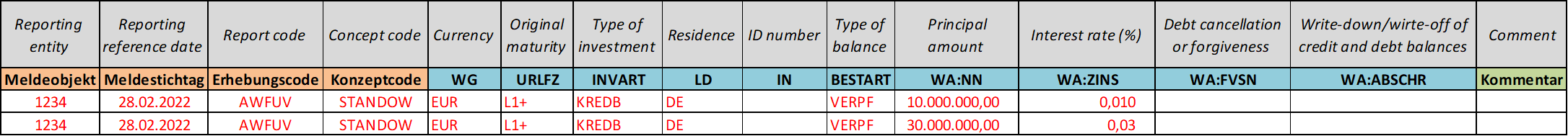

Example 2: Weighted average interest rate

The reporting company AT-Test GmbH with identification number 1234 has two long-term loan obligations (original currency = euro) to German banks. One obligation amounts to EUR 10,000,000 and bears interest at 1% p.a. The second obligation amounts to EUR 30,000,000 and bears interest at 3% p.a.

The two debit balances must be reported as a total in the column WA:NN. A weighted average interest rate (= 10,000,000/40,000,000*0.01 + 30,000,000/40,000,000*0.03 = 0.025) must be entered in the column WA:ZINS.

Correct Registration:

The two debit balances may not be reported in two lines.

Wrong Registration:

Internal settlement rates

Quasi-money market interest rates are also due for funds deposited or raised within a group; please indicate these rates here.

Write-down/write-off of receivables and payables (ABSCHR)

Use this field to report nonperforming receivables and payables.

Such impairments reduce credit and debit balances.

Debt cancellation/debt forgiveness (FVSN)

Debt cancellation or debt forgiveness relates to cases where creditors agree to the settlement of a debt for less than the amount owed (write-offs or write-downs). The essential characteristic of debt forgiveness or cancellation is that it constitutes an irreversible transfer from creditors to debtors.

Such transactions need to be reported in the reporting period during which the changes were accounted for. They need to be reported only once, irrespective of the period during which the respective amounts are kept on the accounts.

Please note that the amounts reported per type of receivables or payables must not exceed the credit or debit balances disclosed in the previous period.

Past-due claims (UEF)

Assets and liabilities are deemed unrecoverable if a debtor files for bankruptcy or reorganization bankruptcy, is permanently unable to pay, or if the amounts are not recoverable for some other reason. The debt cancellation is not based on a contractual agreement between creditors and debtors.

Such incidents need to be reported in the reporting period during which these changes which are not related to transactions were accounted for. They need to be reported only once, irrespective of the period for which the respective amounts are kept on the accounts.

Debt cancellation/debt forgivenenss related to past-due claims (FVSNUEF)

Value

All values are to be specified in original currency, as rounded figures (rounded to 1 decimal place (default) or up to two decimal places (optional)). Instead of a plus or minus sign, indicate the type of balance.

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Use the comments function for system-related queries that may arise during reporting (mandatory).

In order to avoid queries from OeNB to your firm, OeNB draws your attention to the following points:

To ensure the informative value of the comments, avoid abbreviations.

Comment on high stock and interest rate changes (due to their statistical significance or changes that do not occur regularly) by indicating the business case background.

If the sum of inflows (funds received from abroad) differs greatly from the sum of outflows (funds flowed abroad), comment on the use of funds or the raising of funds as well as the reason for the increased/decreased liquidity requirement.

Quality requirements

AWFUV reports must be complete and must be submitted to the OeNB in due time.

As a precondition, the master data must have been entered correctly and confirmed as current before the actual reporting using the MeldeWeb application.

Full AWFUV reports cover all dimension characteristics of all types of investments (loan data and trade loan data in one report).

Use the comments function for system-related queries that may arise during reporting (mandatory).

The data reported will be checked by the OeNB. We will contact you in case any queries should arise, Queries need to be answered without delay.

See also: General provisions .

Technical description

Reporting template (enhanced for IT interface)

Header data | Concepts reported | Dimensions | ||

Code | Designation | Code | Designation | |

Report code (EC): Reporting entity (MO) Reporting reference date (MP) | STANDOW | Credit and debit balances | IN | ID number |

LD | Residence | |||

WG | Currency | |||

URLFZ | Original maturity | |||

INVART | Type of investment | |||

BESTART | Type of balance | |||

WA | Type of value | |||

Dimensions (data fields)

Code | Designation |

WG | Currency |

URLFZ | Original maturity |

INVART | Type of investment |

LD | Residence |

IN | ID number |

BESTART | Type of balance |

WA | Type of value |

Attributes

WG Currency | |

Code | Designation |

ISO currency code | Currency |

URLFZ | |

Code | Designation |

TF | Demand deposits |

K0-12 | Short-term (up to 1 year) |

L1 | Long-term (over 1 years) |

INVART | |

Code | Designation |

VER | Settlement accounts |

CPOOL | Cash pooling |

KREDB | (Interbank) loans |

KREDN | Loans (to nonbanks) |

EINL | Current account balances, deposits |

REPO | Securities repurchase agreements and securities lending transactions |

FINLE | Financial leasing |

SONS | Other |

KONS | Syndicated loans |

HAKRE | Trade credit |

LD | |

Code | Designation |

ISO-Landcode | Country |

IN | |

Code | Designation |

OeNB ID number | OeNB ID number |

BESTART | |

Code | Designation |

FORD | Credit balances |

VERPF | Debit balances |

WA | |

Code | Designation |

NN | Principal amount |

ZINS | Interest rate (%) |

ABSCHR | Write-down/write-off of credit and debt balances |

FVSN | Debt cancellation or forgiveness |

UEF | Past-due receivables (To be reported only by OeKB) |

FVSNUEF | Debt cancellation/debt forgivenenss related to past-due receivables (To be reported only by OeKB) |

Reporting examples (xlsx/xml)

Example: