AWFDE Reporting: Cross-Border Financial Derivatives

For any questions please email aussenwirtschaft.FDE@oenb.at.

Contents

See the directory on the right.

Key Reporting Data

Reporting Code | AWFDE |

Designation | Cross-border financial derivatives |

Description | Reporting of cross-border transactions and positions arising from financial derivatives that are subject to reporting requirements |

Reporting Agents | All residents conducting cross-border financial derivatives transactions with nonresidents |

Reporting Frequency | Monthly |

Reporting Deadline | 15th calendar day of the following month |

Reporting Reference Date | Last day of the month |

Reporting Threshold | EUR 1,000,000 |

Reporting Currency/Unit | Euro; values rounded to whole numbers (or optionally to two decimal places) |

Reporting Channels (Data Submission) | recommended: other options:

Information on registration (access requests) for all submission channels can be found here. |

Reporting Group (for technical reporting agents) | Z – External sector (file type: DE) |

Master and Validation Data (for technical reporting agents) | Reporting master data (for technical data agents) (.xml) Validation master data (for technical data agents) (.xml) Data model/Basic cube (for financial institutions/banks) |

Contact |

Reporting Matrix

Cross-Border Financial Derivatives (AWFDE) | |

Reporting Entity | |

Reporting Reference Date | |

Financial Derivatives – Balances (STAND) | Financial Derivatives – Transactions (TRANS) |

Country of residence / domicile (LD) | Country of residence / domicile (LD) |

Type of derivative (DERART) | Type of derivative (DERART) |

Asset class (AKL) | Asset class (AKL) |

Balance type (BESTART) | Transaction classification (TRANSZ) |

Type of value (WA) | Type of value (WA) |

Value | Value |

Reporting Content

Cross-border transactions (inflows and outflows) and positions (claims and liabilities) related to financial derivatives must be reported on a regional basis, in accordance with the AWFDE reporting matrix.

Financial derivatives include all derivative instruments as defined in Annex II of Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms (CRR Regulation), as well as credit derivatives. Exchange-traded financial derivatives (both domestic and foreign), such as standardized options and futures for which an ISIN has been assigned, must be reported under financial derivatives and must not be included in the reporting under Domestic Securities Deposits (AWWPI).

Under the AWFDE reporting, both transaction and position data must be submitted for the following types of derivatives:

Options

Purchased Options

Purchased options include both exchange-traded and over the counter (OTC) options that are purchased by a resident from a non-resident counterparty. A purchased option may be either a call option or a put option. In the case of an option (a contingent forward contract), the buyer (long position, holder of the option) has the right to exercise the option or let it expire. The buyer acquires a claim. This section must always be reported from the holder’s perspective (long position), regardless of whether the option is a call or a put.

From the holder’s perspective (long position), the derivative category “options” includes, among others:Purchased credit spread options,

Purchased interest rate options,

Purchased currency options,

Purchased options on tangible assets and other equity index options,

Purchased precious metal options,

Purchased commodity options and other contingent forward contracts.

Written Options

Written options include both exchange-traded and over the counter (OTC) options that are sold by a resident to a non-resident counterparty. A written option may be either the sale of a call option or the sale of a put option. In the case of an option (a contingent forward contract), the seller (short position, writer of the option) always incurs an obligation. This section must always be reported from the writer’s perspective (short position), regardless of whether the option is a call or a put.

From the writer’s perspective (short position), the derivative category “options” includes, among others:Written credit spread options,

Written interest rate options,

Written currency options,

Written options on tangible assets and other equity index options,

Written precious metal options,

Written commodity options and other written contingent forward contracts.

Futures

Futures are standardized, unconditional forward contracts that represent an obligation to buy or sell a specific underlying asset at a predetermined price on a specified future date.

For futures, only transaction data are collected — no position data are reported.

The derivative category “Futures” includes commodity and financial futures, among others:Interest rate futures and interest rate index contracts,

Currency futures / foreign exchange forwards (FX forwards) and currency index contracts,

Futures on tangible assets and other equity price-related index futures,

Index futures on tangible assets and other equity price-related index contracts,

Precious metal futures,

Commodity futures and other comparable contracts.

Forwards

Forwards are unconditional forward contracts that constitute an obligation to buy or sell a specific underlying asset at a predetermined price on a specified future date.

Unlike futures, the contractual terms of forwards are typically not standardized, but instead individually negotiated between the two counterparties and traded over the counter (OTC).

The derivative category “Forwards” includes, among others:Interest rate forwards (forward rate agreements), including forward purchases and sales of time deposits and securities,

Foreign exchange forwards,

Precious metal forwards,

Commodity forwards,

Credit spread forwards.

Swaps

Swaps are contractual agreements in which counterparties agree to exchange payment flows based on a notional principal amount, over a defined period and under pre-agreed terms and conditions.

The derivative category “Swaps” includes, among others:Interest rate swaps,

Floating interest rate swaps (floating to fixed, fixed to floating and float to float),

Cross-currency interest rate swaps and capital market swaps,

Money market swaps (foreign exchange swaps),

Single-name credit default swaps (CDS),

Portfolio credit default swaps,

Total return swaps.

Other Financial Derivatives

The category “Other Financial Derivatives” includes only those derivative transactions that cannot be assigned to any of the other categories.

Important:

The following must not be included in the AWFDE report:

Underlying assets (underlyings)

Notional amounts of swaps and forwards

Derivative securities or securitized financial derivatives, such as warrants, certificates (e.g. capital-protected, index, investment, or turbo certificates), and securities with embedded derivatives (e.g. equity-linked bonds, convertible bonds, option bonds, credit-linked notes), as well as similar leveraged products structured as securities – these items (third bullet point) must be reported under Domestic Securities Deposits (AWWPI)

Initial margins must be reported under Cross-Border Claims and Liabilities (AWFUV) as deposits (EINL)

Reporting Threshold

The reporting threshold can be reached or exceeded either through transactions or through positions arising from cross-border financial derivatives. If either threshold (transactions or positions) is reached or exceeded, both elements (transactions and positions) must be reported.

Transactions:

The net amount (difference) of cross-border inflows and outflows related to financial derivatives within a reporting period: EUR 1,000,000

Positions:

The total absolute value of all valued claims and liabilities arising from cross-border financial derivatives as of the end of the month: 1,000,000

Falling below the threshold + nil report:

If, after a previous report, the reporting threshold is no longer met in the following reporting period — both for transactions (inflows and outflows) and for positions (claims and liabilities) — a nil report must be submitted. Further reports are only required once the threshold is again reached or exceeded.

Example: Reporting threshold for cross-border financial derivatives transactions (positive net amount)

A resident entity sells a (written) option to a German counterparty for EUR 3,000,000 (cash inflow). At the same time, the resident entity receives interest payments of EUR 700,000 (cash inflow) from an interest rate swap with a counterparty in Ireland, and must pay EUR 500,000 in interest payments to the same Irish counterparty (cash outflow).

The net amount of these transactions is calculated as follows: EUR 3,000,000 + EUR 700,000 – EUR 500,000 = EUR 3,200,000

Since the net amount of the transactions exceeds the reporting threshold of EUR 1,000,000, two transactions must be reported:

A transaction with Germany (+ EUR 3,000,000)

A transaction with Ireland (+ EUR 200,000)

Example: Reporting threshold for cross-border financial derivatives transactions (negative net amount)

A resident entity purchases options with a cash outflow of EUR 300,000 from Germany, a cash outflow of EUR 400,000 from the United States, and a cash outflow of EUR 350,000 from the United Kingdom.

The net amount of these transactions is calculated as follows: – EUR 300,000 – EUR 400,000 – EUR 350,000 = – EUR 1,050,000

The absolute value of the net amount (EUR 1,050,000) exceeds the reporting threshold of EUR 1,000,000. Therefore, the following transactions must be reported:

One transaction with Germany (– EUR 300,000)

One transaction with the United States (- EUR 400,000)

One transaction with the United Kingdom (- EUR 350,000)

Example: Reporting threshold for cross-border financial derivatives transactions (connections between transactions and positions)

As of 31 January, a resident entity holds claims from purchased options against Italy totaling EUR 2,000,000. In addition, during January, the resident entity receives interest payments of EUR 300,000 (cash inflow) from a Spanish counterparty under an interest rate swap.

Since the claim (position) exceeds the reporting threshold of EUR 1,000,000, both the received transaction (cash inflow) from Spain (+ EUR 300,000) and the claim against Italy (EUR 2,000,000) must be reported.

Reporting Entity/Reporting Obligation

All resident entities that conduct cross-border financial derivatives transactions with non-residents are subject to reporting — provided that the reporting thresholds outlined in the previous section are exceeded.

For CRR credit institutions using the Common Reporting Data Model, see the representation of this reporting requirement in the Supervisory Reporting Data and Information Model (MDI; modelled in the Basic Cube). Reporting is to be carried out in accordance with the specified data model.

Reporting Reference Date/Reporting Period

Reports for both transactions and positions must be submitted monthly, no later than the 15th calendar day of the following month. A reporting period corresponds to a calendar month. Transactions must be assigned to a reporting period based on the booking date, not the settlement date. This means that transactions with a booking date after the end of the month (e.g. 31 March) must not be included in the report for that month-end (31 March). Such transactions are to be reported in the following reporting period (i.e. April).

Transactions

The reporting reference date for transactions (cash inflows and outflows) is the last calendar day of the month in which the transactions were booked.

Balances

The reporting reference date for positions (claims and liabilities) is the last calendar day of the respective month.

Regional Breakdown

Transactions (cash inflows and outflows) and positions (claims and liabilities) from cross-border financial derivatives transactions must be reported by ISO country code of the foreign counterparty, and broken down by derivative type and asset class.

Example: Regional breakdown

In May, a resident entity conducts several cross-border transactions involving financial derivatives:

Payments are received from the United Kingdom (options), Germany (futures), and the United States (options)

Payments are made to counterparties in Italy and France

The absolute value of the net amount of these transactions exceeds the reporting threshold of EUR 1,000,000.

Accordingly, five transactions must be reported to the OeNB, broken down by country (GB, DE, US, IT, and FR) and by derivative type (futures, options, etc.), in accordance with the AWFDE reporting matrix.

Positions in Financial Derivatives (CONCEPT CODE = STAND)

Positions (claims and liabilities) must be valued at clean fair value (excluding accrued interest) and aggregated by derivative type, asset class, and ISO country code of the foreign counterparty, resulting in a total claims or total liabilities position.

Certain types of financial derivatives may change over the course of the contract from a claim to a liability and vice versa. In general, positions must always be reported as positive values, either as a claim or as a liability. If a position changes during the reporting period without a settlement, the market value of the gross claim or liability at the end of the previous reporting period must be reset to zero, and the new gross claim or liability must be recorded at the market value as of the end of the current reporting period. For derivatives that are settled on a daily basis, the position value is zero in the balance sheet.

Description of Data Fields and Their Attributes

The codes for each data field (dimension) and their possible attributes are indicated in parentheses. These codes are required when submitting reports via Excel upload or through the IT interface (XML)

Country – Country of Residence (LD)

The two-letter ISO code must be reported for the country of domicile of the foreign counterparty. The relevant criterion is the place of business. In the case of individuals as counterparties, the country of residence, not the nationality, must be used.

f the counterparty is an international organization based abroad, the appropriate country code for its registered location must be used.

For derivatives traded directly on foreign exchanges, the country code of the exchange’s location may be reported.

For OTC transactions, either the country of the clearing house or the actual counterparty's domicile must be reported.

The ISO code refers to the country code as defined in ISO standard 3166.

→ Classifications – Oesterreichische Nationalbank (OeNB)

Example: Country of residence (LD) for positions

A resident entity holds a claim (position) arising from a purchased option against a British counterparty. The underlying asset, which is not subject to AWFDE reporting, consists of German equities.

In this case, the correct ISO country code to report is: United Kingdom = GB

Type of derivative (DERART)

Positions (claims and liabilities) from cross-border financial derivatives transactions must be categorized as follows:

Forwards (FORW)

Options (OPT)

Swaps (SWAP)

Other financial derivatives (SONSFD)

Asset class (AKL)

The asset class of the underlying instrument must be classified as follows:

Commodity (COMM)

Credit (CRED)

Foreign exchange and gold (CURR)

Equity (EQU)

Interest rate (INTRATE)

Other asset class (SONSAK)

Type of position (BESTART)

Since positions in claims and liabilities are reported as absolute values (see data field "Wert"), a further classification using the following codes is required:

Claims (FORD)

Liabilities (VERPF)

For futures, no position is to be reported (Concept Code = STAND must not be used, and BESTART must be left blank). Only the combination of Concept Code = TRANS and TRANSZ = FORD or VERPF is permitted.

Type of value (WA)

The market value (MW) must always be reported in this field.

Value

Positions (claims and liabilities) must be valued at fair value per country of counterparty, where positive fair values are aggregated under claims, negative fair values are aggregated under liabilities, and both must be reported as absolute values. As a result, all position values must be reported as positive figures.

The report must be submitted in euro. For positions, the last available exchange rate of the month corresponding to the reporting period must be used.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Example: Exchange rate for positions

As of 30 September, a resident entity holds liabilities from cross-border financial derivatives transactions amounting to GBP 5,000,000 with a counterparty in the United Kingdom. This foreign currency amount must be converted and reported using the ECB reference rate as of the reporting reference date (30 September).

The exchange rate on 30 September is: 1 EUR = 0,81275 GBP

The foreign currency amount must be converted using the last available exchange rate of the month: 5,000,000 GBP / 0.81275 = EUR 6,151,953

A position in liabilities of EUR 6,151,953 must be reported for the United Kingdom.

Value comment

All reported values may be accompanied by a comment. Comments help reduce potential follow-up questions. If a system-generated query arises during the submission process, entering a mandatory comment is required.

Transactions Related to Financial Derivatives (CONCEPT CODE = TRANS)

Transactions captured under financial derivatives include the trading of contracts as well as the net settlement amounts. Such transactions may occur at initiation, on secondary markets, as part of ongoing contractual activity (e.g. margin payments), or at settlement. Valuation gains or losses are not to be reported as transactions.

Transactions related to financial derivatives include, but are not limited to, the following cash inflows and outflows:

Premiums

Premiums paid (cash outflow) or received (cash inflow) – for example, when purchasing or selling an option on the primary or secondary market.Cash settlement

Cash settlements (ongoing or at exercise/closure of the contract), such as variation margins (e.g. in the case of futures). These must be reported under financial derivatives as ongoing settlement payments, i.e. cash inflows or cash outflows. Variation margins are daily exchange-based bookings that realize gains and losses on individual positions.Physical settlement

The difference between the strike price and the actual price of the underlying financial instrument on the exercise date.Asynchronous settlements

For example, quarterly versus annual interest payments in the case of an interest rate swap.

The following cash inflows and outflows must NOT be reported as transactions related to financial derivatives:

Initial margins: These are not to be reported as transactions. An initial margin refers to the amount of money that must be deposited by the client into a segregated account at the time a transaction is initiated.

In the case of currency swaps, the exchange of currencies (i.e. the underlying asset of the swap) must not be reported as a transaction related to financial derivatives. Only the settlement of the market value at the closure of the contract is to be reported as a cash inflow or outflow.

Fees or commissions paid to or received from brokers or intermediaries for arranging options, futures, swaps, or other derivative contracts.

Description of Data Fields and Their Attributes

The codes for each data field (dimension) and their possible attributes are indicated in parentheses. These codes are required when submitting reports via Excel upload or through the IT interface (XML)

Country – Country of Residence (LD)

The two-letter ISO code must be reported for the country of domicile of the foreign counterparty. The relevant criterion is the place of business. In the case of individuals as counterparties, the country of residence, not the nationality, must be used.

f the counterparty is an international organization based abroad, the appropriate country code for its registered location must be used.

For derivatives traded directly on foreign exchanges, the country code of the exchange’s location may be reported.

For OTC transactions, either the country of the clearing house or the actual counterparty's domicile must be reported.

The ISO code refers to the country code as defined in ISO standard 3166.

→ Classifications – Oesterreichische Nationalbank (OeNB)

Example: Country of residence (LD) for transactions

A resident entity acquires an option from a British counterparty. The underlying asset consists of German equities.

In this case, the correct ISO country code to report is: United Kingdom = GB

Type of derivative (DERART)

Transactions (cash inflows and outflows) from cross-border financial derivatives transactions must be classified as follows:

Forwards (FORW)

Futures (FUTURE)

Options (OPT)

Swaps (SWAP)

Other financial derivatives (SONSFD)

Asset class (AKL)

The asset class of the underlying must be classified as follows:

Commodity (COMM)

Credit (CRED)

Foreign exchange and gold (CURR)

Equity (EQU)

Interest rate (INTRATE)

Other asset class (SONSAK)

Transaction Classification (TRANSZ)

Using the transaction classification, transactions must be assigned to either claim or liability positions:

Claims (FORD)

Liabilities (VERPF)

The classification of transactions must be carried out as follows, based on the position at the time of payment execution:

TRANSZ = FORD: Net amount of all cash inflows and outflows related to derivative contracts that, at the time of payment, were in a claim position (FORD) — aggregated by derivative type, asset class, and country of the foreign counterparty.

TRANSZ = VERPF: Net amount of all cash inflows and outflows related to derivative contracts that, at the time of payment, were in a liability position (VERPF) — aggregated by derivative type, asset class, and country of the foreign counterparty.

A negative net amount must always be reported with a negative sign!

It is explicitly noted that cash inflows and outflows may occur on both the claims and the liabilities side. It is incorrect to submit cash inflows exclusively using Concept Code = TRANS and Dimension = TRANSZ with attribute value = FORD, and cash outflows exclusively with attribute value = VERPF.

If a reporting entity offers, for example, foreign exchange forwards solely as a financial intermediary for clients or within a group, no transactions are to be reported — provided that cash inflows and outflows offset each other at the time of payment, and the reporting entity is not a contractual counterparty to the derivative transaction. Valuation differences between the forward rate and the spot rate must be reported using the concept code = STAND and the dimension = BESTART. If the forward contract is in a claim position, the attribute value FORD is to be used. If the forward contract is in a liability position, the attribute value VERPF is to be used.

Exception Rule for Transactions

If a reporting entity is unable to submit transaction data for financial derivatives in accordance with the standard rule described above (transaction classification at the time of payment execution), the following simplified approach may be applied:

TRANSZ = FORD: positive net amount of cash inflows and outflows, aggregated by derivative type, asset class, and country of the foreign counterparty.

TRANSZ = VERPF: negative net amount of cash inflows and outflows, aggregated by derivative type, asset class, and country of the foreign counterparty.

A negative net amount must always be reported with a negative sign!

The OeNB must be notified if this exception rule is applied (please send an email to: Aussenwirtschaft.FDE@oenb.at).

Type of value (WA)

In the MeldeWeb online application, selecting a value type is not required. However, when submitting the report via Excel upload or IT interface (XML), market value (MW) must be selected as the value type.

Value

Transactions (cash inflows and outflows) must be reported as a net amount per reporting period, aggregated by derivative type, asset class, and country (ISO code) of the foreign counterparty. Positive net amounts must be reported as positive values. Negative net amounts must be reported as negative values.

The report must be submitted in euro. For transactions, the exchange rate of the respective day (i.e. the transaction date) must be used.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Example: Exchange rate for transactions

On 3 October, a reportable transaction occurs from a cross-border financial derivatives transaction:

A resident entity receives a cash inflow of USD 2,000,000 from an option. No other reportable transactions related to financial derivatives take place during this reporting period. The foreign currency amount of USD 2,000,000 must be converted and reported using the ECB reference rate of 3 October.

The exchange rate published for October 3 is as follows: EUR 1 = USD 1.3035.

The foreign currency amount must be converted using the exchange rate of the transaction date: USD 2,000,000 / 1.3035 = EUR 1,534,331

A cash inflow transaction (positive value) of EUR 1,534,331 must be reported.

Value comment

All reported values may be accompanied by a comment. Comments help reduce potential follow-up questions. If a system-generated query arises during the submission process, entering a mandatory comment is required.

Quality requirements

The AWFDE report must be submitted to the OeNB in a timely and complete manner.

A complete AWFDE submission includes all dimensional attributes across all types of financial derivative investments carried out.

If a system-generated query arises during submission, a mandatory comment must be provided.

The OeNB reviews all incoming reports and will contact reporting entities in case of any questions. Such inquiries must be responded to without delay.

See also: General provisions.

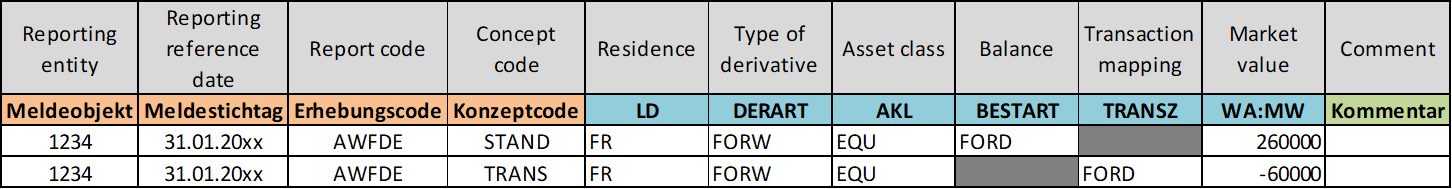

Reporting Examples for Selected Business Cases / Scenarios

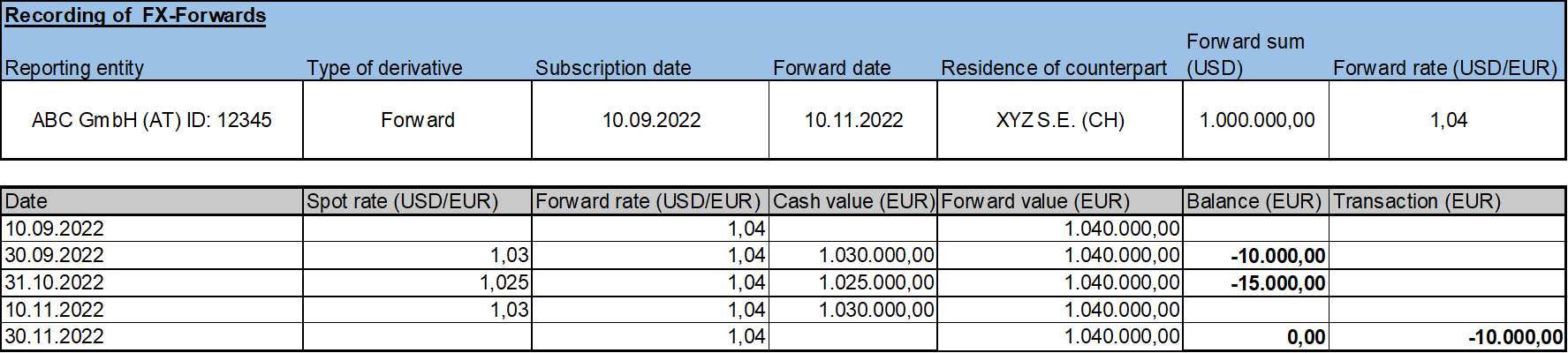

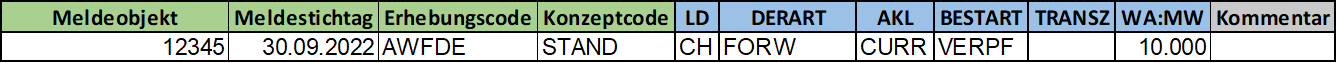

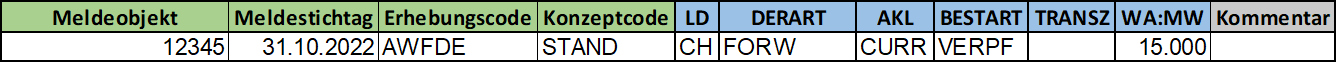

Example: FX-Forward

Please note: Transactions in the AWFDE report result in a change in foreign deposit/brokerage accounts, which must be transmitted to the OeNB as part of the AWFUV report.

AWFDE report on reporting reference date 30.09.2022:

AWFDE report on reporting reference date 31.10.2022:

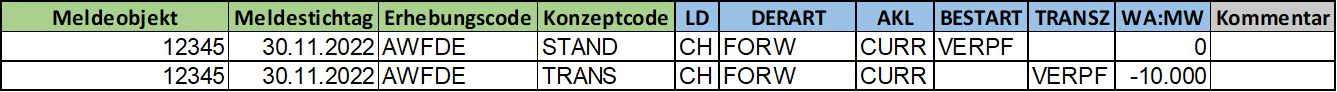

AWFDE report on reporting reference date 30.11.2022:

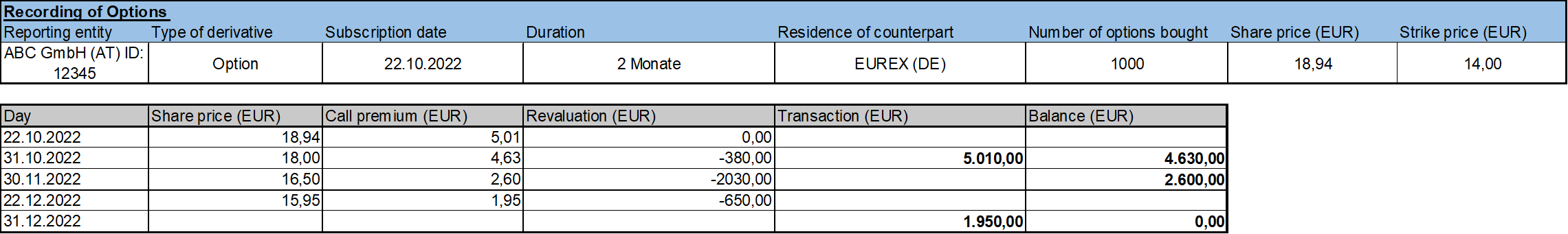

Example: Call/Put of an Option

Please note: Transactions in the AWFDE report result in a change in foreign deposit/brokerage accounts, which must be transmitted to the OeNB as part of the AWFUV report.

The following is an example of a single transaction (below the reporting threshold); note that all cross-border financial derivatives transactions within the reporting period must be taken into account when submitting the report.

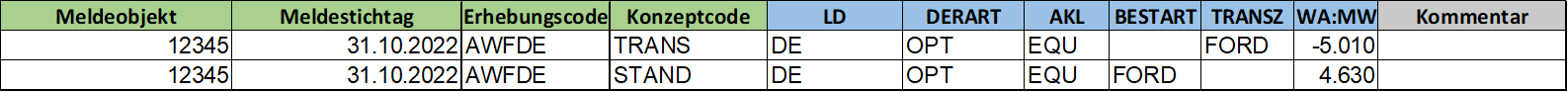

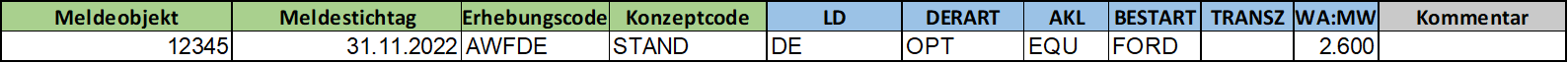

AWFDE report on reporting reference date 31.10.2022:

AWFDE report of buyer:

AWFDE report of seller:

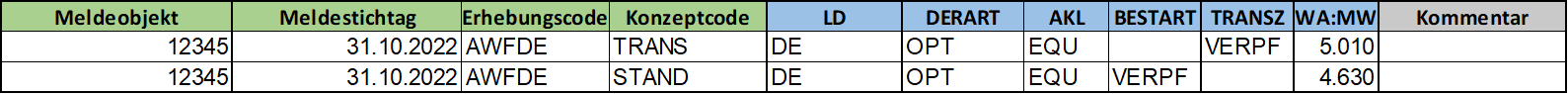

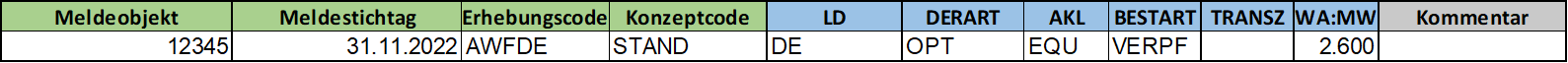

AWFDE report on reporting reference date 30.11.2022:

AWFDE report of buyer:

AWFDE report of seller:

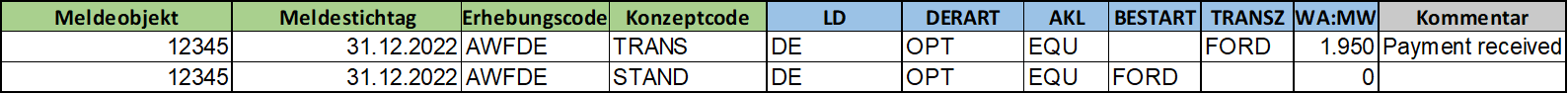

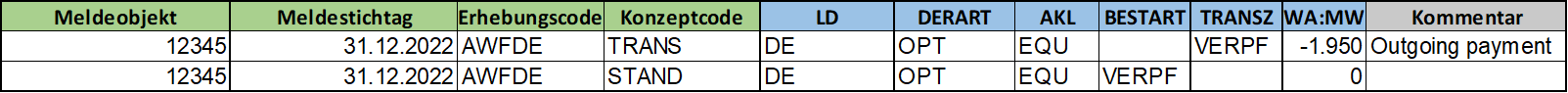

AWFDE report on reporting reference date 31.12.2022:

The agreed strike price is lower than the market price of the share on the reporting date. The buyer exercises the option!

AWFDE report of buyer:

AWFDE report of seller:

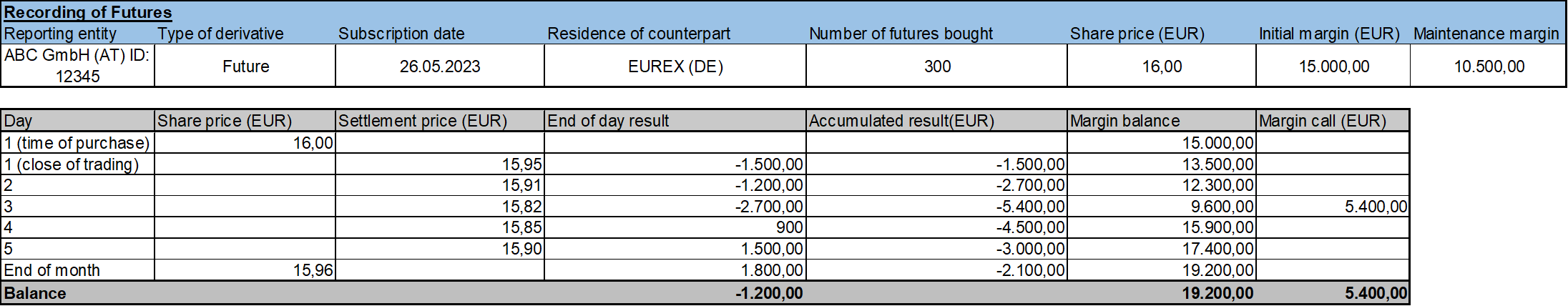

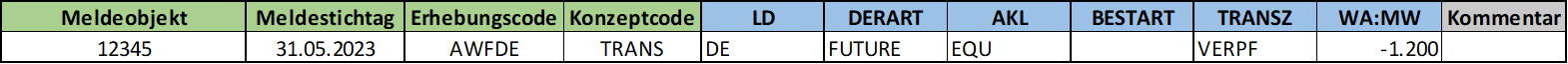

Example: Future

Please note: Transactions in the AWFDE report result in a change in foreign deposit/brokerage accounts, which must be transmitted to the OeNB as part of the AWFUV report. For futures, no position is to be reported (Concept Code = STAND must not be used, and BESTART must remain blank). Only the combination of Concept Code = TRANS and TRANSZ = FORD or VERPF is permitted.

The following is an example of a single transaction (below the reporting threshold); note that all cross-border financial derivatives transactions within the reporting period must be taken into account when preparing the report.

AWFDE report on reporting reference date 31.05.2023:

AWFDE report of buyer:

AWFDE report of seller:

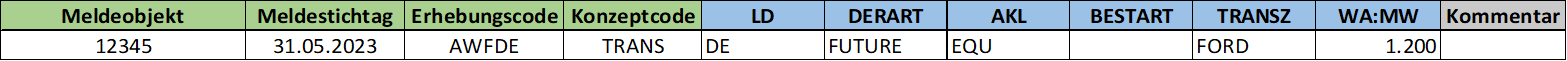

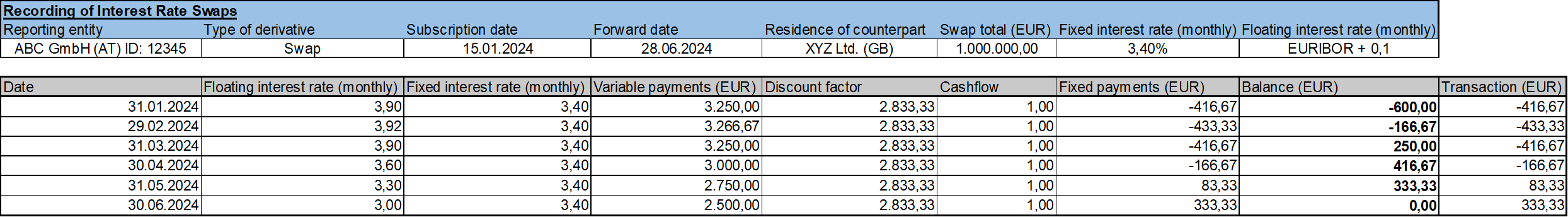

Example: Interest Rate Swap

Please note: Transactions in the AWFDE report result in a change in foreign deposit/brokerage accounts, which must be transmitted to the OeNB as part of the AWFUV report.

The following is an example of a single transaction (below the reporting threshold); note that all cross-border financial derivatives transactions within the reporting period must be taken into account when preparing the report.

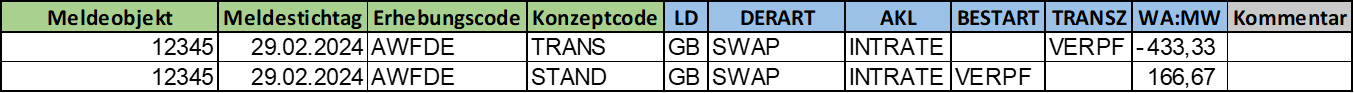

The position as of 31 January 2024 (EUR 600) results from the sum of the future cash flows (from February to June).

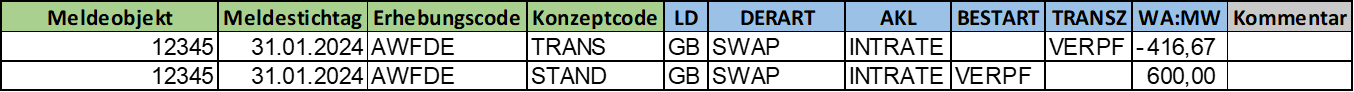

AWFDE report on reporting reference date 31.01.2024:

AWFDE report on reporting reference date 29.02.2024:

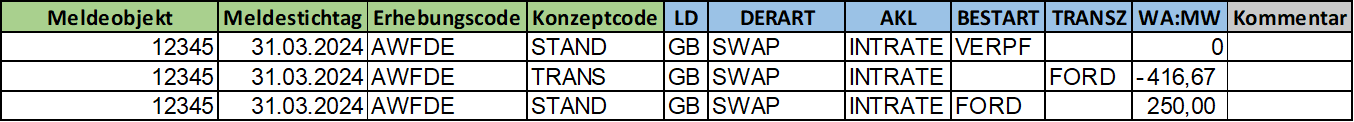

AWFDE report on reporting reference date 31.03.2024:

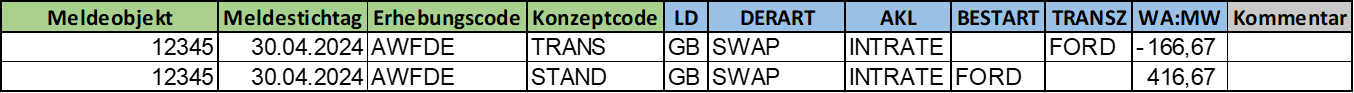

AWFDE report on reporting reference date 30.04.2024:

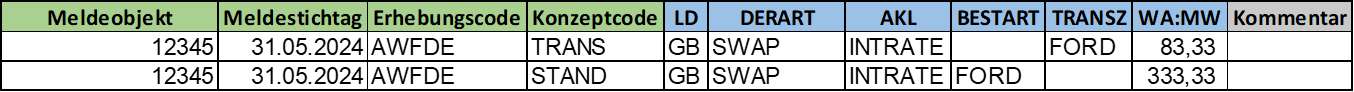

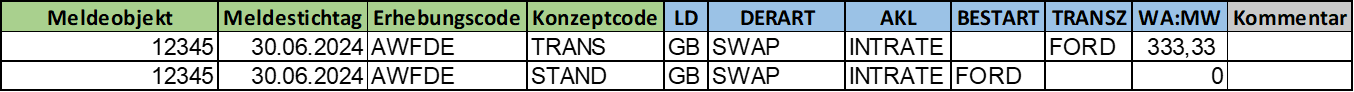

AWFDE report on reporting reference date 31.05.2024:

AWFDE report on reporting reference date 30.06.2024:

Technical Description

Reporting Template (optimized for IT interface)

Header data | Reported Concepts | Dimensions | ||

Code | Designation | Code | Designation | |

Report Code (EC): Reporting Entity (MO) Reporting Reference Date (MP) | STAND | Positions in financial derivatives | LD | Country of residence |

DERART | Type of derivative | |||

AKL | Asset class of the underlying | |||

BESTART | Type of position (claim or liability) | |||

WA | Type of value (e.g. market value) | |||

TRANS | Transactions related to financial derivatives | LD | Country of residence | |

DERART | Type of derivative | |||

AKL | Asset class of the underlying | |||

TRANSZ | Transaction classification | |||

WA | Type of value (e.g. market value) | |||

Dimensions (data fields)

Code | Designation |

LD | Country of Residence |

DERART | Type of derivative |

AKL | Asset class of the underlying |

BESTART | Type of position (claim or liability) |

TRANSZ | Transaction Classification |

WA | Type of value (e.g. market value) |

Attributes

LD | |

Code | Designation |

ISO country code | Country |

DERART | |

Code | Designation |

FUTURE | Futures |

OPT | Options |

FORW | Forwards |

SWAP | Swaps |

SONSFD | Other financial derivatives |

AKL | |

Code | Designation |

COMM | Commodity |

CRED | Credit |

CURR | Foreign exchange and gold |

EQU | Equity |

INTRATE | Interest rate |

SONSAK | Other asset class |

BESTART | |

Code | Designation |

FORD | Claims |

VERPF | Liabilities |

TRANSZ | |

Code | Designation |

FORD | Claims |

VERPF | Liabilities |

WA | |

Code | Designation |

MW | Market value |

Reporting examples (xlsx/xml)

Example 1:

AWFDE_reporting_example_1.xlsx

FAQs

Below are the answers to questions raised during the webinar on cross-border financial derivatives and forward transactions held on 7 May 2024. Identical or similar questions have been grouped together.

General

Where can I find the presentation from the 7 May 2024 webinar?

The presentation materials are available on the OeNB website under:

Meldewesen/Meldebestimmungen/Aussenwirtschaftsstatistik/Meldeinhalte (see section 4: Cross-border financial derivatives; Webinar-Präsentation AWFDE).

What are the consequences of failing to meet the reporting deadline?

The reporting deadlines are set based on the (inter)national delivery obligations of the OeNB and must generally be observed. In exceptional cases, extensions may be granted upon justified request. The Foreign Exchange Act grants the OeNB the right to initiate sanctioning measures. Anyone who fails to meet their obligations to provide information, disclose data, submit documents or evidence, or grant access completely and in due time, or who knowingly provides incomplete or incorrect information, may be sentenced to a monetary fine in the course of an administrative penalty procedure conducted by the competent district administrative authority or the provincial police directorate.

Are there penalties for late reporting or non-reporting?

Yes. The Foreign Exchange Act grants the OeNB the right to initiate sanctioning measures in the case of reporting violations. Anyone who fails to meet their obligations to provide information, disclose data, submit documents or evidence, or grant access completely and in due time, or who knowingly provides incomplete or incorrect information, may be sentenced to a monetary fine as part of an administrative penalty procedure conducted by the competent district administrative authority or the provincial police directorate.

How can non-Austrian legal representatives who do not have USP access register with MeldeWeb?

The Austrian Business Service Portal (USP) (http://usp.gv.at) offers solutions for non-Austrian managing directors who do not have direct access.

What must be considered before submitting the AWFDE report? Is there a checklist available?

Yes. Please refer to the following checklist or slide 33 of the webinar presentation.

Checklist:

Both exchange-traded and over-the-counter (OTC) derivatives must be taken into account.

Signs (+/–) must be applied correctly. Positions must be reported without a sign. Cash outflows must be reported with a negative sign.

The following are not part of the AWFDE reporting content: Underlyings, positions in futures, credit lines/ISDA-agreements/margin-accounts/other collateral.

Changes in margin accounts must be reported under the AWFUV survey

Onset of the reporting obligation

Is a nil report required if there has never been a reporting obligation for cross-border financial derivatives and forward transactions, and none currently exists either?

No. If there has been no reporting obligation in the past and none currently exists, then a nil report does not need to be submitted.

Who is required to report if cross-border financial derivatives and forward transactions are executed by a group company located abroad?

The reporting obligation to the OeNB applies exclusively to entities domiciled in Austria that are the contractual counterparties to the transactions.

Are individual cross-border financial derivatives and forward transactions subject to reporting under the AWFDE survey?

Cross-border financial derivatives and forward transactions must be aggregated by derivative type and asset class, and broken down by counterparty country.

The two-letter ISO code for each respective foreign counterparty country must be provided.

Who is required to report if a financial derivative is concluded between an Austrian bank (proprietary trading) and a foreign parent company?

The Austrian bank is subject to reporting.

Does a reporting obligation arise if financial derivatives are concluded within a corporate group (intercompany)?

Yes. Cross-border intercompany financial derivatives and forward transactions are subject to reporting.

Within a group, is the holding company or the specific legal entity required to report?

The reporting obligation always lies with the Austrian-based entity that acts as the contractual counterparty in the cross-border financial derivative or forward transaction.

Are public sector entities subject to reporting in the context of cross-border financial derivatives?

Yes. Public sector entities are subject to reporting if they engage in cross-border financial derivatives or forward transactions and act as the contractual counterparty.

Is hedging for group companies subject to reporting, even if no physical exports are conducted?

Cross-border hedging transactions are considered financial derivatives under the AWFDE survey and must therefore be reported to the OeNB. Hedging transactions must be strictly separated from actual exports and imports. Internal transfers or offsets within a corporate group may result in intercompany claims or liabilities. See also the AWFUV report.

Who is required to report if a financial derivative is concluded between a foreign group financing company and a swap bank?

The reporting obligation lies with the entity or bank domiciled in Austria that acts as the contractual counterparty to the cross-border financial derivative or forward transaction.

Cross-Border Element

Which counterparty country must be reported when trading financial derivatives via Direct Market Access (DMA)?

Direct Market Access provides access to a reference exchange. In this case, the country of domicile of the exchange must be reported.

Are financial derivatives concluded with a domestic (Austrian) bank subject to reporting?

Only cross-border financial derivatives and forward transactions must be reported—i.e. those concluded with counterparties domiciled abroad. Transactions with domestic banks are not subject to reporting under AWFDE.

Are hedging transactions concluded by an Austrian company with a domestic bank reportable, if they are later passed on to foreign subsidiaries?

Financial derivatives and forward transactions between an Austrian company and an Austrian bank are not reportable under AWFDE, since no cross-border element is involved. However, if these positions are passed on to a foreign subsidiary, for example in the form of deposits or loans, they must be reported to the OeNB under the AWFUV survey. See AWFUV reporting requirements.

Reporting Thresholds

Which financial derivatives must be reported if one of the specified reporting thresholds (for positions or transactions) is exceeded?

A reporting obligation for cross-border financial derivatives and forward transactions arises if the reporting threshold of EUR 1,000,000.00 is reached or exceeded, either for transactions or for positions. If either threshold is reached or exceeded, all cross-border financial derivatives must be reported.

Cross-border financial derivatives and forward transactions must be aggregated by derivative type and asset class, and broken down by region (foreign counterparty), using the two-letter ISO code of the respective counterparty country.

Is the underlying taken into account when calculating the reporting thresholds?

No. The underlying asset is not to be considered when calculating the reporting threshold. Only the sum of the valued positions or the net amount of transactions involving cross-border financial derivatives and forward transactions is relevant.

Which period must be considered when calculating the reporting threshold?

The month-end (Monatsultimo) must be used as the reference date.

A reporting obligation arises if one of the following conditions is met:

The sum of all claims and liabilities (fair value) from cross-border financial derivatives and forward transactions on the month-end date reaches or exceeds EUR 1,000,000.00, or

The net amount of all cash inflows and outflows from cross-border financial derivatives and forward transactions on the month-end date reaches or exceeds EUR 1,000,000.00.

If neither threshold is reached, no reporting obligation arises.

How are the reporting thresholds calculated?

For positions, the relevant value is the fair value of all cross-border financial derivatives and forward transactions. For transactions, the relevant amount is the net total of all cash inflows and outflows within a calendar month related to cross-border financial derivatives and forward transactions.

How is the reporting threshold calculated for different currencies?

Positions must be converted to euro using the month-end exchange rate.

Transactions must be converted to euro using the monthly average exchange rate.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Is the reporting threshold to be calculated per individual entity or at the group level?

The reporting threshold applies to the individual entity that conducts cross-border financial derivatives and forward transactions and is domiciled in Austria.

Do the stated reporting thresholds apply to individual transactions or to the total volume of cross-border financial derivatives?

To calculate the reporting thresholds, all cross-border financial derivatives and forward transactions with all countries must be considered as of the respective month-end date.

Does a reporting obligation arise if the net amount of cash inflows and outflows—for example, in commodity futures—does not reach EUR 1,000,000?

If the reporting threshold is not reached, no reporting obligation arises. Voluntary reporting is accepted.

Are nil reports (also retroactively) required if the reporting threshold was never exceeded?

If the reporting threshold is not met, and has never been exceeded in the past, there is no requirement to submit a nil report.

Which reference period must be used to calculate the reporting threshold?

All cross-border financial derivatives and forward transactions with all countries must be considered as of the respective month-end.

Are forward purchases of CO₂ certificates, energy hedges, and commodity hedges subject to reporting?

Yes. All cross-border forward and hedging transactions, regardless of the underlying asset, fall within the scope of the AWFDE survey.

Example Collection

Are interest rate floor or cap options subject to reporting?

Yes. Options—regardless of their specific structure—must be reported under the derivative type "Option (OPT)", assigned to the corresponding asset class, and broken down by counterparty country.

Is a dollar hedge / foreign currency hedge subject to reporting?

Yes. Cross-border foreign currency hedging transactions are classified as forward transactions and fall under the AWFDE survey.

Under which derivative type should foreign exchange options be reported?

Cross-border foreign exchange options must be reported under the derivative type "Option (OPT)" and the asset class "Currency (CURR)".

Should different commodities be reported as a single sum?

No. Different commodities must be assigned to the appropriate derivative types and reported under the asset class "Commodity (COMM)".

Should EU Allowances (EUAs/CO₂ emissions) be reported under the asset class "Commodity" or under "Other asset class"?

EUAs / CO₂ certificates must be reported under the asset class "Commodity (COMM)".

Can derivative types and asset classes be aggregated per counterparty country?

All cross-border financial derivatives and forward transactions must be aggregated by derivative type and asset class, and broken down by counterparty country.

Are OTC transactions with physical delivery (e.g. gas and electricity trading) subject to reporting?

Yes. Cross-border financial derivatives and forward transactions—whether exchange-traded or OTC, and regardless of the type of settlement (physical or cash)—are subject to the AWFDE survey.

OTC transactions with physical delivery are exempt under the REMIT carve-out. Does this also apply to the AWFDE survey?

No. For the AWFDE survey, the provisions of the ZABIL Reporting Regulation apply. Exemptions defined in other regulations (e.g. MiFID II) do not apply.

Should positions in interest rate swaps be reported using the clean fair value or the dirty fair value (i.e. including accrued interest)?

Positions in cross-border interest rate swaps must be reported using the clean fair value (i.e. including accrued interest).

Are simple spot transactions subject to reporting under the AWFDE survey?

No. Cross-border spot transactions are not forward transactions and therefore are not subject to the AWFDE survey.

Are cross-border fixed-term deposits subject to reporting under the AWFDE survey?

No. Cross-border fixed-term deposits are not part of the AWFDE survey; they must be reported under the AWFUV survey. See AWFUV survey.

Which market value must be reported as a transaction when a derivative is settled?

The market value at the time of settlement must be reported, even if the data is transmitted as of month-end.

Reporting Channels

Is submission only possible via USP access?

As a rule, reports must be submitted via secure access through the Oesterreichische Nationalbank’s portal. Further information is available at: Außenwirtschaftsstatistik – Meldewege - Oesterreichische Nationalbank (OeNB). For special cases, please contact the OeNB via the following email address: aussenwirtschaft.fde@oenb.at

Retroactive Data Submission

Are retroactive reports required? From which month onward must retroactive submissions be made?

Yes. Retroactive AWFDE reports must be submitted monthly, starting from December 2021. Multiple reporting periods may be included in chronological order within a single reporting file.