AWBET report: cross-border investors and affiliates – transactions

For any questions please email aussenwirtschaft.BET@oenb.at.

Contents

See the directory on the right.

Key reporting data

Report code | AWBET |

Designation | Cross-border investors and affiliates – transactions |

Description | Reportable transactions with cross-border investors and/or direct foreign affiliates |

Reporting agents | Natural residents, legal residents and other resident entities with or without a separate legal identity |

Reporting interval | Ad hoc monthly report |

Reporting date | 15th day of the following month |

Reporting reference date | Last day of the month |

Reporting threshold | EUR 500,000 or less if transactions cause direct investments reported earlier to drop below the 10% threshold or lead to a complete disinvestment |

Reporting currency/unit | Euro; amounts rounded to one decimal place (default) or two decimal places (optional) |

Reporting channel (reporting data) | recommended:

other options:

Information on the registration (access requests) for all reporting channels can be found here. |

Reporting channel (master data) | Use the “MeldeWeb” platform to enter your data |

Reporting group (for technical data providers) | Z – External sector (file type: BT) |

Master data for reporting and validation (for technical data providers) | |

Contact |

Reporting matrix

Cross-border investors and affiliates – transactions (AWBET) | |||

Reporting entity | |||

Reporting reference date | |||

Share or equity transactions excluding profit distributions (without ISIN/WK) (TRANSAKBOWK) | Share or equity transactions excluding profit distributions (with ISIN/WK) (TRANSAKBMWK) | Profit distributions (without ISIN/WK) (TRANSGEWOWK) | Profit distributions (with ISIN/WK) (TRANSGEWMWK) |

ID number (IN) | ID number (IN) | ID number (IN) | ID number (IN) |

Type of transaction (TRANSART) | Type of transaction (TRANSART) | Type of transaction (TRANSART) | Type of transaction (TRANSART) |

Direction of transaction (TRANSRI) | Direction of transaction (TRANSRI) | Direction of transaction (TRANSRI) | Direction of transaction (TRANSRI) |

Complete disinvestment (KDES) | Complete disinvestment (KDES) | ||

Declaration date (BZP) | Declaration date (BZP) | ||

Securities identification number (WK) | Securities identification number (WK) | ||

Type of value (WA) | Type of value (WA) | Type of value (WA) | Type of value (WA) |

Value | Value | Value | Value |

Scope

Data on cross-border transactions to be reported include

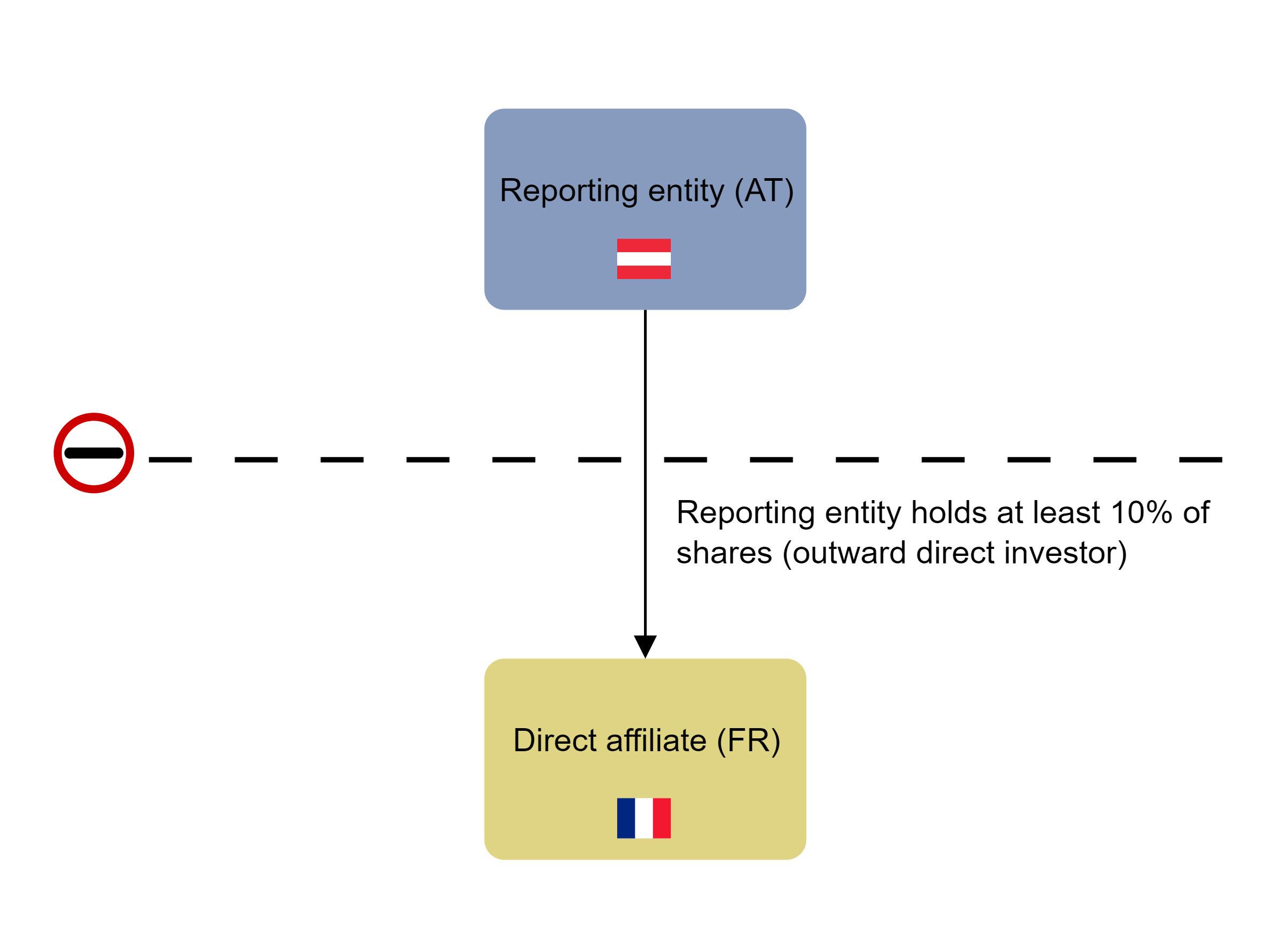

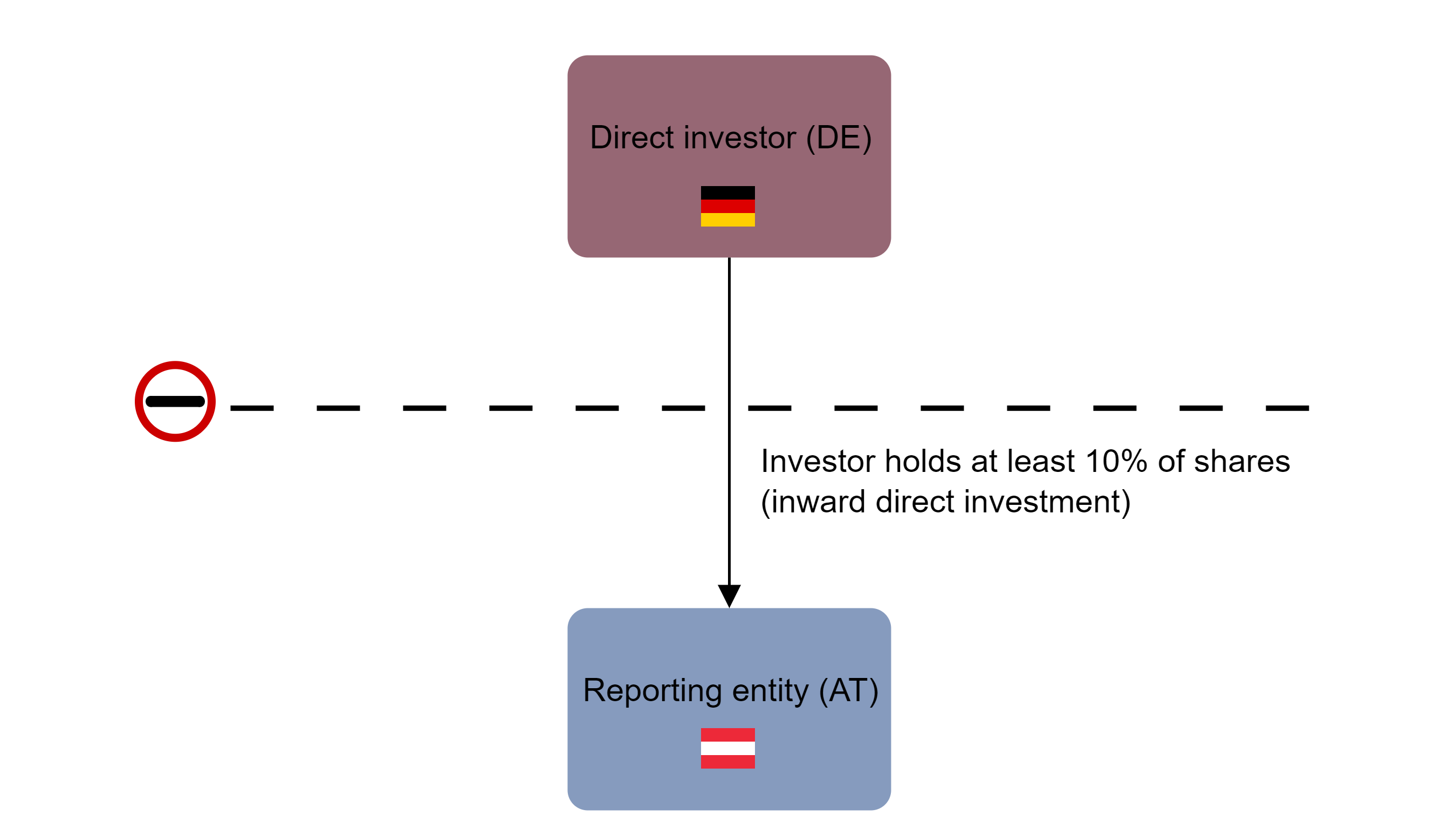

transactions related to outward FDI and inward FDI (Definitions - Direct investment) and

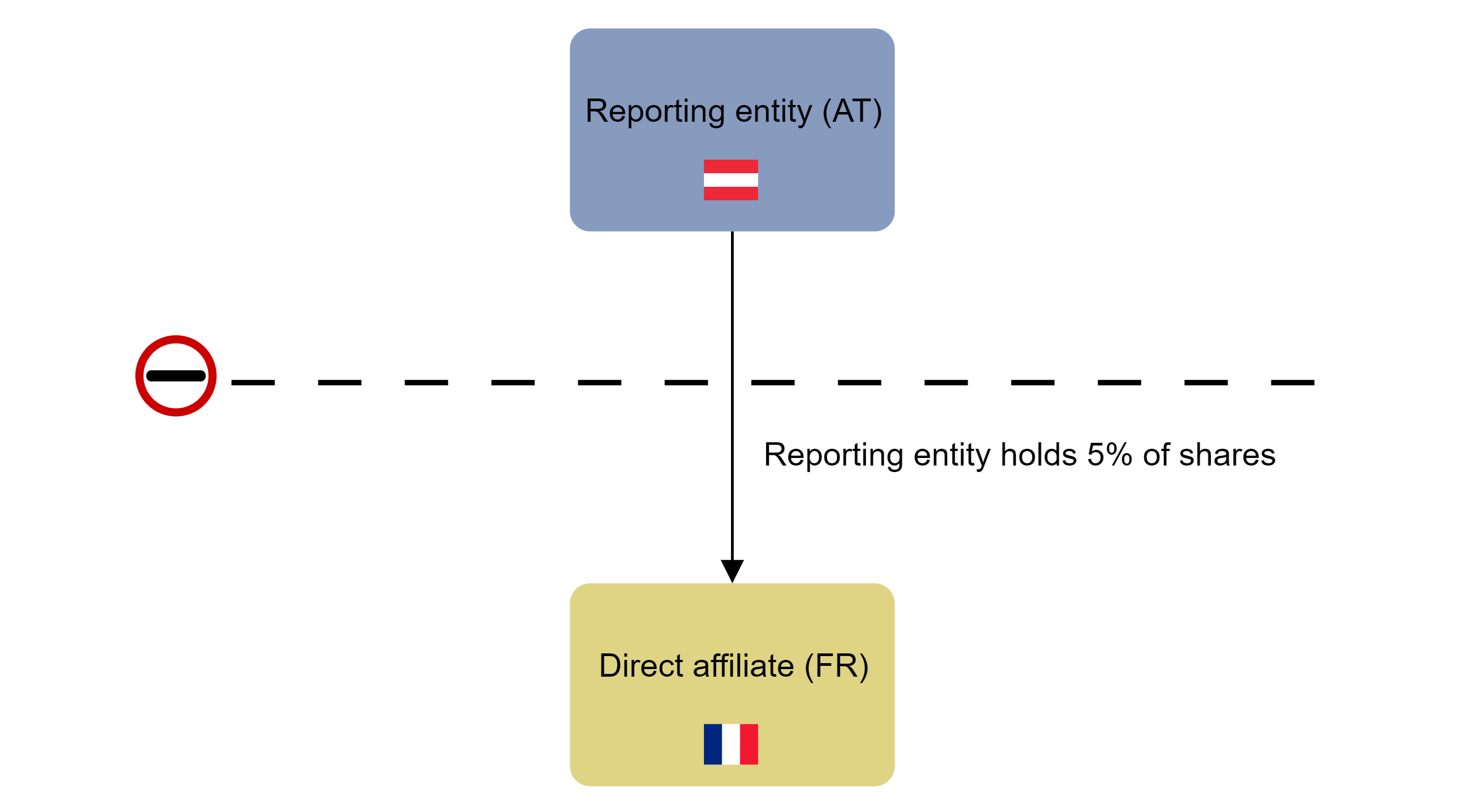

transactions in connection with other investments abroad (actively held shares of less than 10%, except for shares in listed or unlisted stock corporations) and with other investments from abroad in Austria (passively held shares of less than 10%, except for shares in listed or unlisted stock corporations) (Definitions - Shares of less than 10%) in accordance with the AWBET report overview.

FDI transactions with indirect affiliates, such as indirect capital contributions, must be reported as transactions with the direct affiliate(s).

Master data must be submitted or completed and updated in due time before the reporting deadlines. Master data constitute basic underlying information on the resident and nonresident entities involved. For a list of master data to be reported, see Master data reporting.

Example: Outward FDI

Example: Inward FDI

Example: Other outward investment (share of less than 10% of equity, other than shares in listed or unlisted stock corporations, held in foreign affiliates)

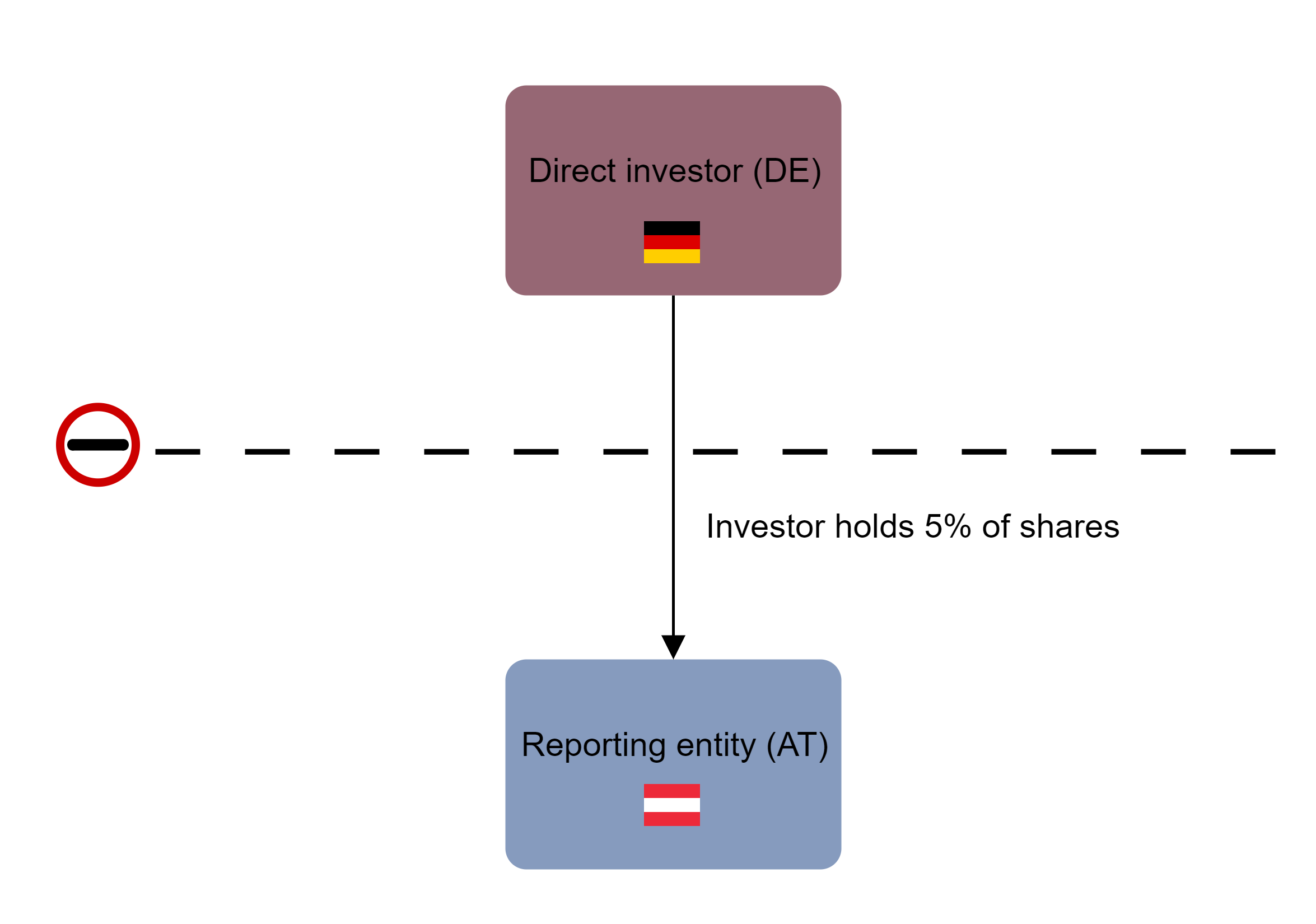

Example: Other inward investment (share of less than 10% of equity, other than shares in listed or unlisted stock corporations, held by foreign investor)

Reporting threshold

Individual transactions must be reported when totaling EUR 500,000 or more (or the euro equivalent). Transactions that cause direct investments reported earlier to drop below the 10% threshold or that lead to a complete disinvestment (share of the equity following the transaction = 0%) always need to be reported.

In this respect, it is irrelevant whether the transactions were effected through cash or noncash capital contributions or through stock swaps, or by increasing or decreasing credit or debit balances, etc. In the event of netting, please report the netted amounts. Note the AWFUV reporting thresholds for credit and debit balances.

Nil reports are not required if all transactions remained below the reporting threshold during a reporting period. However, nil reports may have to be sent to reverse reports made earlier or if so requested by the OeNB.

Example: Transaction exceeding the reporting threshold

The reporting entity receives a profit distribution of EUR 1,500,000 from a direct foreign affiliate. This transaction exceeds the reporting threshold (EUR 500,000) and must therefore be reported. As the reporting entity, therefore use the ABWET template to report the transaction under “profit distribution received.”

Example: Transaction below the reporting threshold

The reporting entity is the sole shareholder of a direct foreign affiliate. Out of its 100% share, it sells 20% to a foreign company for a price of EUR 400,000. No AWBET report is required as the transaction value is below the reporting threshold (EUR 500,000).

Example: FDI disinvestments

The reporting entity is owned by an Austrian and a foreign investor, with each shareholder holding 50% of the shares. The foreign investment was reported in a previous AWBET or AWBES report. Now the foreign investor sells 45% of its share to the Austrian shareholder for EUR 350,000. Since the transaction leads to FDI disinvestments (drop below 10% threshold) and relates to data reported earlier, the transaction needs to be reported as a rule. As the reporting entity, therefore use the AWBET template to report the transaction under “sale of shares by foreign investors.”

The answer to the question whether or not a complete disinvestment occurred is “no” as the foreign investor continues to hold 5% of equity.

Example: Complete disinvestment

The reporting entity liquidates its stake in a foreign affiliate and receives EUR 1 in terms of liquidation proceeds. The foreign affiliate was reported under FDI assets in a previous AWBET or AWBES report. As the reporting entity, therefore use the ABWET template to report the transaction under “capital withdrawn from foreign affiliates.” Since the transaction leads to a complete disinvestment, it needs to be reported as a rule.

The answer to the question whether or not a complete disinvestment occurred is “yes” as the reporting entity no longer holds any equity.

Reporting entity/reporting agent

Data must be reported by resident companies engaged in outward or inward FDI, or in other inward or outward investment (i.e. companies holding a share of less 10% of equity, except for shares in listed or unlisted stock corporations, in foreign affiliates, and companies in which foreign investors hold less than 10% of equity, except for shares in listed or unlisted stock corporations). For reporting purposes, entities that are not a separate legal entity (which includes branches, unincorporated businesses or long-term partnerships (>1 year)) are equivalent to entities with a separate legal entity.

Reporting reference date/reporting period

Data must be provided upon reporting agents’ own initiative on an ad hoc basis, by the 15th day of the month following the reporting month. The reporting period is the month in which the transactions to be reported (effective date) were made. Transactions that were accounted for retrospectively must also be reported retrospectively. Profit distributed or extracted is to be reported in the month in which the amounts were transferred (not at the time the profit distribution was approved). If the distribution or extraction of profit occurs in instalments, the sum total is to be reported for the month in which the first instalment was paid.

Example: Reporting period – Purchase of shares

The reporting entity draws up a contract on July 14 for obtaining 100% ownership of a foreign entity as of August 20. The contracting parties agree that payment of the purchase price falls due on December 31. The reporting reference date is the effective date of the ownership transfer; therefore the transaction must be reported for the month of August. As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB under “purchase of shares in foreign affiliates” and submit the data no later than September 15 for the August reporting period.

Example: Reporting period – Ex post purchase of shares

The reporting entity draws up a contract on July 14 for obtaining 100% ownership of a foreign group of companies as of March 1 of the same year. The contracting parties agree that payment of the purchase price falls due on December 31. The reporting reference date is the effective date of the ownership transfer; therefore the transaction must be reported for the month of March. As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB for the March reporting period under “intragroup restructuring (takeover of shares in foreign affiliates).” Submit the report without delay.

Example: Reporting period – Profit distribution

On April 29, the reporting entity endorses a profit distribution of EUR 10,000,000 to its foreign investor. The profit distribution is made on May 4. As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB for the month in which the sum was transferred (i.e. May) under “profit distribution made.” Submit the report no later than June 15.

Example: Reporting deadline

The reporting entity sells 50% of its share in a foreign affiliate. The effective date of the ownership transfer is September 10. As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB for the September reporting period and submit the data no later than October 15 for the September reporting period. If October 15 were to be a Saturday, Sunday or a public holiday, then the reporting deadline would shift to the next business day.

Share or equity transaction excluding profit distributions (without ISIN/WK) (TRANSAKBOWK)

The reporting requirement covers any transactions with foreign entities that either increase or decrease equity (irrespective of whether the share of affiliate ownership changes as a result) as well as the cross-border purchase or sale of company shares.

This type of report is required when ownership was created with instruments other than stocks.

Data fields and attributes

In the following we provide the data field codes (dimensions) and data field attributes that you will need to supply when submitting your reports via Excel upload or via IT interface (XML)

ID number (IN)

OeNB ID number: Identification number assigned by the OeNB to directly owned affiliates or direct investors

Type of transaction (TRANSART)

Capital contributed to foreign affiliates (AKAPZUF)

Such transactions include: creation of a new business, capital increase, indirect capital contributions, noncash contributions (that do not relate to the contribution of shares in another group company), capital subsidies, transfer of capital to reserves, purchase of new shares

Such transactions do not include: purchase of shares from third parties, accounting adjustments and revaluations, mergers

Capital contributed by foreign investors (PKAPZUF)

Such transactions include: creation of a new business, capital increase, indirect capital contributions, noncash contributions (that do not relate to the contribution of shares in another group company), capital subsidies, transfer of capital to reserves, purchase of new shares

Such transactions do not include: purchase of shares from third parties, accounting adjustments and revaluations, mergers

Capital withdrawn from foreign affiliates (AKAPABB)

Such transactions include: reserve transfers, capital reductions without change of relative ownership shares, unwinding of a business, liquidations

Such transactions do not include: sale of shares to third parties, accounting depreciation and devaluation, profit distributions received/profit extraction through the return of capital, noncash profit distributions, mergers

Capital withdrawn by foreign investors (PKAPABB)

Such transactions include: reserve transfers, capital reductions without change of relative ownership shares, unwinding of a business, liquidations

Such transactions do not include: sale of shares to third parties, accounting depreciation and devaluation, profit distribution made/profit extraction through the return of capital, noncash profit distributions, mergers

Purchase of shares in foreign affiliates (AERWANT)

Such transactions include: purchase of shares in foreign affiliates (transaction between unconnected entities), capital contribution to foreign affiliates that is mainly earmarked for purchases of shares by the foreign affiliate or other foreign entities of the same group in another business outside the group of companies

Such transactions do not include: creation of a new business, purchase of new shares, mergers

Purchase of shares by foreign investors (PERWANT)

Such transactions include: purchase of shares in reporting entity (transaction between unconnected entities), capital increase by foreign investors that is mainly earmarked for purchases of shares by the reporting entity or other domestic entities of the same group in another business outside the group of companies

Such transactions do not include: creation of a new business, purchase of new shares, mergers

Sale of shares in foreign affiliates (AVERKANT)

Such transactions include: sale of shares in foreign affiliates (transaction between unconnected entities)

Such transactions do not include: decrease of capital, issuance of new shares, investor exit amid capital reduction, creation of a new business, unwinding of a business, mergers

Sale of shares by foreign investors (PVERKANT)

Such transactions include: sale of shares in reporting entity (transaction between unconnected entities)

Such transactions do not include: decrease of capital, issuance of new shares, investor exit amid capital reduction, creation of a new business, unwinding of a business, mergers

Intragroup restructuring (takeover of shares in foreign affiliates) (AKONZUMU)

Such transactions include: purchase or takeover of shares in foreign affiliates (transaction between connected entities), mergers involving affiliates (with the entity that takes over the other company being the counterparty), capital contribution to foreign affiliate earmarked for loss absorption, noncash contributions (that do relate to the contribution of shares in another group company)

Such transactions do not include: Transactions involving entities outside the group structure

Intragroup restructuring (takeover of shares by foreign investors) (PKONZUMU)

Such transactions include: purchase or takeover of shares in reporting entity (transaction between connected entities), mergers involving the reporting entity (with the entity that takes over the other company being the reporting entity), capital contribution made to foreign affiliate earmarked for loss absorption, noncash contributions (that do relate to the contribution of shares in another group company)

Such transactions do not include: Transactions involving entities outside the group structure

Intragroup restructuring (transfer of shares in foreign affiliates) (AKONZUMA)

Such transactions include: sale or transfer of shares in foreign affiliates (transaction between connected entities), mergers involving affiliates (with the company transferred being the counterparty)

Such transactions do not include: transactions involving entities outside the group structure

Intragroup restructuring (transfer of shares by foreign investors) (PKONZUMA)

Such transactions include: sale or transfer of shares in reporting entity (transaction between connected entities), mergers involving the reporting entity (with the company transferred being the reporting entity)

Such transactions do not include: transactions involving entities outside the group structure

Direction of transaction (TRANSRI)

Outward investment: If the reporting entity holds or held shares in a foreign entity, its transactions must be identified as outward. (AKTIV)

Inward investment: If a foreign entity holds or held shares in the reporting entity, its transactions must be identified as inward. (PASSIV)

Complete disinvestment (KDES)

In the event of a capital withdrawal, ownership sale or intragroup restructuring (transfers), information needs to be provided whether the disinvestment was complete. With other types of transactions, indicating “no” (N) is optional.

YES (WAHR): The disinvestment was complete. (J)

NO (FALSCH): The disinvestment was not complete. (N)

Type of value (WA)

Market value: Reported transaction values must reflect market values. For purchases and sales, purchase and sale prices must be reported. For transactions for which sales or purchase prices are not available, near-market valuations must be reported as the transaction value. If no near-market valuation was made at the time of the transaction, the most recent valuation before the transaction date must be reported as the transaction value. If you can provide neither a purchase/sale price nor a valuation that is close to the market reality in the case of intra-group reorganisations the transaction value may be approximated, by way of exception, as the pro rata balance sheet value of equity (on the transaction date or on the last balance sheet date preceding the transaction). If there are subsequent adjustments to the reported transaction value (e.g. purchase price subsequently changes due to the occurrence of an agreed earn-out clause), the (preliminary) transaction value/purchase price observed at that time must be reported within the statutory reporting period and subsequently adjusted by means of an adjusted report once the actual value has been determined. (MW)

Value

Amounts must be reported in euro, or as euro equivalents based on the exchange rate applying on the date of the transaction. We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Please use the daily euro foreign exchange reference rates updated and published by the ECB. In case daily euro reference rates should not be available for the currencies in question, consult the other tables provided for relevant conversion rates.

Example: Conversion of transaction balances

The reporting entity creates a Hungarian company, providing HUF 500,000,000 as equity on March 2, 2021. For reporting purposes, the Austrian entity must convert the HUF 500,000,000 to euro (= reporting currency) using the ECB reference rate for March 2, 2021.

Based on the conversion rate published on the OeNB’s website (EUR 1 = HUF 363.70), the conversion works out as follows:

HUF 500,000,000 / 363.70 = EUR 1,374,759.42

As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB under “capital contributed to foreign affiliates” with a value of EUR 1,374,759.42.

Example: Subsequent purchase price adjustment

The Austrian company AT-Example GmbH (= reporting entity) acquires shares in the German company DE-Target GmbH in April 2025. For the acquisition of the shares, AT-Example GmbH and the seller agree on a purchase price of EUR 20,000,000. In addition, AT-Example GmbH undertakes to pay the seller an additional purchase price (earn-out) of up to EUR 1,500,000 if the EBITDA of DE-Target GmbH exceeds a certain threshold in the 2026 financial year. The determination of whether the EBITDA has reached the threshold shall be made in the course of the preparation of the annual financial statements of DE-Target GmbH by an independent auditor in June 2027. If an additional purchase price payment is required, AT-Example GmbH undertakes to transfer the agreed amount to the seller no later than July 31st, 2027.

Since the purchase price for the shares in DE-Target GmbH (EUR 20,000,000) exceeds the reporting threshold of EUR 500,000, AT-Example GmbH is subject to reporting obligations under the AWBET survey and must submit the corresponding report to the OeNB by May 15th, 2025. As it is not yet known whether the agreed earn-out clause will be fulfilled, the provisional purchase price of EUR 20,000,000 must be reported by May 15th, 2025. If the earn-out clause is triggered and results in a subsequent adjustment of the purchase price, a adjusted AWBET report with an adjusted transaction value of EUR 21,500,000 must be submitted by July 15th, 2027.

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Market value comments may be added to provide information on the use of funds (inward investment) or the source of funding (outward investment). Use the comments function for system-based queries that may arise during reporting (mandatory).

Share or equity transaction excluding profit distributions (with ISIN/WK) (TRANSAKBMWK)

The reporting requirement covers any transactions with foreign entities that either increase or decrease equity (irrespective of whether the share of affiliate ownership changes as a result) as well as the cross-border purchase or sale of company shares.

This section of the report is for investments in ISIN stocks (direction of transaction = outward designates stocks held by the nonresident entity; inward designates stocks held by the reporting entity).

Data fields and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

ID number (IN)

OeNB ID number: Identification number assigned by the OeNB to directly owned affiliates or direct investors

Type of transaction (TRANSART)

Capital contributed to foreign affiliates (AKAPZUF)

Such transactions include: creation of a new business, capital increase, indirect capital contributions, noncash contributions (that do not relate to the contribution of shares in another group company), capital subsidies, transfer of capital to reserves, purchase of new shares

Such transactions do not include: purchases of shares from third parties, accounting adjustments and revaluations, mergers

Capital contributed by foreign investors (PKAPZUF)

Such transactions include: creation of a new business, capital increase, indirect capital contributions, noncash contributions (that do not relate to the contribution of shares in another group company), capital subsidies, transfer of capital to reserves, purchase of new shares

Such transactions do not include: purchases of shares from third parties, accounting adjustments and revaluations, mergers

Capital withdrawn from foreign affiliates (AKAPABB)

Such transactions include: reserve transfers, capital reductions without change of relative ownership shares, unwinding of a business, liquidations

Such transactions do not include: sale of shares to third parties, accounting depreciation and devaluation, profit distributions received/profit extraction through the return of capital, noncash profit distributions, mergers

Capital withdrawn by foreign investors (PKAPABB)

Such transactions include: reserve transfers, capital reduction without change of relative ownership shares, unwinding of a business, liquidations, stock buybacks

Such transactions do not include: sale of shares to third parties, accounting depreciation and devaluation, profit distribution made/profit extraction through the return of capital, noncash profit distributions, mergers

Purchase of shares in foreign affiliates (AERWANT)

Such transactions include: purchase of shares in foreign affiliates (transaction between unconnected entities), capital contribution to foreign affiliates that is mainly earmarked for purchases of shares by the foreign affiliate or other foreign entities of the same group in another business outside the group of companies

Such transactions do not include: creation of a new business, purchase of new shares, mergers

Purchase of shares by foreign investors (PERWANT)

Such transactions include: purchase of shares in reporting entity (transaction between unconnected entities), capital increase by foreign investors that is mainly earmarked for purchases of shares by the reporting entity or other domestic entities of the same group in another business outside the group of companies

Such transactions do not include: creation of a new business, capital increase and purchases of shares, purchase of new shares, mergers

Sale of shares in foreign affiliates (AVERKANT)

Such transactions include: sale of shares in foreign affiliates (transaction between unconnected entities)

Such transactions do not include: capital withdrawal, issuance of new shares, exit of an investor amid capital reduction, creation of a new business, unwinding of a business, mergers

Purchase of shares by foreign investors (PVERKANT)

Such transactions include: sale of shares in reporting entity (transaction between unconnected entities)

Such transactions do not include: decrease of capital, issuance of new shares, investor exit amid capital reduction, creation of a new business, unwinding of a business, mergers

Intragroup restructuring (takeover of shares in foreign affiliates) (AKONZUMU)

Such transactions include: purchase of shares in foreign affiliates (transaction between connected entities), mergers involving affiliates (if the entity that is taking over is the counterparty), capital contribution to foreign affiliate earmarked for loss absorption, noncash contributions (that do relate to the contribution of shares in another group company)

Such transactions do not include: transactions involving entities outside the group structure

Intragroup restructuring (takeover of shares by foreign investors) (PKONZUMU)

Such transactions include: purchase of shares in reporting entity (transaction between connected entities), mergers involving the reporting entity (if the entity that is taking over is the reporting entity), capital contribution made by foreign affiliate earmarked for loss absorption, noncash contributions (that do relate to the contribution of shares in another group company)

Such transactions do not include: transactions involving entities outside the group structure

Intragroup restructuring (transfer of shares in foreign affiliates) (AKONZUMA)

Such transactions include: sale or transfer of shares in foreign affiliates (transaction between connected entities), mergers involving affiliates (with the company transferred being the counterparty)

Such transactions do not include: transactions involving entities outside the group structure

Intragroup restructuring (transfer of investments made by foreign investors) (PKONZUMA)

Such transactions include: sale or transfer of shares in reporting entity (transaction between connected entities), mergers involving the reporting entity (if the reporting entity is the entity that is being transferred)

Such transactions do not include: transactions involving entities outside the group structure

Direction of transaction (TRANSRI)

Outward investment: If the reporting entity holds or held shares in a foreign entity, its transactions are to be identified as outward. (AKTIV)

Inward investment: If a foreign entity holds or held shares in the reporting entity, its transactions are to be identified as inward. (PASSIV)

Complete disinvestment (KDES)

In the event of a capital withdrawal, sale of shares or intragroup restructuring (transfers), information needs to be provided whether the disinvestment was complete. With other types of transactions, indicating “no” (N) is optional.

YES (WAHR): The disinvestment was complete. (J)

NO (FALSCH): The disinvestment was not complete. (N)

Securities identification number (WK)

For transactions with ISIN-identified securities, ISIN/WK information needs to be supplied.

The international securities identification number (ISIN) is a 12-digit combination of letters and numbers that serves to unambiguously identify a given securities instrument (ISIN code under ISO 6166). ISINs are being assigned by national numbering agencies (NNAs); in Austria by the Oesterreichische Kontrollbank (OeKB). An ISIN will be deemed valid when it is contained in the database of the Association of NNAs (ANNA).

An ISIN consists of:

a 2-digit country code (such as AT for Austria or DE for Germany),

a 9-digit national ID, and

a 1-digit verification code.

Do not use

official securities identification numbers other than ISIN (as provided by Wertpapier-Mitteilungen (WM) Frankfurt, Clearstream, CUSIP and Valoren),

securities identification numbers beginning with “XF” (these are not unambiguous),

securities identification numbers beginning with “QOXDBY” (these are preliminary numbers, used for accounting purposes)

In case of transactions with non-ISIN securities, report master data (including data on dividends) → Master data required for reporting.

Type of value (WA)

Market value: Reported transaction values must reflect market values. For purchases and sales, purchase and sale prices must be reported. For transactions for which sales or purchase prices are not available, near-market valuations must be reported as the transaction value. If no near-market valuation was made at the time of the transaction, the most recent valuation before the transaction date must be reported as the transaction value. If you can provide neither a purchase/sale price nor a valuation that is close to the market reality in the case of intra-group reorganisations the transaction value may be approximated, by way of exception, as the pro rata balance sheet value of equity (on the transaction date or on the last balance sheet date preceding the transaction). If there are subsequent adjustments to the reported transaction value (e.g. purchase price subsequently changes due to the occurrence of an agreed earn-out clause), the (preliminary) transaction value/purchase price observed at that time must be reported within the statutory reporting period and subsequently adjusted by means of an adjusted report once the actual value has been determined. (MW)

Number: Please indicate the number of stocks that were transferred during the given transaction. In case the number of stocks remained unchanged during the transaction, indicate 0. (STK)

Value

Amounts must be reported in euro, or as euro equivalents based on the exchange rate applying on the date of the transaction. We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Please use the daily euro foreign exchange reference rates updated and published by the ECB. In case daily euro reference rates should not be available for the currencies in question, consult the other tables provided for relevant conversion rates.

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Market value comments may be added to provide information on the use of funds (inward investment) or the source of funding (outward investment). Use the comments function for system-based queries that may arise during reporting (mandatory).

Profit distribution (without ISIN/WK) (TRANSGEWOWK)

The reporting requirement extends to cross-border profit distributions and profit extraction. This type of report is required when ownership was created with instruments other than stocks.

Note the applicable reporting thresholds AWFUV in case the declaration date and the payment date should relate to different months.

Data fields and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

ID number (IN)

OeNB ID number: Identification number assigned by the OeNB to directly owned affiliates or direct investors

Type of transaction (TRANSART)

Profit distribution received: This is the type of transaction to be selected for profit inflows in the form of profit distribution and extraction. (AERHGEW)

Examples include profit received in the form of profit distribution/ extraction or dividends, profit received through return of capital, noncash profit distributions received

Profit distribution made: This is the type of transaction to be selected for profit outflows in the form of profit distribution and extraction. (PBEZGEW)

Examples include profit paid out in the form of profit distribution/ extraction or dividends, profit paid out by returning capital, noncash profit distributions paid

Direction of transaction (TRANSRI)

Outward investment: If the reporting entity holds or held shares in a foreign entity, its transactions are to be identified as outward. (AKTIV)

Inward investment: If a foreign entity holds or held shares in the reporting entity, its transactions are be identified as inward. (PASSIV)

Declaration date (BZP)

The declaration date to be indicated is the last day of the month in which the profit distribution was endorsed. (Datum)

Type of value (WA)

Market value: The transaction value reported must be equivalent to the amount endorsed for profit distribution or profit extraction. Distributed or extracted profits are to be reported before deduction of any taxes and fees. (MW)

Value

Amounts must be reported in euro, or as euro equivalents: profit distributed and extracted are to be converted with the exchange rate applying on the date of the transaction. We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Please use the daily euro foreign exchange reference rates updated and published by the ECB. In case daily euro reference rates should not be available for the currencies in question, consult the other tables provided for relevant conversion rates.

Example: Conversion of transaction balances

The reporting entity receives a profit distribution of HUF 500,000,000 from a Hungarian subsidary on March 2, 2021. For reporting purposes, the Austrian entity must convert the HUF 500,000,000 to euro (= reporting currency) using the ECB reference rate for March 2, 2021.

Based on the conversion rate published on the OeNB’s website (EUR 1 = HUF 363.70), the conversion works out as follows:

HUF 500,000,000 / 363.70 = EUR 1,374,759.42

As the reporting entity, therefore use the AWBET template to report EUR 1,374,759.42 under “profit distribution received.”

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Market value comments may be added to provide information on the use of funds (inward investment) or the source of funding (outward investment). Use the comments function for system-based queries that may arise during reporting (mandatory).

Profit distribution (with ISIN/WK) (TRANSGEWMWK)

The reporting requirement extends to cross-border profit distribution and extraction. This section of the report is for capital invested in ISIN stocks, covering outward transactions for stocks held in the nonresident entity and inward transactions for stocks held in the reporting entity.

Note the applicable reporting thresholds AWFUV in case the declaration date and the payment date should relate to different months.

Data fields and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

ID number (IN)

OeNB ID number: Identification number assigned by the OeNB to directly owned affiliates or direct investors

Type of transaction (TRANSART)

Profit distribution received: This is the type of transaction to be selected for profit inflows in the form of profit distribution and extraction. (AERHGEW)

Examples include profit received in the form of profit distribution/ extraction or dividends, profit received through return of capital, noncash profit distributions received

Profit distribution made: This is the type of transaction to be selected for profit distributions made and profit extraction paid for. (PBEZGEW)

Examples include profit paid out in the form of profit distribution/ extraction or dividends, profit paid out by returning capital, noncash profit distributions paid

Direction of transaction (TRANSRI)

Outward investment: If the reporting entity holds or held shares in a foreign entity, its transactions are to be identified as outward. (AKTIV)

Inward investment: If a foreign entity holds or held shares in the reporting entity, its transactions are be identified as inward. (PASSIV)

Declaration date (BZP)

The declaration date to be indicated is the last day of the month in which the profit distribution was endorsed. Date:

Securities identification number (WK)

For transactions with ISIN-identified securities, ISIN/WK information needs to be supplied.

The international securities identification number (ISIN) is a 12-digit combination of letters and numbers that serves to unambiguously identify a given securities instrument (ISIN code under ISO 6166). ISINs are being assigned by national numbering agencies (NNAs); in Austria by the Oesterreichische Kontrollbank (OeKB). An ISIN will be deemed valid when it is contained in the database of the Association of NNAs (ANNA).

An ISIN consists of:

a 2-digit country code (such as AT for Austria or DE for Germany),

a 9-digit national ID, and

a 1-digit verification code.

Do not use

official securities identification numbers other than ISIN (as provided by Wertpapier-Mitteilungen (WM) Frankfurt, Clearstream, CUSIP and Valoren),

securities identification numbers beginning with “XF” (these are not unambiguous),

securities identification numbers beginning with “QOXDBY” (these are preliminary numbers, used for accounting purposes)

In the absence of an ISIN for a given security, the respective master data must be submitted (including data on dividends) → Master data required for reporting.

Type of value (WA)

Market value: The transaction value reported must be equivalent to the amount endorsed for profit distribution or profit extraction. Distributed or extracted profits are to be reported before deduction of any taxes and fees. (MW)

Number: Please indicate the number of stocks that were transferred during the given transaction. In case the number of stocks remained unchanged during the transaction, indicate 0. (STK)

Value

Amounts must be reported in euro, or as euro equivalents: profit distributed and extracted are to be converted with the exchange rate applying on the date of the transaction. We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Please use the daily euro foreign exchange reference rates updated and published by the ECB. In case daily euro reference rates should not be available for the currencies in question, consult the other tables provided for relevant conversion rates.

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Market value comments may be added to provide information on the use of funds (inward investment) or the source of funding (outward investment). Use the comments function for system-based queries that may arise during reporting (mandatory).

Quality requirements

AWBET reports must be complete and must be submitted to the OeNB in due time.

As a precondition, the master data must have been entered correctly and confirmed before the actual reporting using the MeldeWeb application.

Apart from the master data, AWBET reports are complete if

they include all inward and outward FDI transactions to be reported for the reporting period,

the transaction values correspond to the market values of the reported transactions.

Note that the report must include transactions relating to business establishments and branches in other countries as well as the transactions of foreign affiliates with a separate legal identity.

Use the comments function for system-based queries that may arise during reporting (mandatory).

The data reported will be checked by the OeNB. We will contact you in case any queries should arise. Queries need to be answered without delay.

See also: General provisions.

Reporting examples for selected business cases

Example: Indirect capital contribution via foreign subsidiary (outward FDI)

The reporting entity is the sole direct owner of a French affiliate, which in turn is the 50% owner of a German affiliate. Thus, the reporting entity is the indirect owner of the German affiliate.

The reporting entity provides an indirect capital contribution of EUR 3,500,000 to its German affiliate. This transaction is to be reported as a transaction with the direct affiliate in France. Indirect capital contributions to affiliates are to be reported, as a rule, as a transaction with the direct affiliate as the counterparty.

Therefore, the reporting entity must report this transaction with its French affiliate under “capital contributed to foreign affiliates,” using the AWBET template.

.png?inst-v=c351dfb2-34f4-4245-9484-b2d3f5249590)

Example: Indirect capital contribution via domestic subsidiary (outward FDI)

The reporting entity is wholly directly owned by a domestic investor. The reporting entity in turn is the 75% owner of a foreign affiliate. Thus, the reporting entity’s direct investor is indirectly affiliated with the foreign affiliate.

The reporting entity’s direct investor provides EUR 15,000,000 as an indirect capital contribution to the foreign affiliate. This transaction is to be reported as a transaction between the reporting entity and its foreign affiliate. Indirect capital contributions to affiliates are to be reported, as a rule, as a transaction with the direct affiliate as the counterparty.

Therefore, the reporting entity must report this transaction with its foreign affiliate under “capital contributed to foreign affiliates,” using the AWBET template.

.png?inst-v=c351dfb2-34f4-4245-9484-b2d3f5249590)

Example: Indirect capital contribution via nonresident parent (inward FDI)

The reporting entity is wholly directly owned by a foreign investor resident in Germany. The German company, in turn, is owned by a higher-tier entity, a French investor. Thus, the French company is a higher-tier shareholder of the reporting entity.

The reporting entity receives an indirect capital contribution from the higher-tier French entity in the amount of EUR 780,000. This transaction is to be reported as a transaction with the direct German investor. Indirect capital contributions by investors are to be reported, as a rule, as a transaction with the direct investor as the counterparty.

Therefore, the reporting entity must report this transaction with its foreign affiliate under “capital contributed by foreign investors,” using the AWBET template.

%20(1).png?inst-v=c351dfb2-34f4-4245-9484-b2d3f5249590)

Example: Indirect capital contribution via domestic parent (inward FDI)

The reporting entity is wholly directly owned by a foreign investor. The reporting entity in turn is the 100% owner of a domestic affiliate. Thus, the reporting entity interconnects the foreign higher-tier investor with the domestic lower-tier affiliate.

The reporting entity’s direct foreign investor provides EUR 1,800,000 as an indirect capital contribution to the domestic affiliate. This transaction is to be reported as a transaction between the reporting entity and its foreign investor. Indirect capital contributions by investors are to be reported, as a rule, as a transaction with the direct shareholder as the counterparty.

Therefore, the reporting entity must report this transaction with its foreign affiliate under “capital contributed by foreign investors,” using the AWBET template.

.png?inst-v=c351dfb2-34f4-4245-9484-b2d3f5249590)

Example: Purchase of new shares (outward FDI)

Before the transaction, one German investor and two Austrian investors share the ownership of a direct affiliate resident in the USA. The German investor holds 50% of the shares of the US entity, and the two Austrian shareholders hold 25% each.

The reporting entity also becomes a shareholder of the US affiliate by making a capital contribution that increases the equity.

After the transaction, the US affiliate has four direct shareholders. None of the shareholders invested in the affiliate before the transaction sold any of their ownership interests. The former shareholders’ shares in the US affiliate have remained unchanged relative to the company’s business value or stock capital. At the same time, the percentage shares of the ownership interests in the foreign affiliate were halved by the capital contribution made.

Therefore, the reporting entity must report this transaction with its foreign affiliate under “capital contributed to foreign affiliates,” using the AWBET template. The transaction value is the sum total of the equity increase and the premium at which the new shares were issued beyond the nominal value.

The two other Austrian need not report any AWBET transactions, because no reportable transactions occurred. They do, however, need to amend their master data to adjust their ownership percentages.

.png?inst-v=c351dfb2-34f4-4245-9484-b2d3f5249590)

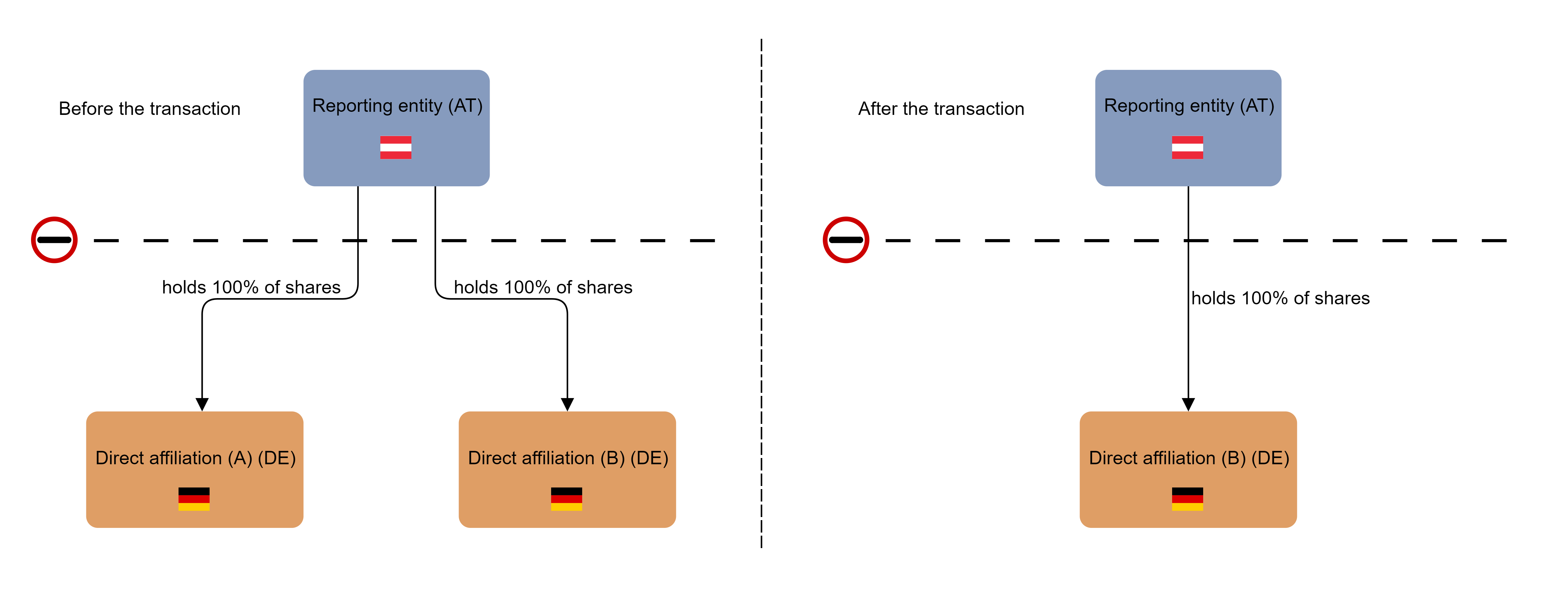

Example: Merger of affiliates

Prior to the transaction, an Austrian company (reporting entity) holds two direct German subsidiaries of 100% each (subsidiary A and B). Entity A and entity B are merged. Entity A, as the transferring company, is merged with entity B, as the acquiring company. After the merger, only entity B still exists.

The reporting object must transmit an AWBET report with the following two transactions:

(Outward) Transaction type Intragroup restructuring (transfer of shares in foreign affiliates): It must be reported that the merged German participation A is no longer held by the reporting object. The transaction value to be reported is 100% of the equity of the merged entity according to the closing balance sheet (or according to the last available balance sheet before the merger date). It must be stated that no more shares are held in participation A after the transaction.

(Outward) Transaction type Intra-group restructuring (takeover of shares in foreign affiliates): It must be reported that entity B has increased as a result of the merger. The transaction value to be reported (identical to the first transaction) is 100% of the equity of the merged entity A according to the closing balance sheet (or according to the last available balance sheet before the merger date).

Determination of the reporting period: The reporting period corresponds to the month in which the first day after the preparation of the closing balance sheet falls. (Example: If a closing balance sheet is prepared as at 30 June, the next day is 1 July – July must therefore be selected as the reporting period).

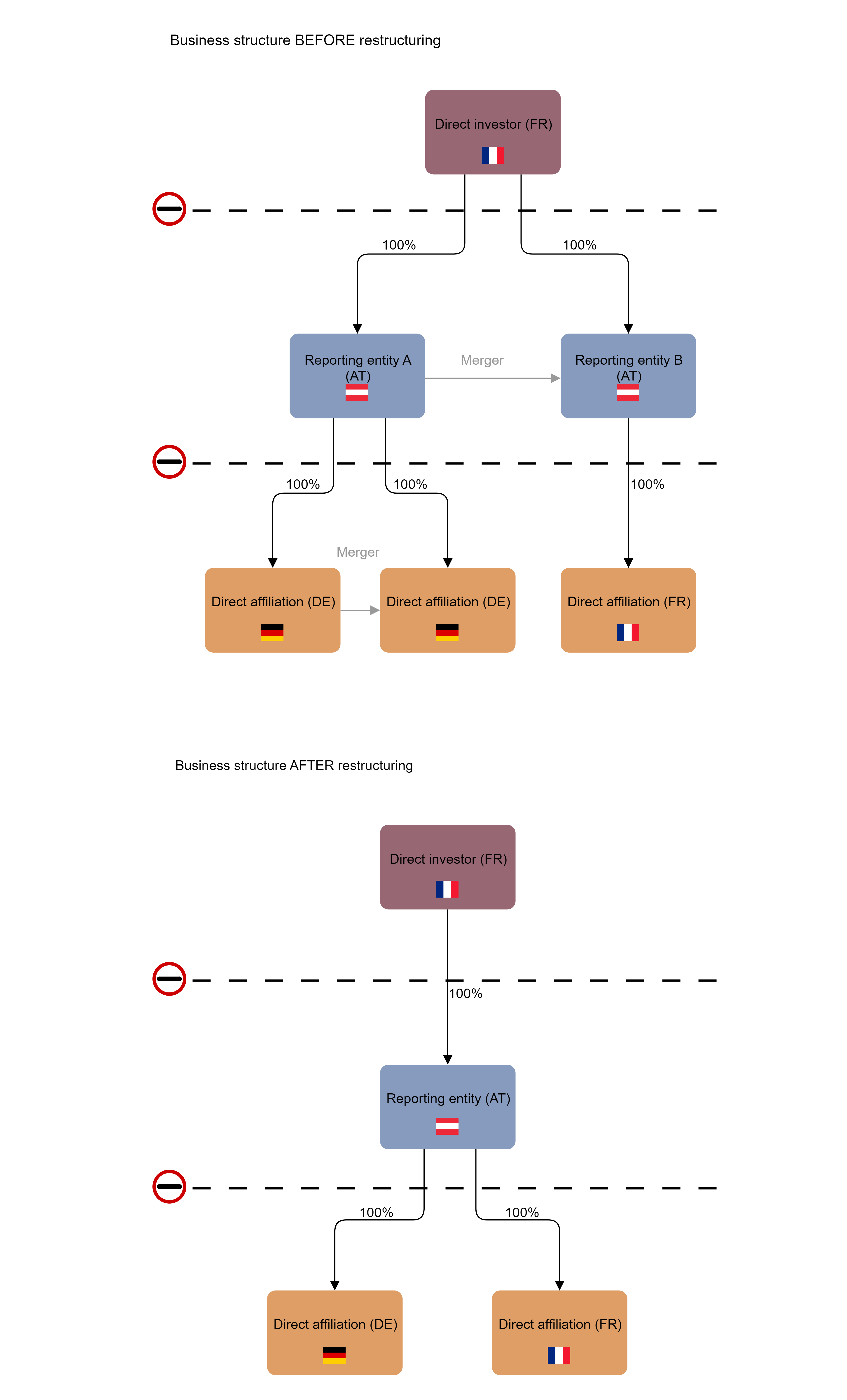

Example: Group restructurings involving mergers

A French shareholder is the sole owner of two Austrian entities (reporting entities A and B). In turn, reporting entity A owns two German affiliates, and reporting entity B owns 100% of the shares of a French affiliate.

Amid a restructuring of the group, reporting entities A and B are merged, with B taking over A; and the two German affiliates held by A are merged as well.

The merger transaction value is equivalent to the pro rata balance sheet value of the merged entity (i.e. of the entity that was taken over), on the transaction date or on the last balance sheet date preceding the transaction.

In the context of the group-wide restructuring, AWBET reports are required from both reporting entities (A and B):

Reporting entity A must report three AWBET transactions in the context of the group restructuring:

(Outward) Type of transaction group restructuring (transfer of shares in foreign affiliates): The purpose of the report is to indicate that the German affiliate that was taken over is no longer being held by reporting entity A. The transaction value to be indicated is 100% of the equity capital of the merged entity, as disclosed in the closing balance sheet (or in the latest balance sheet available before the merger date).

(Outward) Type of transaction group restructuring (transfer of shares in foreign affiliates): The purpose of the report is to indicate that the German affiliate that took over the other German affiliate is no longer being held by reporting entity A. The transaction value to be indicated is 100% of the equity capital of the entity that took over the other entity, as disclosed in the closing balance sheet (or in the last balance sheet available before the merger date).

(Inward) Type of transaction intragroup restructuring (investments transferred by foreign investors): The purpose of the report is to indicate that reporting entity A is no longer being held by the French shareholder. The transaction value to be indicated is 100% of the equity capital of the reporting entity A, as disclosed in the closing balance sheet (or in the last balance sheet available before the merger date).

Reporting entity B must report two AWBET transactions in the context of the group restructuring:

(Outward) Type of transaction group restructuring (takeover of shares in foreign affiliates): The purpose of the report is to indicate that reporting entity B now also holds a German affiliate. The transaction value to be indicated is 100% of the equity of the two entities that were merged, using the latest available figures (equity of the German company that was taken over, equity of the German company that took over the other company).

(Inward) Type of transaction intragroup restructuring (takeover of shares by foreign investors): The information to be provided is that reporting entity A was taken over by reporting entity B. The transaction value to be reported is the share of the equity for which the merged reporting entity A used to account.

Determination of the reporting period: The reporting period corresponds to the month in which the first day after the preparation of the closing balance lies. (Example: If a closing balance sheet is prepared as of 30.06., the next day is 01.07. – July must therefore be selected as the reporting period).

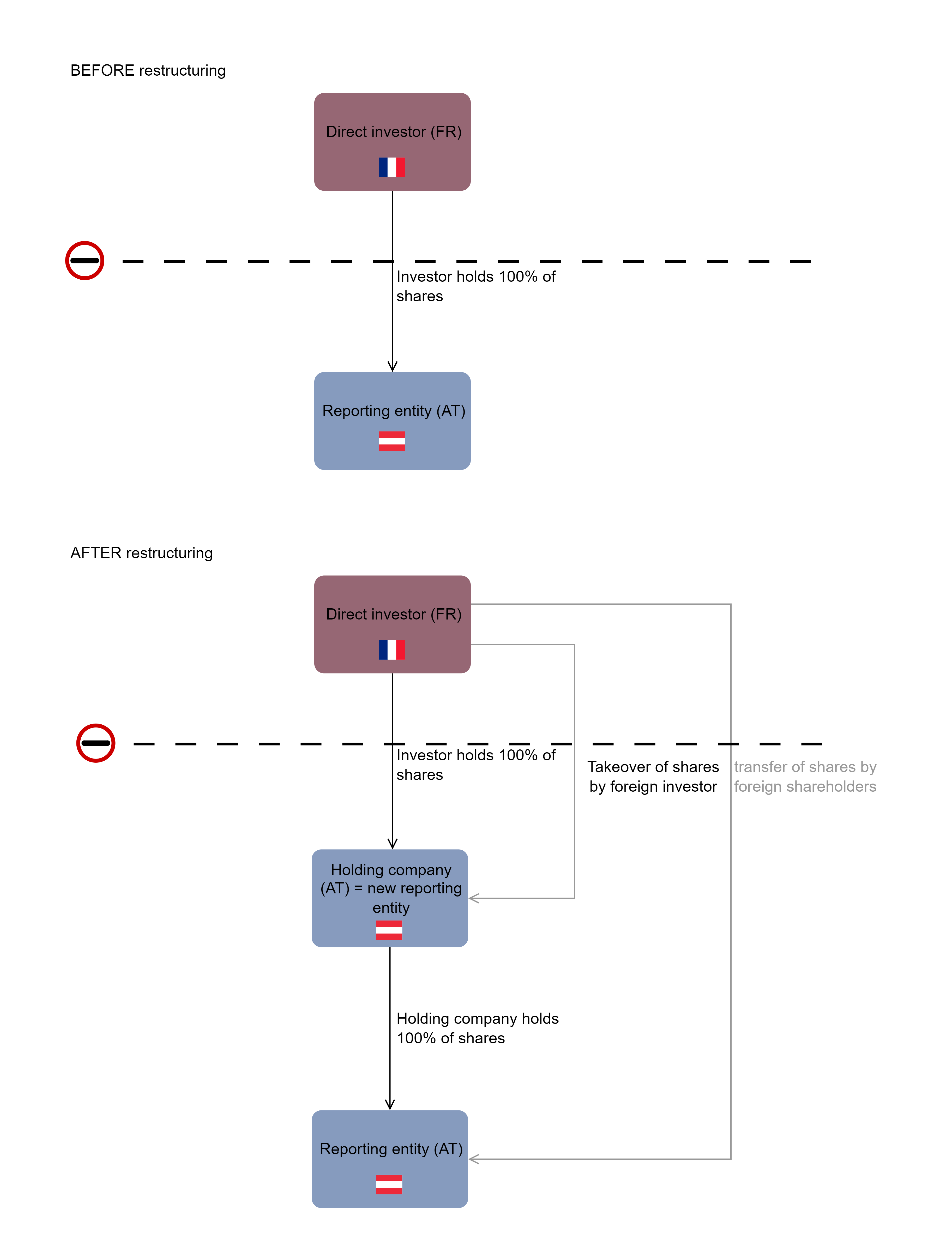

Example: Creation of a holding company as middle layer

The reporting entity is 100% wholly owned by a French direct investor. The French shareholder establishes a holding company in Austria for the purpose of managing the Austrian reporting entity. This transaction turns the reporting entity into an indirect affiliate of the French shareholder.

The transactions leading to the creation of the holding company must be submitted as two separate AWBET reports by the two Austrian entities involved:

The reporting entity must report an AWBET transaction under “intragroup restructuring (transfer of shares by foreign investors)” as it is no longer directly owned by the French company.

The holding company (the new reporting entity) must report an AWBET transaction under “intragroup restructuring” (takeover by foreign investors)” as it now holds an Austrian affiliate.

In its capacity as the new reporting entity, it will be up to the holding company introduced as a middle layer to report any future FDI transactions to the OeNB, using the AWBET template.

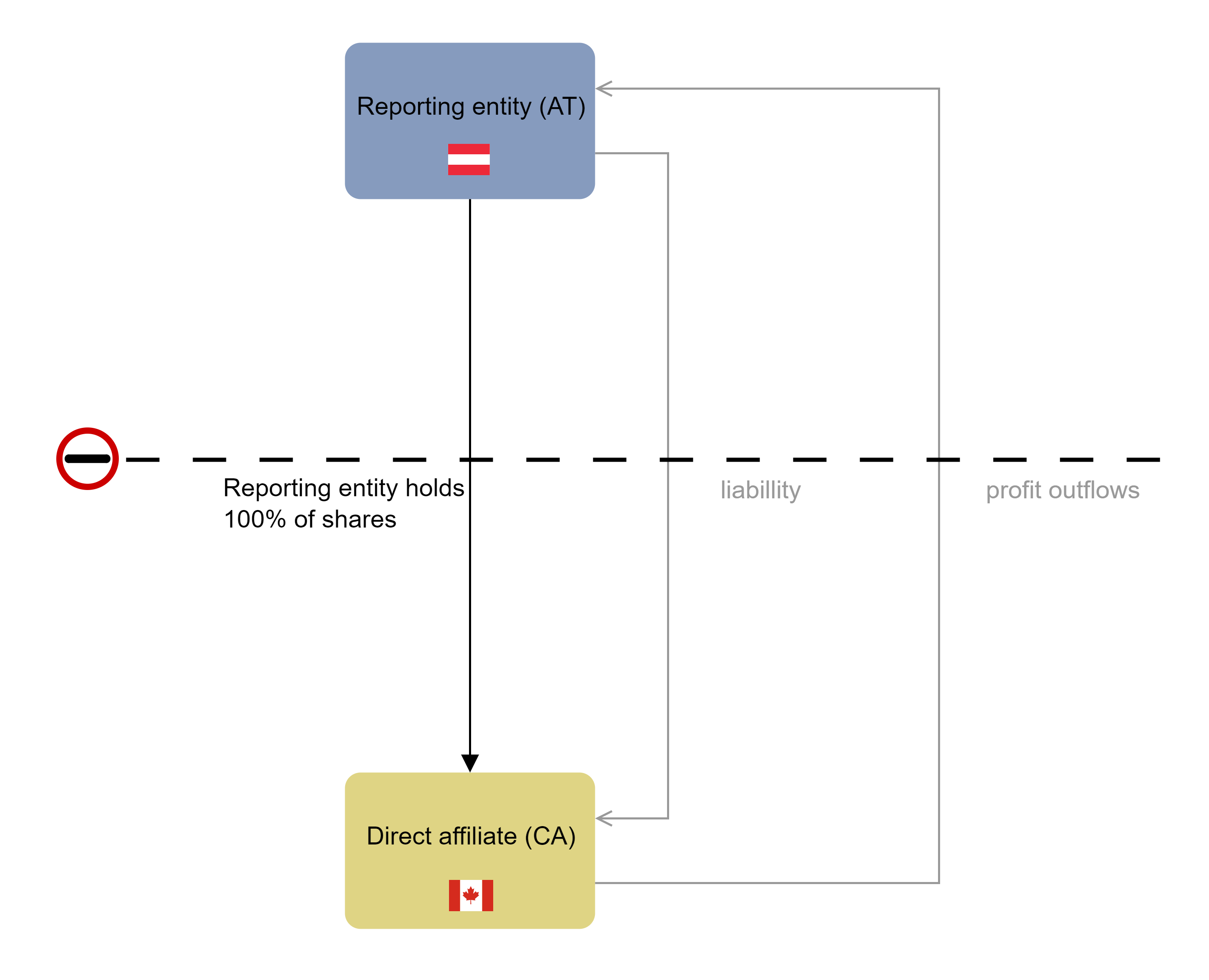

Example: Netting with a liability

The reporting entity has a liability to a direct affiliate in Canada from long-term loans in the amount of EUR 15,000,000, as reported earlier (AWFUV report). This liability is netted with a profit distribution of EUR 4,000,000 made by the Canadian affiliate.

As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB under “capital contributed to foreign affiliates.” Remember to adjust the scope of liabilities in the AWFUV report accordingly, i.e. to lower the end-of-month level by EUR 4,000,000.

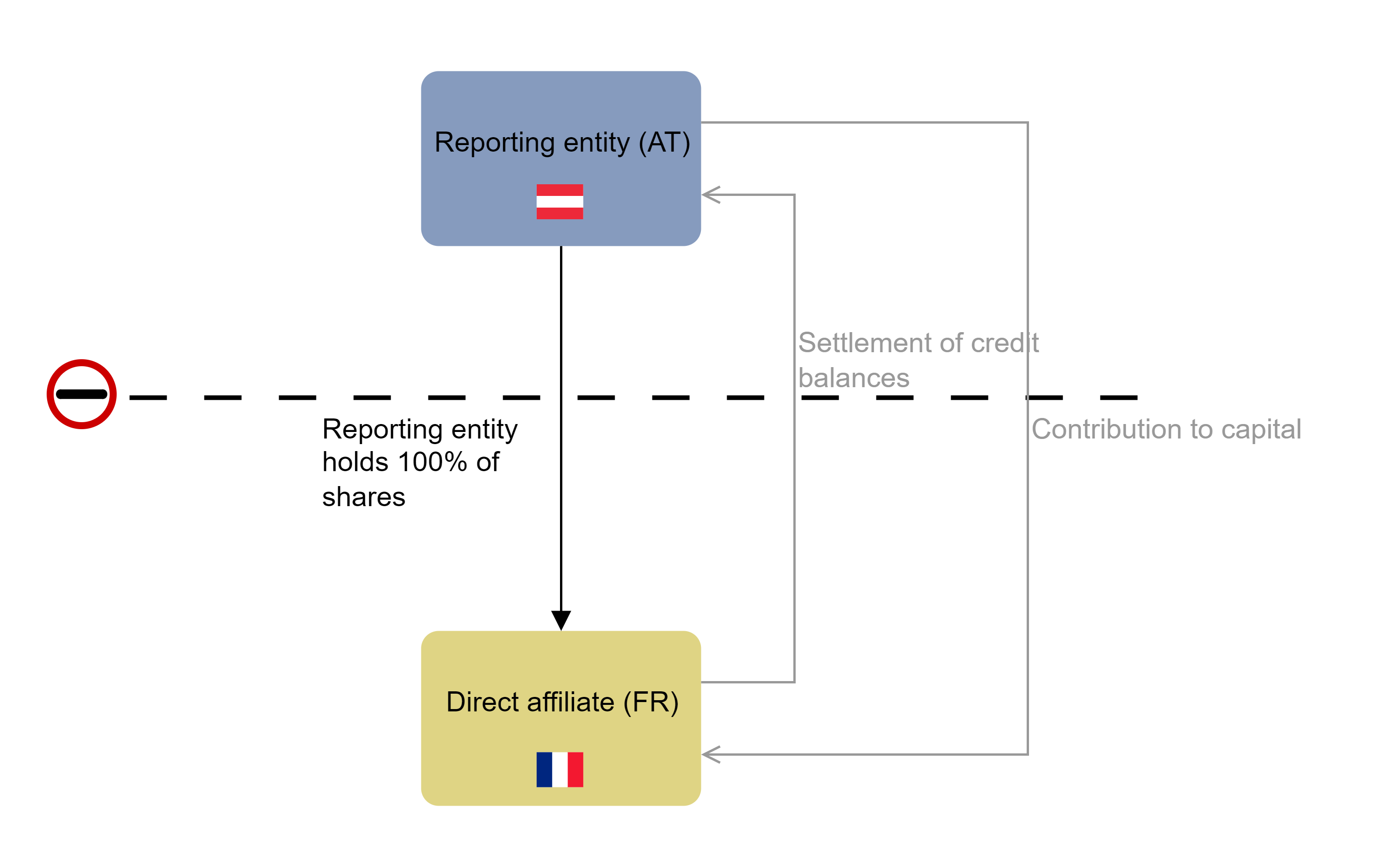

Example: Debt/equity swap

The reporting entity is the sole owner of a French affiliate. The reporting entity has claims on this affiliate from long-term loans in the amount of EUR 10,100,000, as reported earlier (AWFUV report). For the French affiliate, this amount is a liability, which it discloses as debt capital in the balance sheet.

The reporting entity now provides the foreign affiliate with capital in the amount of EUR 10,100,000. The foreign affiliate uses this amount to pay back the outstanding loan. From the point of view of the foreign affiliate, debt was swapped for equity without a corresponding change in total assets.

As the reporting entity, therefore use the AWBET template to report the transaction to the OeNB under “capital contributed to foreign affiliates.” Adjust the amount of claims in the AWFUV report to EUR 0.

Technical description

Reporting template (enhanced for IT interface)

Header data | Concepts reported | Dimensions | ||

Code | Designation | Code | Designation | |

Report code (EC) Reporting item (MO) Reporting reference date (MP) | TRANSAKBOWK | Share or equity transactions excluding profit distributions (without ISIN/WK) | IN | ID number |

TRANSART | Type(s) of transaction | |||

TRANSRI | Direction of transaction | |||

KDES | Complete disinvestment | |||

WA | Type of value | |||

TRANSAKBMWK | Share or equity transactions excluding profit distributions (with ISIN/WK) | IN | ID number | |

TRANSART | Type(s) of transaction | |||

TRANSRI | Direction of transaction | |||

KDES | Complete disinvestment | |||

WK | Securities identification number | |||

WA | Type of value | |||

TRANSGEWOWK | Profit distributions (without ISIN/WK) | IN | ID number | |

TRANSART | Type(s) of transaction | |||

TRANSRI | Direction of transaction | |||

BZP | Declaration date | |||

WA | Type of value | |||

TRANSGEWMWK | Profit distributions (with ISIN/WK) | IN | ID number | |

TRANSART | Type(s) of transaction | |||

TRANSRI | Direction of transaction | |||

BZP | Declaration date | |||

WK | Securities identification number | |||

WA | Type of value | |||

Dimensions (data fields)

Code | Designation |

IN | ID number |

TRANSART | Type(s) of transaction |

TRANSRI | Direction of transaction |

KDES | Complete disinvestment |

BZP | Declaration date |

WK | Securities identification number |

WA | Type of value |

Attributes

IN | |

Code | Designation |

OeNB ID number | ID number |

TRANSART | |

Code | Designation |

AKAPZUF | Capital contributed to foreign affiliates |

PKAPZUF | Capital contributed by foreign investors |

AKAPABB | Capital withdrawn from foreign affiliates |

PKAPABB | Capital withdrawn by foreign investors |

AERWANT | Purchase of shares in foreign affiliates |

PERWANT | Purchase of shares by foreign investors |

AVERKANT | Sale of shares in foreign affiliates |

PVERKANT | Sale of shares by foreign investors |

AKONZUMU | Intragroup restructuring (takeover of shares in foreign affiliates) |

PKONZUMU | Intragroup restructuring (takeover of shares by foreign investors) |

AKONZUMA | Intragroup restructuring (transfer of shares in foreign affiliates) |

PKONZUMA | Intragroup restructuring (transfer of shares by foreign investors) |

AERHGEW | Profit distribution received |

PBEZGEW | Profit distribution made |

TRANSRI | |

Code | Designation |

AKTIV | Outward transaction |

PASSIV | Inward investment |

KDES | |

Code | Designation |

J | JA (WAHR) |

N | NEIN (FALSCH) |

BZP | |

Code | Designation |

Date | Date |

WK | |

Code | Designation |

ISIN or internal securities identification number | Securities identification number |

WA | |

Code | Designation |

STK | Number |

MW | Market value |

Reporting examples (MeldeWeb/xlsx/xml)

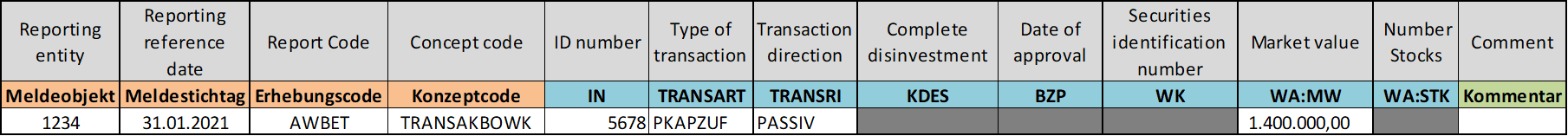

Example 1: Capital contributed by foreign investors (without ISIN/WK)

AWBET_reporting_example_1.xlsx

The reporting entity 1234 (= its OeNB ID number) submits an AWBET report for the reporting reference date January 31, 2021 (must be an end-of-month date).

In the case at hand, the reporting entity reports a transaction with an entity identified with ID number 5678 (IN). The master data (MeldeWeb application) must, therefore, reflect a relationship between the reporting entity and the identified entity on January 31, 2021. With regard to the type of affiliation, AWBET reports make a distinction between direct investment and other investment transactions.

In the absence of a stock-based investment, select the concept code TRANSAKBOWK (OWK = without a securities identification number). For non-ISIN securities, do not report securities identification numbers (WK) and no types of value per number (WA:STK). In other words, these fields are to be left blank.

In the column TRANSRI, indicate the direction of relationship between the reporting entity and the identified entity (IN). In the example at hand, there is an inward investment relationship. Thus, the only types of transactions (TRANSART) to be reported here are inward investment transactions.

Whether or not a complete disinvestment (KDES) occurred must only be indicated for the inward investment transaction types PKAPABB, PVERKANT and PKONZUMA. For the type of transaction reported (PKAPZUF), therefore leave the column for indicating complete disinvestments blank, or enter N.

Do not select PBEZGEW as the type of transaction and leave the approval date column (BZP) empty because the transaction is not a profit distribution (which is to be reported under a different concept code).

The transaction value to be indicated is the market value (WA:MW) in euro. Optionally, comments may also be made generically for each type of value.

In the example, the reporting entity 1234 reported a capital increase (PKAPZUF) from an entity (IN 5678) with which it has an inward direct or other investment relationship (PASSIV) for January 2021 (January 31, 2021). The affiliation between the entity identified as IN 5678 and the reporting entity (1234) is not based on stocks (the concept code ends with OWK). Amount of capital increase: EUR 1,400,000.

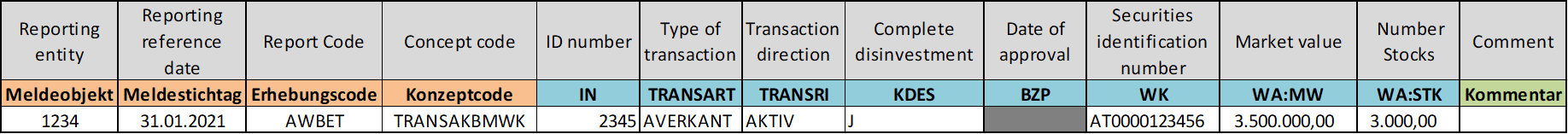

Example 2: Sale of foreign affiliates (with ISIN/WK)

AWBET_reporting_example_2.xlsx

The reporting entity 1234 (= its OeNB ID number) submits an AWBET report for the reporting reference date January 31, 2021 (must be an end-of-month date).

In the case at hand, the reporting entity reports a transaction with an entity identified with the number 5678 (IN). The master data (MeldeWeb application) must, therefore, reflect a relationship between the reporting entity and the identified entity as at January 31, 2021. The type of affiliation to be indicated in AWBET reports with the concept code TRANSAKABBMWL is a direct investment relationship.

As the investment is based on stocks, the concept code to be used is TRANSAKBOWK (MWK = with a securities identification number). In other words, the ISIN (WK) and the type of value (WA-STK) need to be specified.

In the column TRANSRI, indicate the direction of relationship between the reporting entity and the identified entity (IN). In the example at hand, there is outward investment relationship. Thus, the only types of transactions (TRANSART) to be reported here are outward investment transactions.

In the event of AKAPABB, AVERKANT and AKONZUMA transactions, information is also required whether the disinvestment was complete or not (KDES). In the case at hand (type of transaction = AVERKANT), the KDES column must therefore be filled with J or N.

Do not select AERHGEW as the type of transaction and leave the approval date column (BZP) empty because the transaction is not a profit distribution (which is to be reported under a different concept code).

The transaction value to be indicated is the market value (WA:MW) in euro. Optionally, comments may also be made generically for each type of value.

In the example, the reporting entity 1234 reported the sale of shares (AVERKANT) in an entity (IN 2345) with which it used to have an outward direct investment relationship (AKTIV) for January 2021 (January 31, 2021). The investment made by the reporting entity (1234) in the entity identified as IN 2345 is based on stocks (the concept code ends with MW). All in all, the reporting entity sold 3,000 stocks (WA:STK), making a complete disinvestment (KDES = J). Sales price received for 3,000 numbers: EUR 3,500,000 (WA:MW).

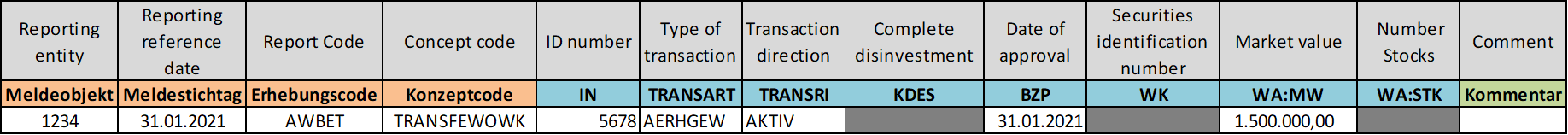

Example 3: Profit distribution received (without ISIN/WK)

AWBET_reporting_example_3.xlsx

The reporting entity 1234 (= its OeNB ID number) submits an AWBET report for the reporting reference date January 31, 2021 (must be an end-of-month date).

In the case at hand, the reporting entity reports a transaction with an entity identified with ID number 5678 (IN). The master data (MeldeWeb application) must, therefore, reflect a relationship between the reporting entity and the identified entity on January 31, 2021. With regard to the type of affiliation, AWBET reports make a distinction between direct investment and other investment transactions.

In the absence of a stock-based investment, the concept code selected is TRANSAKBOWK (OWK = without a securities identification number). For non-ISIN securities, do not report securities identification numbers (WK) and no types of value per number (WA:STK). In other words, these fields are to be left blank.

In the column TRANSRI, indicate the direction of relationship between the reporting entity and the identified entity (IN). In the example at hand, there is outward investment relationship. Since the concept code TRANSGEWOWK was selected, the transaction type (TRANSART) to be indicated is AERHGEW.

Whether or not a complete disinvestment (KDES) occurred must only be indicated for the outward investment transaction types AKAPABB, AVERKANT and AKONZUMA. For the type of transaction reported (PKAPZUF), therefore leave the column for indicating complete disinvestments blank, or enter N.

The transaction at hand is a profit distribution; therefore the approval date column (BZP) must be completed. The declaration date must be equivalent to the reporting reference date or the last day of the month of an earlier period. XLSX files or maps to be uploaded may list the date of adoption using one of two potential formats: TT.MM.JJJJ or JJJJ-MM-TT.

The transaction value to be indicated is the market value (WA:MW) in euro. Optionally, comments may also be made generically for each type of value.

In the case at hand, the reporting entity (1234) reported the following for January 1, 2021: profit distribution (AERHGEW) from entity identified as IN 5678. Since we are dealing with a profit distribution received, the direction of transaction to be indicated is “outward” (AKTIV). The reporting entity’s investment (1234) in the entity identified as IN 5678 is not based on stocks (the concept code ends with OWK). The distribution was adopted in January 2021 (BZP) and paid in January 2021(reporting reference date). Amount of distribution received: EUR 1,500,000.

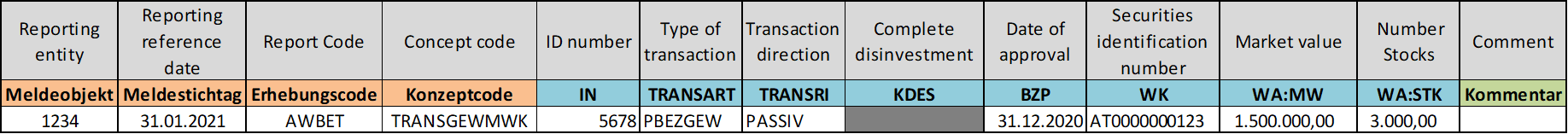

Example 4: Profit distribution made (with ISIN/WK)

AWBET_reporting_example_4.xlsx

The reporting entity 1234 (= its OeNB ID number) submits an AWBET report for the reporting reference date January 31, 2021 (must be an end-of-month date).

In the case at hand, the reporting entity reports a transaction with an entity identified with ID number 5678 (IN). The master data (MeldeWeb application) must, therefore, reflect a relationship between the reporting entity and said identified entity as at January 31, 2021. With regard to the type of affiliation, AWBET reports make a distinction between direct investment and other investment transactions.

As the investment is based on stocks, the concept code to be used is TRANSAKBOWK (MWK = with a securities identification number). In other words, the ISIN (WK) and the type of value (WA-STK) need to be specified.

In the column TRANSRI, indicate the direction of relationship between the reporting entity and the identified entity (IN). In the example at hand, there is a inward investment relationship. Therefore, we are dealing with a paid distribution (TRANSART = PBEZGEW).

In the event of AKAPABB, AVERKANT and AKONZUMA transactions, information is also required whether the disinvestment was complete or not (KDES). For the type of transaction reported (PBEZGEW), therefore leave the column for indicating complete disinvestments blank, or enter N.

The transaction at hand is a profit distribution; therefore the approval date column (BZP) must be completed. The declaration date must be equivalent to the reporting reference date or the last day of the month of an earlier period. XLSX files or maps to be uploaded may list the date of adoption using one of two potential formats: TT.MM.JJJJ or JJJJ-MM-TT.

The transaction value to be indicated is the market value (WA:MW) in euro. Optionally, comments may also be made generically for each type of value.

In the example, the reporting entity 1234 reported a profit distribution (PBEZGEW) to an entity (IN 5678) with which it has an inward direct or other investment relationship for January 2021 (January 31, 2021). The investment made by the reporting entity (1234) in the entity identified as IN 2345 is based on stocks (the concept code ends with MW). The distribution was adopted in December 2020 (BZP) and paid in January 2021 (reporting reference date). Profit was distributed in the form of 3,000 stocks (WA:STK) valued at EUR 1,500,000 (WA:MW).