AWVLM report: cross-border capital transfers and real estate transactions

For any questions please email aussenwirtschaft.VLM@oenb.at.

Contents

See the directory on the right.

Key reporting data

Report code | AWVLM |

Designation | Cross-border capital transfers and real estate transactions |

Description | Regional breakdown of cross-border capital transfers and real estate transactions |

Reporting agents | Natural residents, legal residents and other resident entities with or without a separate legal identity |

Reporting interval | Ad hoc report at monthly intervals |

Reporting date | 15th day of the following month |

Reporting reference date | Last day of the month |

Reporting threshold | EUR 100,000 |

Reporting currency/unit | Euro; amounts rounded to one decimal place (default) or two decimal places (optional) |

Reporting channel (reporting data) | recommended:

other options:

Information on the registration (access requests) for all reporting channels can be found here. |

Reporting group (for technical data providers) | Z – External sector (file type: VL) |

Master data for reporting and validation (for technical data providers) | Reporting master data (for technical data providers) (.xml) Validating master data (for technical data providers) (.xml) |

Contact |

Reporting matrix

Cross-border capital transfers and real estate transactions (AWVLM template) | ||

Reporting entity | ||

Reporting reference date | ||

Capital transfers (TRANSVUE) | Real estate transactions (TRANSLS) | Rental and lease payments and fees for exploiting natural resources (TRANSMPN) |

Country of counterparty (LDC) | Country of counterparty (LDC) | Country of counterparty (LDC) |

Business event (GF) | Business event (GF) | |

Type of transaction (TRANSART) | ||

Country of real estate (LDL) | ||

Type of value (WA) | Type of value (WA) | Type of value (WA) |

Value | Value | Value |

Scope of reporting

Data must be provided for cross-border capital transfers and real estate transactions, with a regional breakdown of data on:

cross-border capital transfers

cross-border purchases and sales of real estate

cross-border rent and lease payments and cross-border fees for the right to exploit natural resources

Based on the AWVLM reporting matrix.

Reporting threshold

Individual transactions must be reported when totaling EUR 100,000 or more (or the euro equivalent). For land and property rent and lease transactions, the reporting threshold relates to the total rent received or paid in the reporting period.

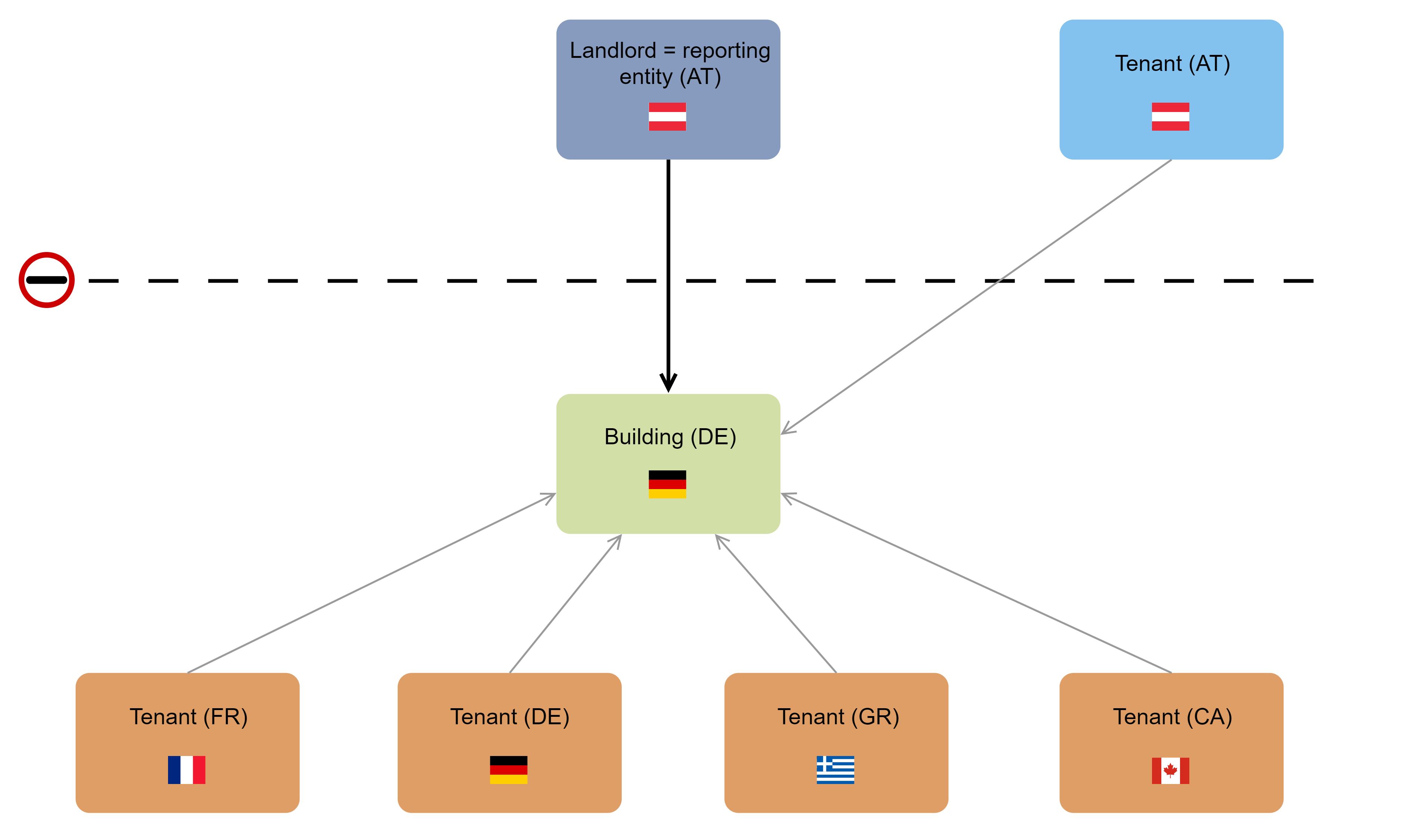

Example: Reporting threshold exceeded

A resident individual owns a conference center in Germany. This conference center can be rented out to up to ten customers per month. In the current month, the center has been rented out to five individuals, from Austria, France, Germany, Greece and Canada. The tenants pay a monthly rent of EUR 26,000 each.

In sum, the rental income received from FR + DE + GR + CA (excluding AT) exceeds the reporting threshold (4 x EUR 26,000 = EUR 104,000).

PLEASE NOTE: Do not include the rental payment from the Austrian individual.

The individual amounts need to be reported to the OeNB because the aggregate exceeds the reporting threshold.

As the reporting entity, report all rental and lease payments received from nonresidents (ERHMIPA).

For the regional breakdown, use the foreign tenants’ country of residence or incorporation, irrespective of the country in which the properties are located. In the case at hand, provide the ISO codes for the countries of counterparty: FR for France, DE for Germany, GR for Greece and CA for Canada.

A couple of months later the Canadian tenant cancels the rental agreement. Because the sum total is below the reporting threshold (3 x EUR 26,000 = EUR 78,000), the individual amounts need not be reported to the OeNB.

Example: Quarterly rent payments

A domestic company rents out a warehouse to an Italian company, accounting for monthly rental income in the amount of EUR 40,000. Rental income is, however, paid at quarterly intervals in March, June, September and December. In all other months, the rental income is booked as receivables from the tenant.

The quarterly rent payments add up to EUR 120,000, which is above the reporting threshold.

Hence, the respective amounts are to be reported to the OeNB in March, June, September and December.

As the reporting entity, report all rental and lease payments received from nonresidents (ERHMIPA).

The ISO code to be provided for the purpose of regional allocation is IT for the country of counterparty (LDC: Italy).

Reporting entity/reporting agent

Data are to be reported by individuals whose home is in Austria or whose period of residence in Austria exceeds three months (irrespective of nationality), and

Legal persons or partnerships incorporated or headquartered in Austria.

Branches and companies established by foreign entities in Austria are classified as resident even when they report to foreign headquarters, irrespective of whether they are a separate legal entity or not.

Special case: Reporting requirement for domestic notaries public

Resident notary publics are required to report any cross-border capital transfers or real estate-related transactions to nonresident heirs they handle. Should the notary public handling the probate proceedings have no information on the market value, an alternative available value (e.g. the assessment unit value times three) is to be used. In the absence of any alternative measures, no report needs to be made.

Resident notary publics are also required to report any cross-border real estate transactions between two nonresidents they handle.

Reporting reference date/reporting period

Data must be provided, whenever such cross-border transactions have occurred, by the 15th day of the month following the reporting month. All transactions made during a given month are to be reported as an aggregate with the last day of the month as the reporting reference date.

The reporting period for capital transfers and real estate transactions is the month during which ownership changed.

For capital transfers to heirs, the reporting period is the month during which the bequeather died. In other words, such data need to be reported retrospectively.

Rental and lease payments must be reported on a monthly basis for the entire duration of the underlying contract.

Payments related to rights to exploit natural resources must be reported at the time such rights take effect.

Example: Reporting period

A domestic individual signs a purchase contract for a foreign property in the Bahamas on 18 January. In line with the purchase contract, the transfer of ownership is February 1.

The data are to be reported by the resident individual.

The reporting period is February.

The deadline for the report is March 15 (the 15th day of the month following the month during which ownership was transferred.

Capital transfers (TRANSVUE)

Capital transfers are one-off payments made across borders from disposable funds. The payments made or received relate to nonproduced nonfinancial assets.

The following incidents are to be reported as capital transfers made or received:

Inheritances (except real estate - to be reported under real estate-related transactions)

Dowries

Donations (except real estate - to be reported under real estate-related transactions)

Fundraising contributions

Patents

Establishment of foundations

Establishment of charities, scientific, religious or cultural institutions

Debt cancellation or forgiveness

Activation of one-off guarantees

Exceptionally high insurance payments to beneficiaries

Earmarked investment subsidies

Trademarks, brand names, logos, domain names, etc.

Client base

Supply rights

Sales rights

Transfer fees for professional athletes/coaches (e.g. football players)

Capital transfers to be reported to the OeNB DO NOT INCLUDE:

Purchase of carbon allowances

Computer software licenses

Licenses for applying R&D findings

Licenses for reproducing and/or selling audiovisuals and related artistic rights

Licences for trademarks and franchise agreements

Data field description and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

Country of counterparty (LDC)

The country of counterparty is defined as the country in which the nonresident entity making or receiving capital transfers has been incorporated. Individuals are to be identified by their country of residence rather than their country of citizenship.

Use the two-digit ISO codes.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Business event (GF)

From a statistical perspective, the cross-border transfer of capital as outlined with the examples provided gives rise to a business case that is to be reported as follows:

Capital transfers received from nonresidents (ERHVUE).

Capital transfers made to nonresidents (GELVUE).

Type of value (WA)

When using the “MeldeWeb” online application, you need not select the type of value. When uploading your data via Excel or via the IT interface (XML), you need to select “market value” as the type of value.

Value

Amounts must be reported in euro, or as euro equivalents based on the exchange rate applying on the date of the transaction.

We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Use the comments function for system-related queries that may arise during reporting (mandatory).

Example: Donation of foreign currency cash

On April 16, a resident individual donates AUD 850,000 to an individual resident in Australia.

For reporting purposes, therefore convert the foreign currency amount using the ECB reference rate for April 16.

For the example at hand, we assume a conversion rate of EUR 1 = AUD 1.2585.

Calculation: AUD 850,000 / 1.2585 = EUR 675,407.

Since this amount exceeds the reporting threshold, it needs to be reported to the OeNB.

The ISO code to be provided for the purpose of regional allocation is AU for country of counterparty (LDC: Australia).

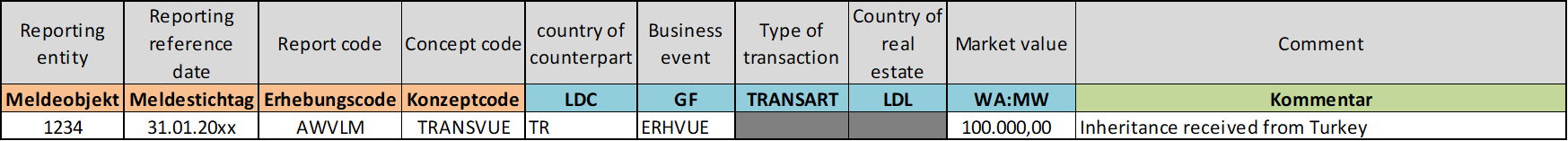

Example: Inheritance of foreign currency cash

A domestic individual inherits TRY 1,000,000 from a Turkish relative.

For reporting purposes, this amount needs to be converted using the ECB reference rate for April 16.

For the example at hand, we assume a conversion rate of EUR 1 = TRY 10.11.

Calculation: TRY 1,000,000 / 10.11 = EUR 98,912

Since this amount exceeds the reporting threshold, it needs to be reported to the OeNB.

The ISO code to be provided for the purpose of regional allocation is TR for the country of counterparty (LDC: Turkey).

Real estate transactions (TRANSLS)

For the purpose of this report, real estate includes land with or without property, and property (buildings and building units).

Real estate transactions to be reported include:

Real estate abroad purchased/inherited/received by a resident.

Real estate abroad sold/inherited/given away by a resident.

Real estate in Austria purchased/inherited/receives by a nonresident.

Real estate in Austria sold/inherited/given away by a nonresident.

PLEASE NOTE: Do NOT include taxes and additional expenses.

Description of data fields and attributes

Country of counterparty (LDC)

The country of counterparty is defined as the country in which the nonresident entity making or receiving capital transfers has been incorporated. Individuals are to be identified by their country of residence rather than their country of citizenship.

Use the two-digit ISO codes.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Country of real estate (LDL)

By definition, the countries to be indicated are the countries in which the respective property is located.

Use the two-digit ISO codes.

→ Data classification (available only in German) - Oesterreichische Nationalbank (OeNB)

Type of transaction (TRANSART)

From a statistical perspective, the cross-border sale or purchase of real estate is a transaction that is to be reported as follows:

Acquisition/inheritance/donation of real estate abroad by a resident (ERW).

Sale/inheritance/donation of real estate abroad by a resident (VERK).

Acquisition/inheritance/donation of real estate in Austria by a nonresident (ERW).

Sale/inheritance/donation of real estate in Austria by a nonresident (VERK).

Type of value (WA)

When using the “MeldeWeb” online application, you need not select the type of value. When uploading your data via Excel or via the IT interface (XML), you need to select “market value” as the type of value.

Value

Amounts must be reported in euro, or as euro equivalents based on the exchange rate applying on the date of the transaction.

We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Use the comments function for system-related queries that may arise during reporting (mandatory).

Example: Sale of an apartment in Vienna to an individual in Germany.

A German citizen living in Vienna (main residence in Vienna) sells her apartment in 1090 Vienna to a friend from Hamburg, Germany. The sales price is EUR 500,000.

Since we are dealing with a cross-border transaction and since the sales price exceeds the reporting threshold, the woman must report the transaction to the OeNB.

Specifically, she will have to report the sale of real estate by a resident to a nonresident (VERK).

The ISO codes to be provided for the purpose of regional allocation are DE for the country of counterparty (LDC: Germany) and AT for the country of real estate (LDL: Austria).

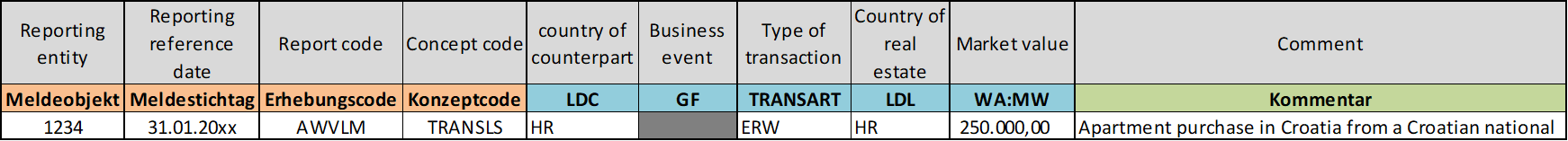

Example: Purchase of real estate in Croatia

An Austrian couple buys a holiday home in Croatia. The purchase price is EUR 450,000. The property is sold by a Croatian developer.

Since EUR 450,000 exceeds the reporting threshold, the Austrian couple is required to report the transaction to the OeNB.

Specifically, the couple will have to report the purchase of real estate by residents abroad (ERW).

The ISO code to be provided for the purpose of regional allocation is HR for both the country of counterparty (LDC: Croatia) and the country of real estate (LDL: Croatia).

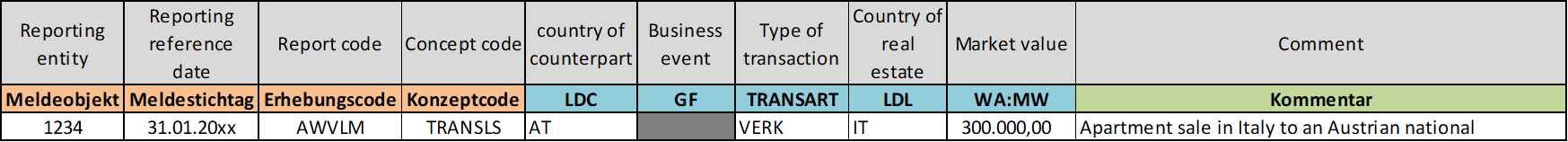

Sale of domestic building lots to nonresidents.

A municipality in the province of Vorarlberg sells several connected building lots to a Swiss real estate investor for EUR 10,000,000. The property sale is administered by a resident notary public.

Since EUR 1,000,000 exceeds the reporting threshold, said municipality is required to report the transaction to the OeNB. The municipality may instruct the notary public to report the transaction.

Specifically, she will have to report the sale of real estate by a resident to a nonresident (VERK).

The ISO codes to be provided for the purpose of regional allocation are CH for the country of counterparty (LDC: Switzerland) and AT for the country of real estate (LDL: Austria).

Sale of domestic building lots to nonresidents.

An individual living in Germany sells her holiday home in Austria to a French individual for EUR 600,000.

The sale and purchase of the holiday home is administered by an Austrian notary public.

Since EUR 600,000 exceeds the reporting threshold, the Austrian notary public is required to report the transaction to the OeNB.

The transaction to be reported involves the sale of real estate in Austria to a nonresident (VERK) and the purchase of real estate in Austria by a nonresident (ERW).

Hence, the ISO codes to be provided for the purpose of regional allocation are DE and FR for the countries of counterparty (LDC: Germany and France) and AT for the country of real estate (LD: Austria).

Rental and lease payments and fees for exploiting natural resources (TRANSMPN)

Rental and lease payments for land and property includes:

Payments received from nonresidents from letting or leasing land and property in Austria or abroad.

Payments sent to nonresidents for renting or leasing land and property in Austria or abroad.

Rights to exploit natural resources includes, for instance, payments for the extraction of oil or payments related to mining, fishing, forestry, or payments for mining rights, etc.

Payments received from nonresidents for the right to exploit natural resources.

Payments sent to nonresidents for the right to exploit natural resources.

PLEASE NOTE: Include tax amounts in the data to be reported. Do not include running costs in the data to be reported.

Description of data fields and attributes

The expressions in parentheses are data field codes (dimensions) and data field attributes. These codes are required for further processing when reporting agents submit their data via Excel uploads or via IT interfaces.

Country of counterparty (LDC)

The country of counterparty is defined as the country in which the nonresident entity making or receiving capital transfers has been incorporated. Individuals are to be identified by their country of residence rather than their country of citizenship.

Use the two-digit ISO code.

Business event (GF)

From a statistical perspective, cross-border lease or rental payments or fees payable for exploiting natural resources give rise to a business event that is to be reported as follows:

Rental or lease payment received from nonresidents (ERHMIPA).

Rental or lease payment made to nonresidents (BEZMIPA).

Payments received from nonresidents for the right to exploit natural resources.

Payments made to nonresidents for the right to exploit natural resources (BEZNATRE).

Type of value (WA)

When using the “MeldeWeb” online application, you need not select the type of value. When uploading your data via Excel or via the IT interface (XML), you need to select “market value” as the type of value.

Value

Amounts must be reported in euro, or as euro equivalents based on the exchange rate applying on the date of the transaction.

We provide relevant exchange rate information on our website.

→ Exchange rates - Oesterreichische Nationalbank (OeNB)

Value comment

Commenting data entries has been enabled and may reduce the need for queries. Use the comments function for system-related queries that may arise during reporting (mandatory).

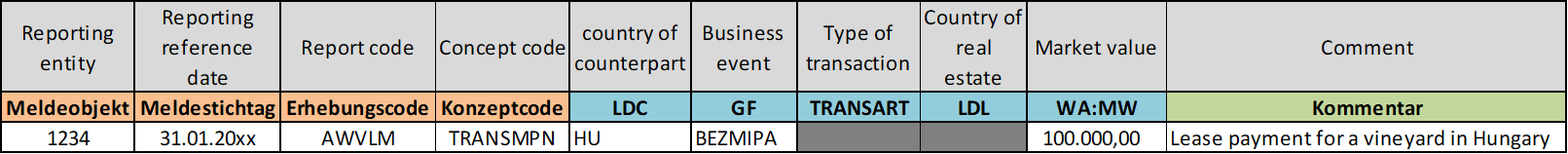

Example: Rental payments to nonresidents

In an office tower owned by a Germany company, an Austrian company rents an office floor for EUR 120,000.

Since EUR 120,000 exceeds the reporting threshold, the Austrian company is required to report the transaction to the OeNB.

The amount is to be reported under rental or lease payments to nonresidents (BEZMIPA).

The ISO code to be provided for the purpose of regional allocation is DE for the country of counterparty (LDC: Germany).

The transaction is to be reported on a monthly basis for as long as the Austrian company keeps renting the office floor.

Example: Rental payments to nonresidents

An Austrian company pays EUR 170,000 EUR to a Ukrainian company for iron ore mining rights.

Since EUR 170,000 exceeds the reporting threshold, the Austrian company is required to report the transaction to the OeNB.

The amount is to be reported under payments made to nonresidents for the right to exploit natural resources (BEZNATRE).

The ISO code to be provided for the purpose of regional allocation is UA for the country of counterparty (LDC: Ukraine).

Under this reporting regulation, there is NO reporting requirement if the Austrian company creates a branch or operational facility or a consortium for that purpose.

Quality requirements

AWVLM reports must be complete and must be submitted to the OeNB in due time.

A full AWVLM report includes all attributes for cross-border capital transfers and real estate transactions.

Use the comments function for system-related queries that may arise during reporting (mandatory).

The data reported will be checked by the OeNB. We will contact you in case any queries should arise, Queries need to be answered without delay.

Technical description

Reporting template (enhanced for IT interface)

Header data | Concepts reported | Dimensions | ||

Code | Designation | Code | Designation | |

Report code (EC) Reporting object (MO) Reporting reference date (MP) | TRANSVUE | Capital transfers | LDC | Country of residence of counterparty |

GF | Business event | |||

WA | Type of value | |||

TRANSLS | Real estate transactions | LDC | Country of residence of counterparty | |

TRANSART | Type(s) of transaction | |||

LDL | Country of real estate | |||

WA | Type of value | |||

TRANSMPN | Rental and lease payments and fees for exploiting natural resources | LDC | Country of residence of counterparty | |

GF | Business event | |||

WA | Type of value | |||

Dimensions (data fields)

Code | Designation |

LDC | Country of counterparty |

GF | Business event |

TRANSART | Type(s) of transaction |

LDL | Country of real estate |

WA | Type of value |

Attributes

LDC | |

Code | Designation |

ISO country code | Country |

TRANSART | |

Code | Designation |

ERW | Purchase |

VERK | Sale |

GF | |

Code | Designation |

ERHVUE | Capital transfers received |

GELVUE | Capital transfers sent |

ERHMIPA | Rental and lease payments received |

BEZMIPA | Rental and lease payments sent |

ERHNATRE | Payments received for the exploitation of natural resources |

BEZNATRE | Payments sent for the exploitation of natural resources |

LDL | |

Code | Designation |

ISO country code | Country |

WA | |

Code | Designation |

MW | Market value |

Reporting examples (MeldeWeb/xlsx/xml)

Example 1:

AWVLM_reporting_example_1.xlsx

Example 2:

AWVLM_reporting_example_2.xlsx

Example 3:

AWVLM_reporting_example_3.xlsx

Example 4: